Will the US CPIs and Fed minutes corroborate the pivot view?

At the start of this week, investors timidly started tilting the scale towards another rate hike by the Fed at its upcoming gathering in May, but a streak of disappointing US data thereafter revived doubts on what could be the wisest choice at the upcoming gathering.

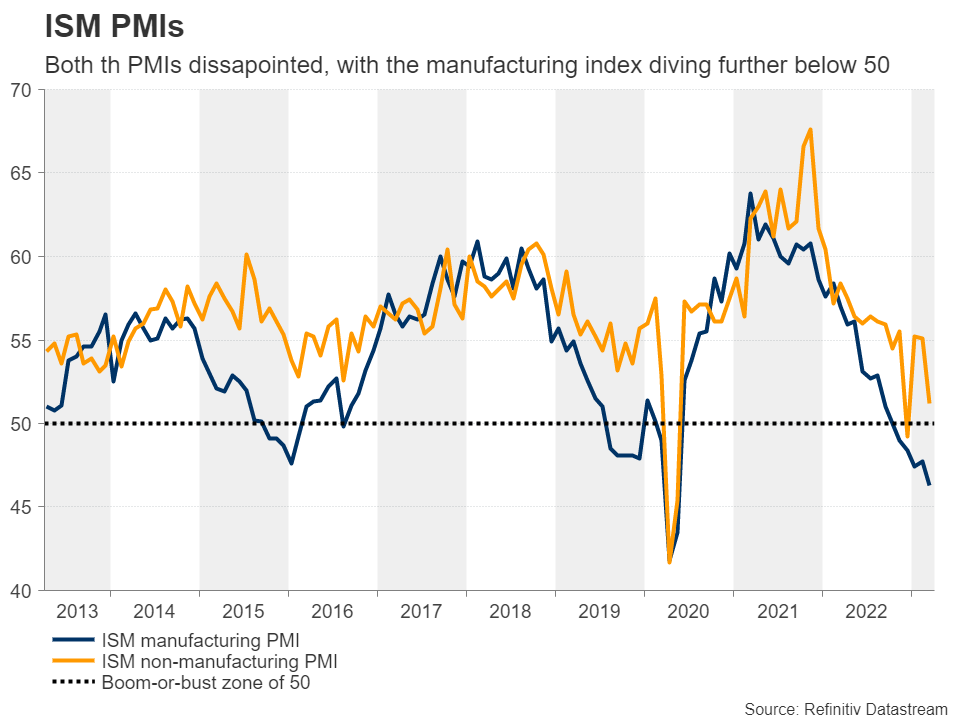

Both the ISM manufacturing and non-manufacturing PMI survey disappointed on all fronts, from employment to prices, with the outlook of the labor market becoming dimmer after job openings for February slipped to their lowest in nearly two years and after the ADP report revealed that the private sector gained fewer than expected jobs in March and much less than it did in February.

