This week, the US scored a sad record. The number of deaths related to the coronavirus in the US surpassed the death toll in China. What does it imply for the US economy and the gold market?

US Epidemiological Situation Is Grim

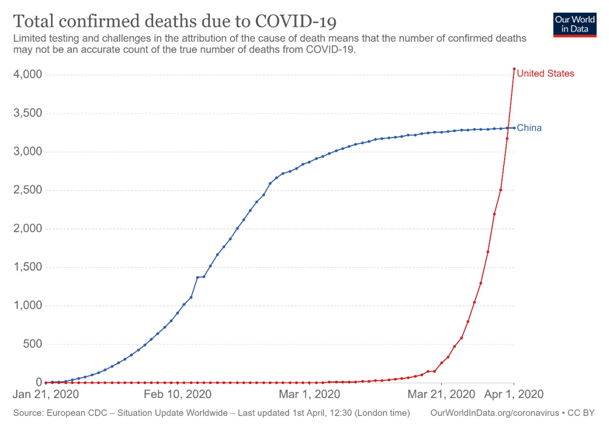

Just as people were overly optimistic before the stock market top, they can be too pessimistic right now. This is a real risk and we take it into account. However, the incoming data confirm our view expressed in the April edition of the Gold Market Overview that “the US will be severely hit” and that “the worst is yet ahead for the States”. Unfortunately, it turned out that we were right. On Monday, COVID-19 was the third leading cause of death in the United States. So much for the claims that influenza is worse than coronavirus. The U.S. coronavirus-related deaths reached more than 4,000 deaths, which is behind only Italy and Spain! The US death toll has actually surpassed the number of deaths in China (much more populous country), as you can see in the chart below.

Chart 1: Total confirmed deaths due to COVID-19 in China (blue line) and the US (red line) by April 1, 2020.

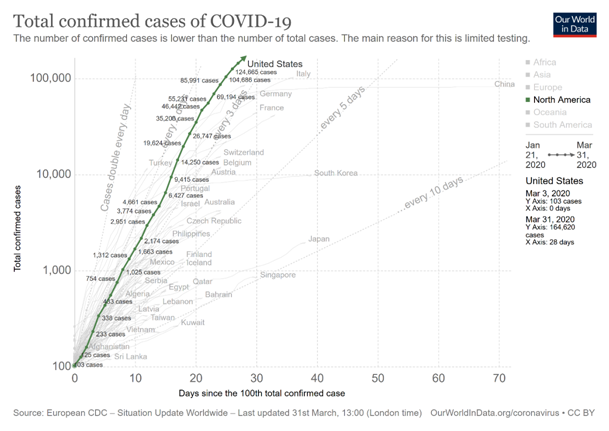

However, the sad truth is that the epidemiological curve in the United States is very steep, steeper than in Italy, as you can see in the chart below. It is so steep that the number of cases and deaths will be still increasing, and they will rise quite rapidly, actually. Well, we warned our readers that this is how exponential growth works. According to the chart below, the number of cases will double every 2-3 days.

Chart 2: Total confirmed cases of COVID-19 and other countries since the 100th confirmed case.

To make matter worse, it’s actually too late to avoid disaster, according to Dr. Michael T. Osterholm, the infectious-disease expert. This is because the United States lacks a unified national strategy,as counting on widespread testing in the United States is doomed to fail, partially because there will be soon a major shortage of chemical reagents for coronavirus testing. Moreover, there will be shortages of personal protective equipment and medical equipment such as respirators.

However, the scariest thing about the epidemic in the United States is that we are observing an increased number of severe illnesses and deaths in people between the ages of 25 and 50. The reason is, just as we warned in one of our previous Fundamental Gold Reports, that many Americans are obese or have cardiovascular disease. We wrote:

But the problem is there are many people with health issues. A great percentage of Americans are obese – which worsens their situation. All this means that it’s probable that pandemic will not be a short-term issue we quickly deal with, but it will stay with us for months

Indeed, the epidemiological prospects for the US are grim. Even the White House expects now up to 240,000 deaths. But even this high a number might be a big underestimate of the total death toll, especially if the health system becomes overburdened. If you multiply the half of the US population with a 1 percent mortality rate, you will get more than 1.6 million – and when the healthcare system collapses, the mortality rate increases to about 5 percent… Do the math on your own!

Implications for Gold

What does it all mean for the US economy and the gold market? Well, we are afraid that all people who oppose the social distancing measures and downplay the threat of the coronavirus still do not grasp the gravity of the situation. So, let’s reiterate: this time is different. We struggle with the real epidemic – luckily not as bad as Spanish flu, but still fatal. The social distancing measures will not end soon. Don’t count on this. For example, Saudi Arabia hinted that it is likely to suspend the annual pilgrimage to Mecca set for late July. Yup, we will not go out from quarantine for a while… Just take a look at China – President Xi Jinping said yesterday that it was too early to suspend all restrictions. Yes, smart scientists will develop the vaccine one day, but it will not be ready until 2021. One thing is to develop a vaccine, but another is to make it working and safe.

So, don’t count on a quick V-shaped recovery. Rather, brace yourself for economic winter. The latest jobless claims were huge – but the numbers are likely to accelerate to the downside still. Markets are only starting to figure out what is really happening and that the monetary and fiscal stimuli will not prevent the crisis. So, it’s probable that the stock market has not yet discounted all the economic damage. And, the longer the shutdown lasts (and in the US the epidemic was not contained early on, so it will last longer), the higher the risk of a negative feedback loop on the financial markets and the financial crisis.

So, it all means that the US stock market may fall further, dragging gold along. But when the sell-off is done, gold should rally in response to the recession, quantitative easing, spike in the fiscal deficit, negative real interest rates, and all the economic madness we are likely to see in the upcoming days.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.