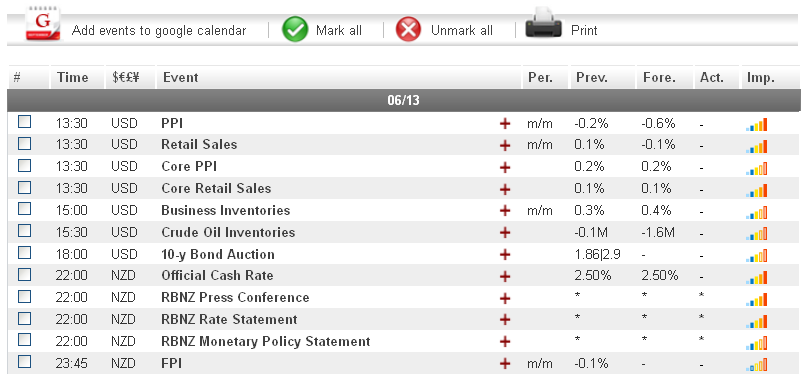

The markets saw very little movement yesterday, as the combination of a slow news day and worries about the outcome of the upcoming elections in Greece caused investors to limit the number of new positions they opened. That being said, more volatility is likely to occur today, as the US is scheduled to release three potentially significant indicators during the mid-day session. Traders will want to pay attention to the Retail Sales, Core Retail Sales and PPI, all being released at 12:30 GMT. With analysts predicting that both the Retail Sales and PPI will come in significantly below last month's figure, the USD could see downward movement against its main currency rivals.

Economic News

USD - US Retail Sales Data May Turn Dollar BearishThe dollar traded steadily against the euro yesterday, largely due to the lack of significant news releases during the European trading session. The EUR/USD advanced some 30 pips over the course of the day, reaching as high as 1.2528 during the morning session. Against the JPY, the dollar received a slight boost during overnight trading following comments out of the International Monetary Fund that the yen is overvalued. The USD/JPY was up just over 40 pips for the day, reaching as high as 79.68 before staging mild downward correction to stabilize at 79.55.

Turning to today, dollar traders will want to pay attention to the US Retail Sales, Core Retail Sales and PPI figures, all scheduled to be released at 12:30 GMT. Analysts are forecasting that the Retail Sales and PPI figures will come in well below last month's figures. If true, the USD could see downward movement against the yen and euro during afternoon trading. That being said, given the poor state of the eurozone at this time, any losses the dollar takes against the euro may turn out to be temporary.

EUR - Eurozone Crisis May Be Spreading To Italy

The euro saw little movement against most of its main currency rivals yesterday, as investors, already concerned with what the outcome of next week's Greek elections will be, remained hesitant about opening new trades. That being said, the EUR/GBP and EUR/AUD both spent most of the day in a bearish trend. The EUR/GBP fell over 50 pips during European trading, eventually reaching as low as 0.8028. Against the aussie, the euro dropped some 52 pips, reaching the 1.2576 level by the afternoon session.

Turning to today, traders will want to monitor any developments out of the eurozone, and in particular Italy. Now that Spain has secured a bailout to help its banking sector recover, all eyes have turned to Italy as it now appears the most likely to be hit by the eurozone debt crisis. Any negative news could weigh down on the common-currency. Furthermore, the euro could see additional volatility if any fresh predictions about the Greek elections are released.

Gold - Gold Advances Past $1600 Level

The price of gold advanced close to $20 an ounce late in European trading yesterday, eventually reaching as high as $1610 an ounce. With many investors still uncertain about how the upcoming elections in Greece will affect the rest of the eurozone, gold has seen gains in recent days due to its status as a safe-haven asset.

Turning to today, any announcements out of the eurozone may impact the price of gold. With the debt situation in Italy being closely eyed by investors, any negative news out of the country may result in the precious metal extending its current upward trend.

Crude Oil - Crude Oil Stages Slight Upward Correction

After dropping to a nine-month low at $81.02 earlier in the week, crude oil staged a mild recovery over the course of the day yesterday. Crude traded as high as $83.38 a barrel yesterday, up close to $2 during European trading. That being said, the commodity was not able to maintain its upward momentum, and was trading around the $82.60 level by the evening session.

Turning to today, crude may see downward movement if US indicators come in below their expected levels. Part of the reason oil has been bearish recently is because of low demand out of the US, the world's leading oil consuming country. Any disappointing American data today may signal that demand for oil will continue to drop.

Technical News

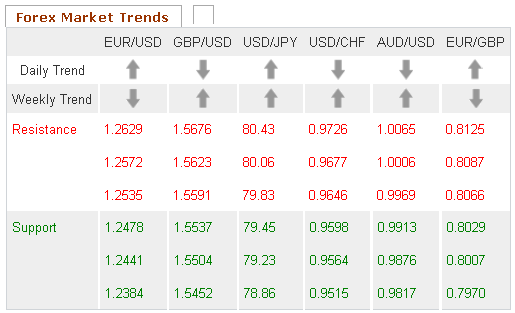

EUR/USDTechnical indicators on the weekly chart show that this pair is currently range trading, meaning that no defined long-term trend can be predicted at this time. That being said, the daily chart's Williams Percent Range has crossed over into overbought territory. Traders may want to open short positions, as downward movement could be seen in the near future.

GBP/USD

A bullish cross has formed on the weekly chart's Slow Stochastic, indicating that this pair could see upward movement in the coming days. In addition, the Bollinger Bands on the daily chart are beginning to narrow, meaning that a price shift could occur in the near future. Opening long positions may be the wise choice.

USD/JPY

While a bullish cross appears to be forming on the weekly chart's Slow Stochastic, most other long-term indicators show that this pair is in neutral territory. Traders may want to take a wait and see approach, as a clearer trend is likely to present itself in the near future.

USD/CHF

Technical indicators are providing mixed signals for this pair. While the Williams Percent Range on the daily chart is in oversold territory, the weekly chart's Slow Stochastic has formed a bearish cross. Traders will want to use a wait and see strategy for this pair.

The Wild Card

EUR/SEKThe Slow Stochastic on the daily chart has formed a bullish cross, indicating that this pair could see upward movement in the near future. Furthermore, the Relative Strength Index on the same chart appears to be on its way to crossing into oversold territory. Forex traders may want to go long in their positions ahead of an upward breach.