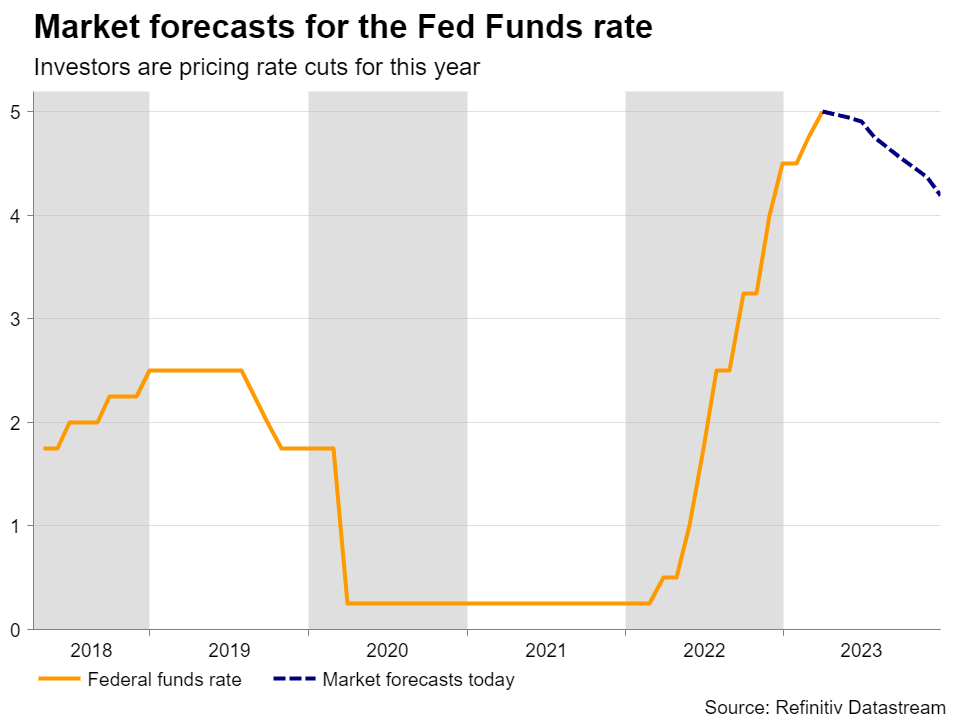

With all that in mind, market participants are now evenly split on whether the Fed should deliver one last 25bps hike in May or stay sidelined, anticipating a series of reductions to start in the summer, with interest rates seen ending 2023 at around 4.2%.

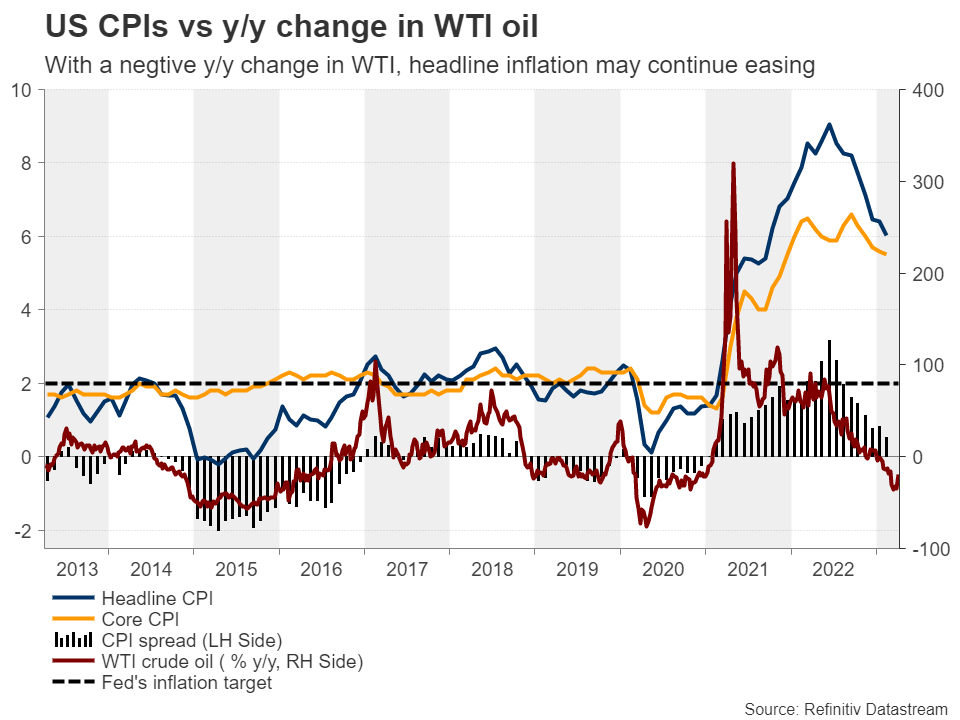

On Wednesday, the CPI data for March are scheduled to be released, while later in the same day, the Fed will publish the minutes of its latest gathering, where officials hiked by 25bps, but changed their forward guidance to note that future increments ‘may’ be warranted. Coming in the midst of concerns about the stability of the banking system, the word ‘may’ was the key to opening the door for a potential pause as soon as at the next gathering, even as the new “dot plot” and several policymakers in the aftermath of the meeting continued indicating that another hike is likely.

