Both key ISM surveys are pointing to a major slowdown in US growth rates. We are forecasting US GDP growth of 1.3% for 2020 versus a consensus estimate of 1.8% with the clear implication that the Federal Reserve has more work to do to support the economy

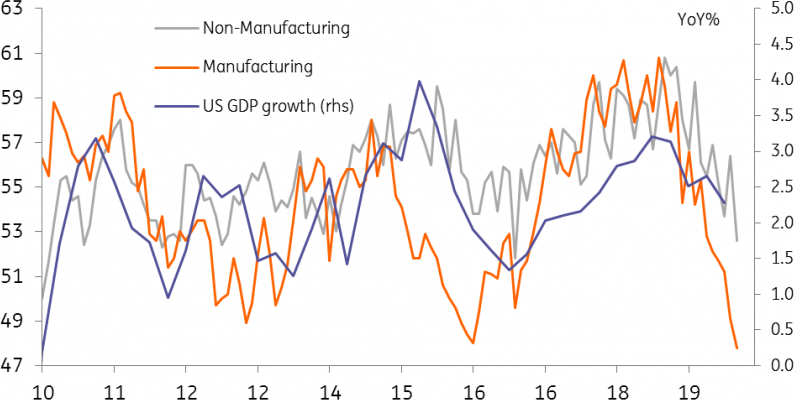

The US slowdown signals are multiplying. We were well aware of the problems in manufacturing given the trade war, slower global growth and the competitive disadvantage of a strong dollar, but it is clear that there are problems brewing in other sectors. The ISM non-manufacturing index has come in at 52.6, the weakest reading for over three years, and as the chart below shows the two ISM series are now showing that GDP growth is in a clear weakening channel.

ISM indices highlight US slowdown threat

There was weakness throughout today’s non-manufacturing report with new orders plunging to 53.7 from 60.3 versus a breakeven level of 50. Business activity fell 6.3 points to 55.2 while employment dropped to 50.4 from 53.1. This is the worst employment reading since early 2014 and given the ISM manufacturing employment number was already pointing to a sharp fall we are not optimistic for tomorrow’s all-important jobs number. The consensus is still for employment growth of 147,000, but the labour surveys (including the ADP (NASDAQ:ADP) report) suggest 100-120k may be more realistic.

Payrolls growth has been slowing over the past year. Initially, there was a sense that this was because firms were struggling to fill vacancies due to a lack of workers with the right skill sets. However, the downturn in business activity suggests that it is increasingly becoming a labour demand story. As such the recent pick-up in wage growth may not continue for much longer, which risks undermining consumer spending.

Given these fears, we cut our US GDP growth forecast for 2020 to 1.3% a couple of months ago. The consensus is still 1.8%, but we imagine that this will be moving lower. The latest developments should add a sense of urgency to talks seeking a resolution to the US-China trade dispute and will keep the pressure on the Fed to ease monetary policy further. We continue to look for a December rate cut and a further move in 1Q20, but the risks are increasingly skewed towards more aggressive action.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more