- High volatility is expected ahead of U.S. CPI data release

- Both the CPI and core CPI are expected to decline, primarily due to the base effect

- And, odds of a 0.25% interest rate hike at the upcoming meeting on July 26 stand at 93%

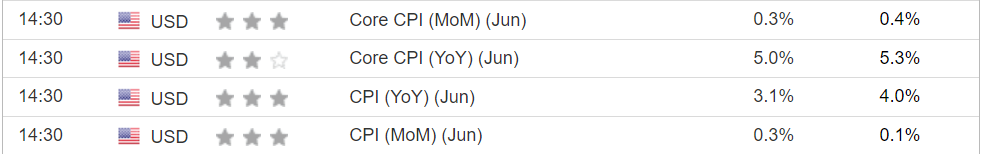

The markets are bracing for a day of high volatility as we await the release of U.S. inflation data. When comparing year-over-year data, both CPI and core CPI (excluding the more volatile components) are expected to show a decline, as illustrated below.

The anticipated decline in CPI and core CPI figures is primarily attributed to the base effect. We can break down the calculation as follows:

CPI (t) = CPI (t-1) + Change in CPI (t) - base effect

In the case of the regular CPI, the calculation would be 4% + 0.3% - 1.19% = 3.1%, precisely matching the expected figure. This calculation estimates the expected inflation detection by factoring in the base effect.