Investors seem to ignore anything that pushes against their view and pay more attention to reaffirmations. Thus, they may dig into the minutes to see whether officials discussed the possibility of a pause. Further slowdown in inflation and even the slightest glimpse in the minutes hinting at a the likelihood of a pause, could add extra credence to the market’s view, thereby sending Treasury yields and the US dollar lower.

The big question is how Wall Street traders will interpret the information. Up until this week, bad data was good for stocks on the thinking that lower interest rates will result in pricier valuations. However, that theme changed this week, with equity indices coming under pressure on fears that the US may be entering a deeper-than-previously-feared downturn.

As for the rest of the US data, Thursday brings the US PPIs for the month, while the last test for dollar traders during next week will come in the form of the US retail sales and industrial production for March, as well as the preliminary UoM consumer sentiment index for April, all to be released on Friday.

Will the BoC be the first major central bank to start cutting rates?

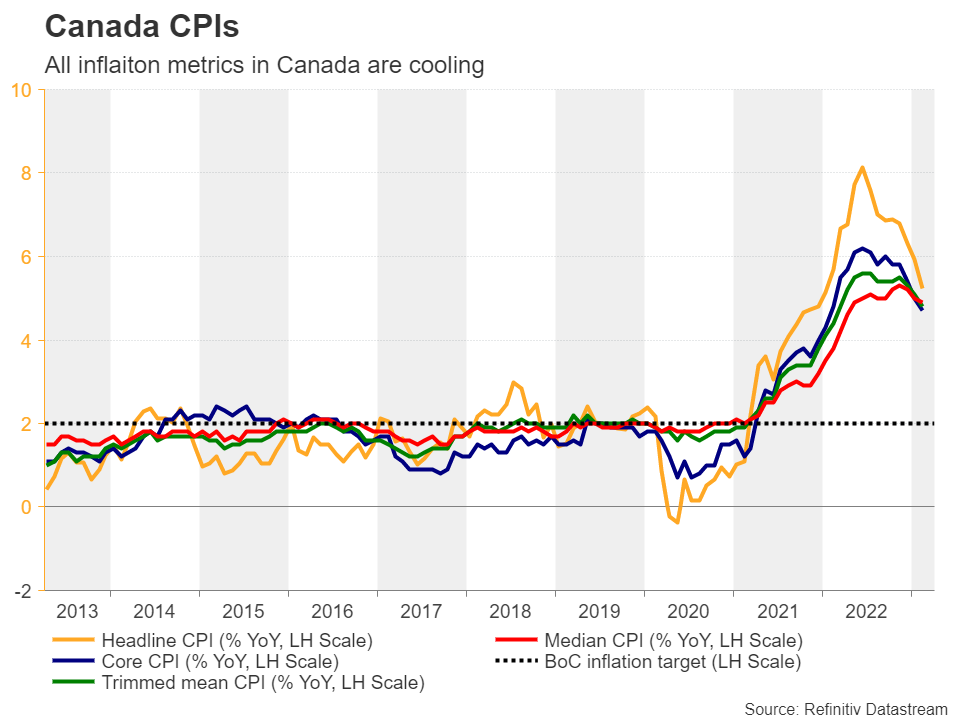

Wednesday will not be a busy day for dollar traders only. Those having the loonie in their portfolios will have to stay in front of their screens when the BoC decides on interest rates. At their last meeting, Canadian policymakers decided to keep interest rates unchanged, becoming the first major central bank to hit the pause button in this tightening crusade. Although in its statement, the BoC reiterated it remains prepared to increase rates further if needed, it also said that the latest data remains in line with the Bank’s expectations that CPI inflation will come down to around 3% in the middle of the year.

