US crude futures are steady on Tuesday, trading at $33.69 a barrel in the North American session. Brent crude futures are trading at $36.47. On the economic front, ISM Manufacturing PMI came in at 49.5 points, within expectations. On Wednesday, the US releases ADP Nonfarm Employment Change, ahead of Nonfarm Payrolls on Friday.

January reports from the US housing sector are raising concerns. Housing Starts and Building Applications fell in January, and New Home Sales and Pending Sales followed suit, missing expectations. Activity in the housing sector is closely monitored by analysts, as a decrease in home building can have a negative impact on other sectors of the economy. The markets will next shift focus to the employment front, starting with the ADP Nonfarm Payrolls. The estimate stands at 185 thousand, much lower than the previous release of 205 thousand.

The US economy has been grappling with a downturn in global demand, which has taken its toll on the export and manufacturing sectors. A strong US dollar, which has posted broad gains in recent months, has only exacerbated the situation. However, there was some positive news late in the week. US Preliminary GDP for the fourth quarter posted a strong gain of 1.0%, well above the estimate of 0.4%. There was also positive news from the manufacturing sector, as durable goods sparkled. Core Durable Goods rose 1.8%, crushing the estimate of 0.2%. This marked the key indicator’s strongest showing since March 2014. Durable Goods Orders followed suit with a sharp rise of 4.9%, rebounding from the previous reading of -5.1%. This was stronger than the estimate of 3.0%.

WTI/USD Fundamentals

Tuesday (March 1)

- 9:45 US Final Manufacturing PMI. Estimate 51.0 points. Actual 51.3 points

- 10:00 US ISM Manufacturing PMI. Estimate 48.5 points. Actual 49.5 points

- 10:00 US Construction Spending. Estimate 0.5%. Actual 1.5%

- 10:00 US ISM Manufacturing Prices. Estimate 35.5 points. Actual 38.5 points

- 10:00 US IBD/TIPP Economic Optimism. Actual 46.8 points

- All Day – US Total Vehicles. Estimate 17.6M

Upcoming Key Events

Wednesday (March 2)

- 8:15 US ADP Nonfarm Employment Change. Estimate 185K

*Key events are in bold

*All release times are EST

WTI/USD for Tuesday, March 1, 2016

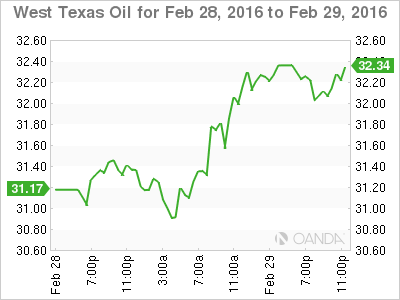

WTI/USD February 29 at 11:30 EST

Open: 33.78 Low: 33.37 High: 34.51 Close: 33.69

WTI/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 26.64 | 30.00 | 32.22 | 35.09 | 37.75 | 40.00 |

- WTI/USD showed gains in the Asian and European sessions but was unable to consolidate these gains. The pair has continued its downward movement in North American trade.

- There is resistance at 35.09

- 32.22 is providing support

Further levels in both directions:

- Below: 32.22, 30.00, 26.64 and 22.88

- Above: 35.09, 37.75 and 40.00