Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

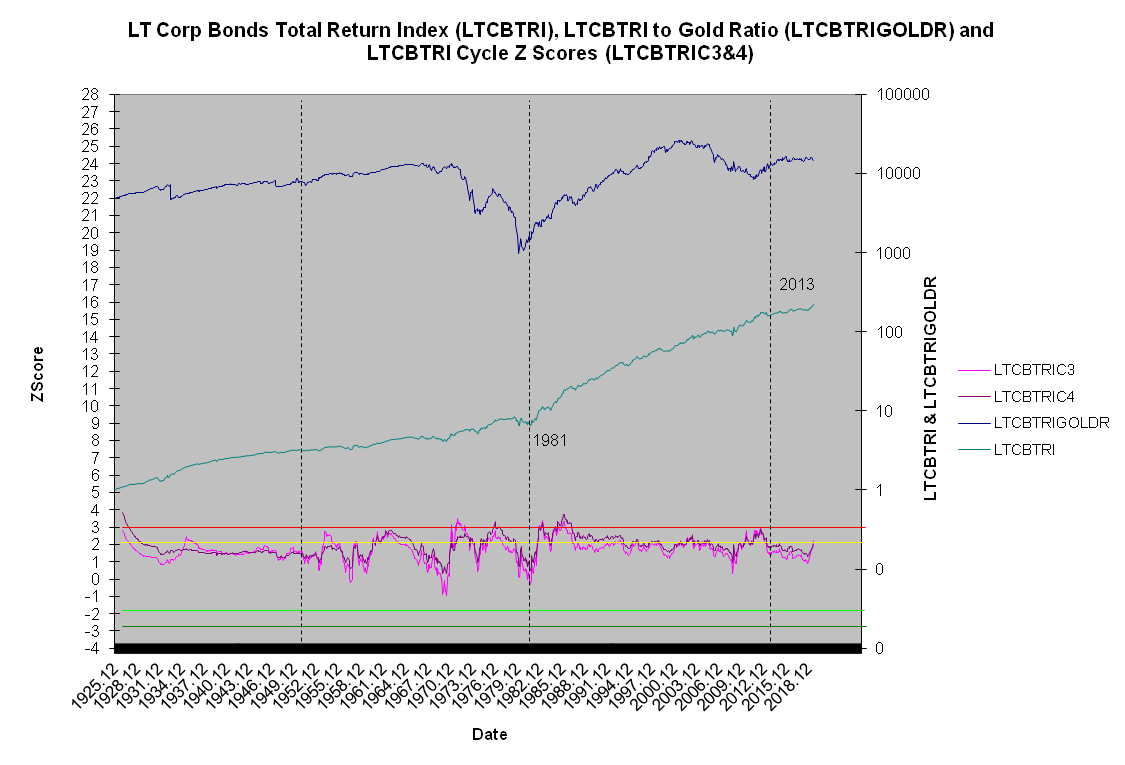

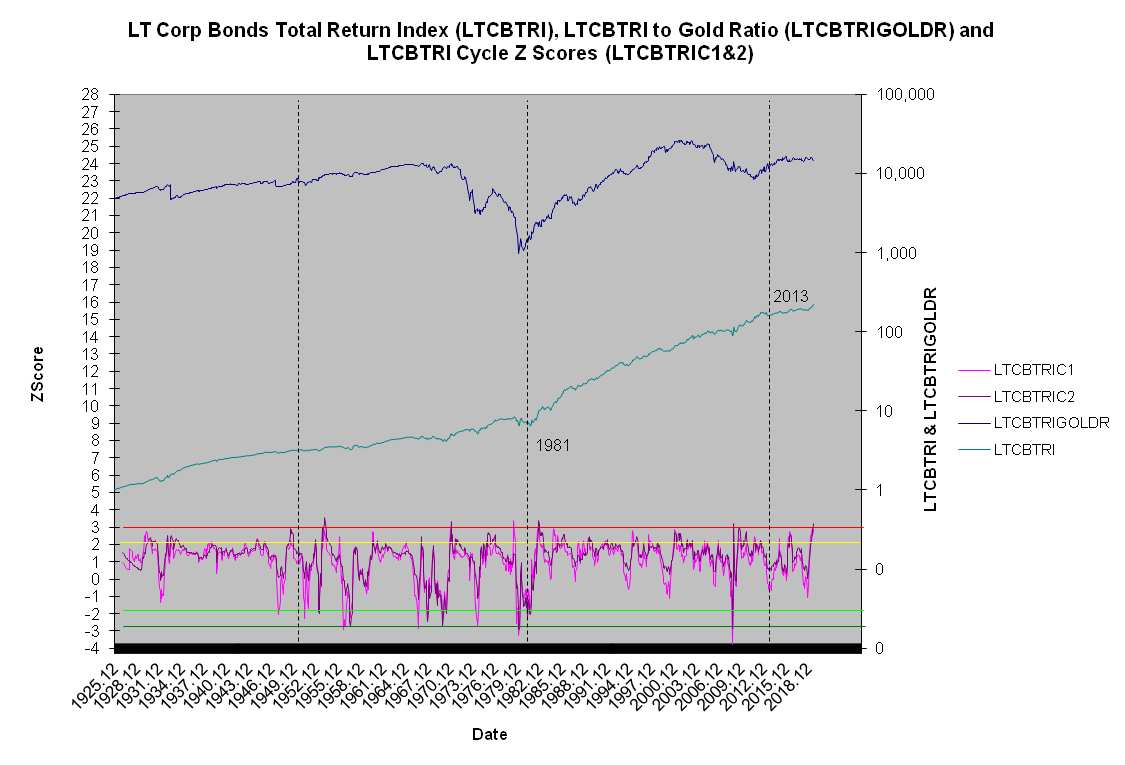

Believe long-term interest rates will head towards zero? Maybe public sector rates, but the computer says don't believe the hype in the high-grade corporate bonds (private sector). Long term cycle concentrations - C1, C2, C3, and C4 define a short and intermediate top forming at least. Longer-term concentration - C3 AND C4 could go higher, but they too will reach a point were lower interest rates are highly unlikely.

Long Term Cycle Concentration C1 C2 High Grade Corp Bonds

Long Term Cycle Concentration C3 C4 High-Grade Corp Bonds