Post-meeting data showed that most inflation metrics in Canada slowed by more than expected in February, reaffirming the Bank’s view and prompting investors to assign a 15% chance of a rate cut as soon as at next week’s gathering, with the remaining 85% pointing to no action. This means that if officials decide to keep interest rates untouched, any market reaction may come from hints and clues regarding the Bank’s future course of action. So, anything suggesting that they could start cutting rates soon could add pressure to the Canadian dollar.

Aussie awaits Australia’s jobs report and China’s inflation numbers

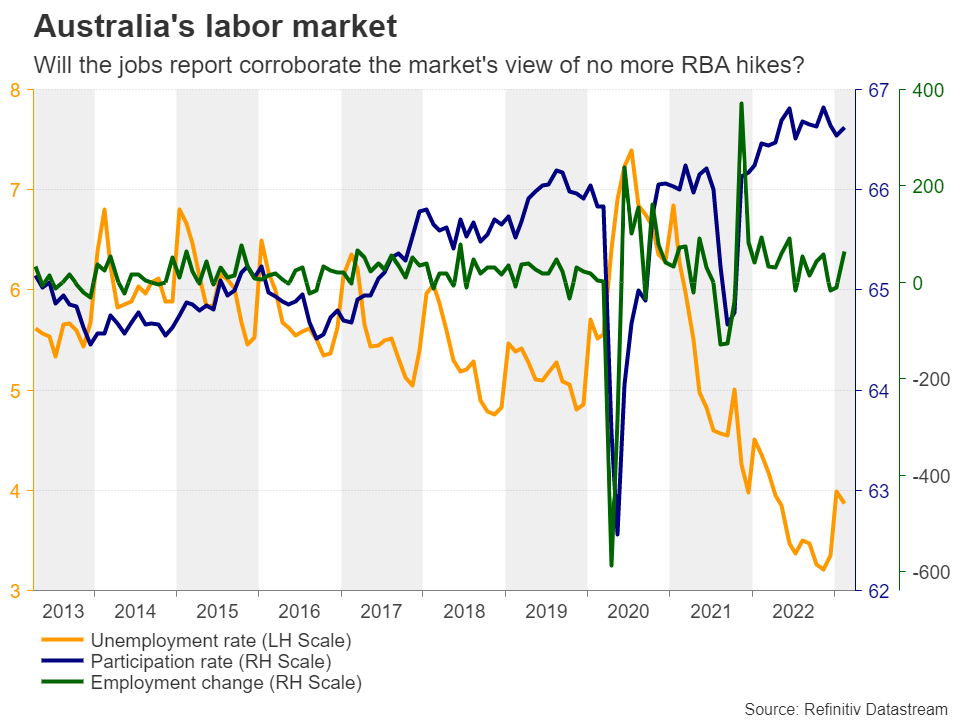

With the RBA standing pat on Tuesday but noting that some further tightening may be needed, aussie traders may pay extra attention to the Australian employment report for March scheduled to be released on Thursday, but also on the Chinese CPI and PPI data, which come on Tuesday, as the world’s second largest economy is Australia’s main trading partner.

The Chinese CPI is forecast to have accelerated notably, but the PPI is expected to have remained well into the negative territory. The former could be due to increasing domestic demand after the economy’s reopening from the COVID-related restrictions, but putting the latter into the equation, it may be hard to identify whether Chinese exports to Australia will fuel Australian inflation. China’s overall trade balance data are coming out on Thursday.

Currently investors are almost fully convinced that the RBA will not deliver any other rate increases. On the contrary, they are nearly fully pricing in a quarter-point rate reduction by the end of this year, and a weak jobs report could justify that view, thereby hurting the already-wounded aussie even more, especially against its New Zealand counterpart, which benefited this week from the RBNZ’s decision to hike by 50bps and signal that more hikes are on the cards.

Other releases on tap

From the Eurozone, retail sales and industrial production for February are coming on Tuesday and Thursday, while on Thursday, traders will also get the industrial and manufacturing production figures, the monthly GDP, and the trade balance, all for February. With the BoE expected to deliver more than 25bps worth of additional rate increments before it takes the sidelines, pound traders may seek reaffirmation in these releases.