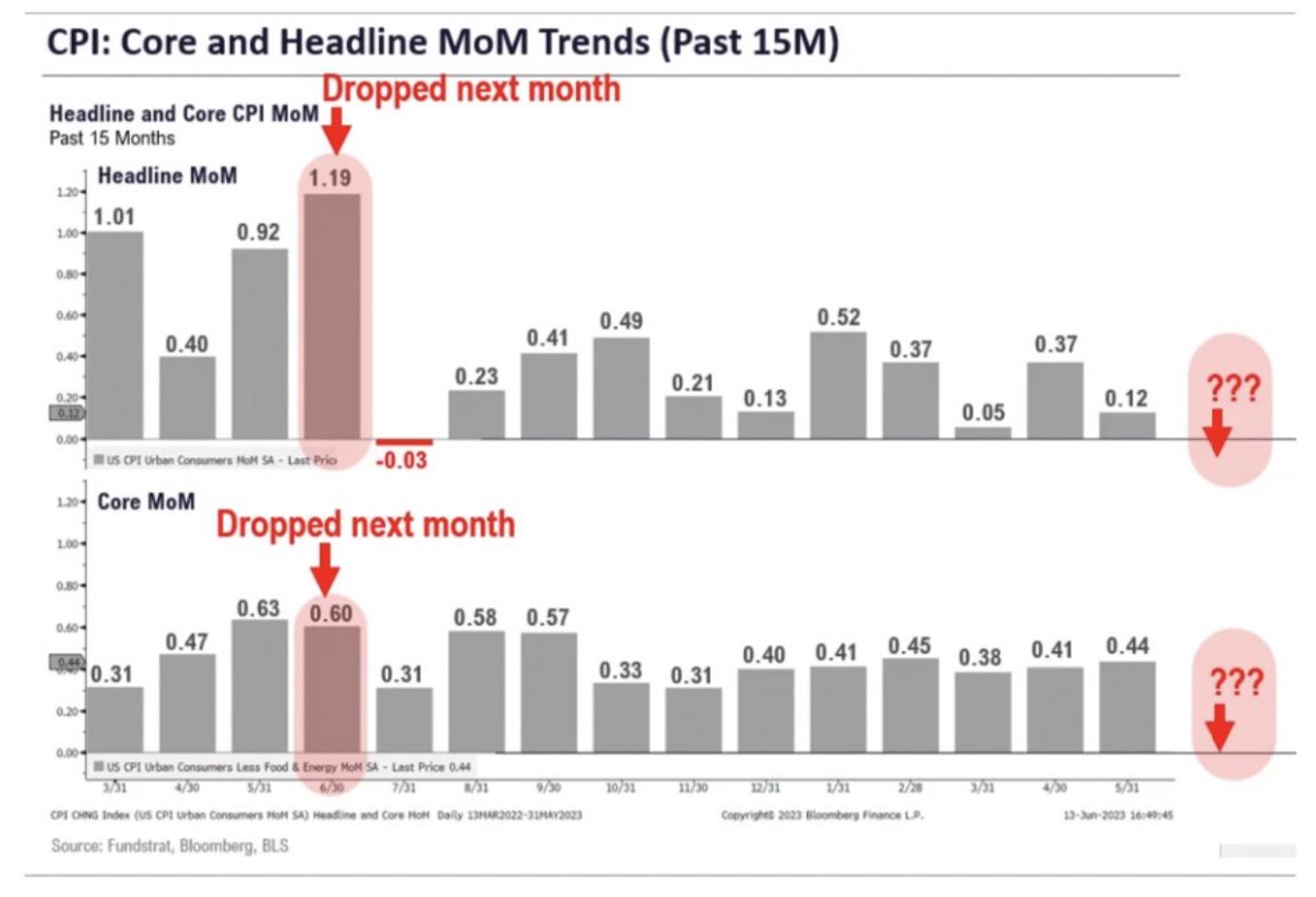

Source: Fundstrat, Bloomberg, BLS

Source: Fundstrat, Bloomberg, BLS

The base effects suggest that the August survey for the CPI will have minimal impact, with potential fluctuations over the subsequent three months. In contrast, for the core CPI, anticipate further declines in the next three months, assuming occasional monthly changes of approximately 0.3%.

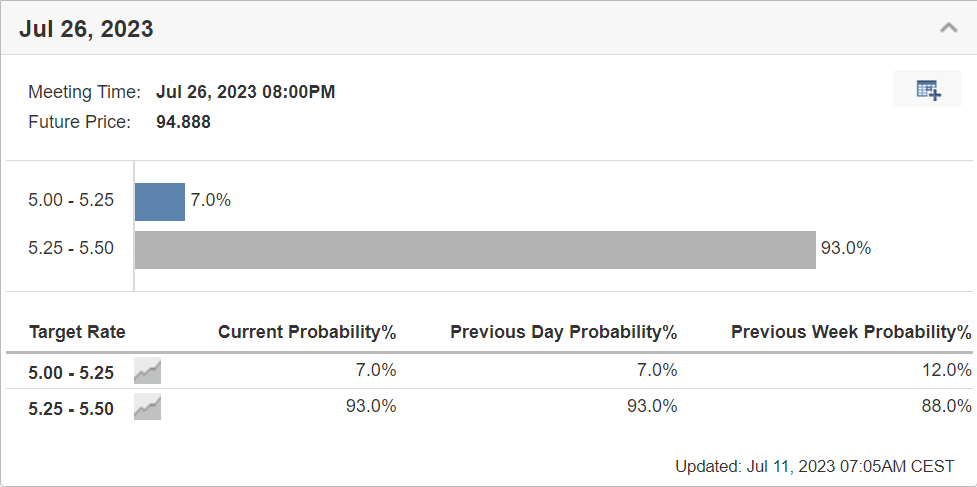

It is essential to highlight that we have not observed the predicted increases indicated by the CPI at 4% and core CPI at 5.3%. However, we will likely witness increases in July, with the CPI expected to be around 3% and the core CPI around 5%. These figures are subject to confirmation and may change over time. Currently, the odds of a 0.25% interest rate hike at the upcoming meeting on July 26 stand at 93%.

Source: Investing.com

The markets have started the week on a positive note, creating a sense of anticipation for the upcoming release of CPI data. It is expected that the CPI figures will show a downward trend.

***

InvestingPro is on sale!

Access first-hand market data, factors affecting stocks, and comprehensive analyses. Take advantage of this opportunity by signing up now and unleashing InvestingPro's potential to improve your investment decisions.

And now, you can purchase the subscription at a fraction of the normal price. Our exclusive summer discount has been extended!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and enjoy the flexibility of a monthly subscription.

- Annual: Save 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Biannual (Web Special): Save 52% and maximize your profits with our exclusive web offer.

Don't miss this time-limited opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the summer sale won't last forever!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.