U.S. Watch

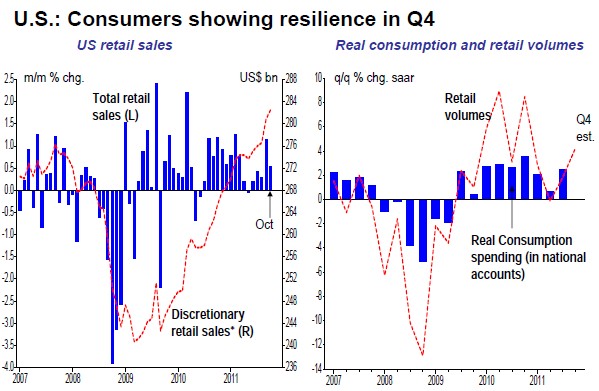

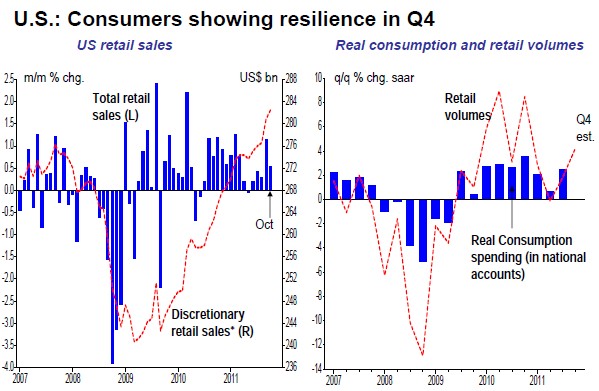

Retail sales in the US surprised to the upside in October, by expanding 0.5%. Auto sales were strong as expected but excluding that category, sales were even better at +0.6%, also topping consensus expectations. Highlighting the resilience of American consumers were the further increase in sales of discretionary items, +0.6% in the month following a 1.5% increase in September.

Assuming a flat print for inflation as per consensus expectations, retail volumes may also have grown 0.5% in October, putting real retail spending on track for annualized growth of over 4% in the final quarter of the year.

As today’s Hot Charts show, that probably means that consumption spending, which helped support GDP in Q3, remained firm in the final quarter of the year as well. So, even though the savings rate has come down (a negative for future consumption spending), it seems that the recovering labour market is providing an offset, helping support America’s main engine of growth, consumers.

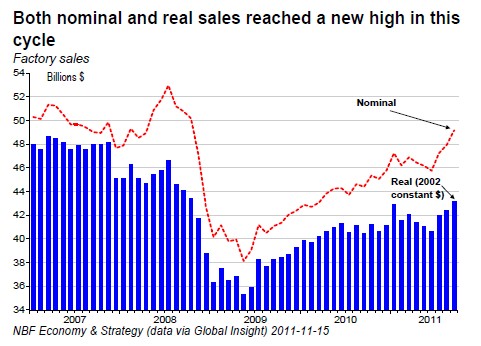

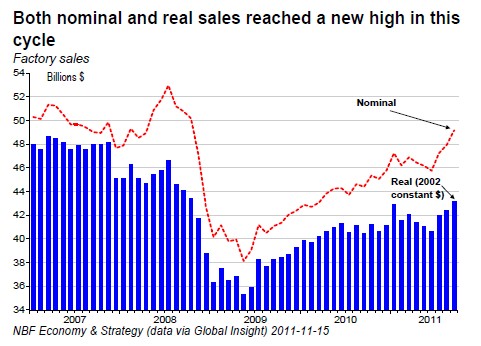

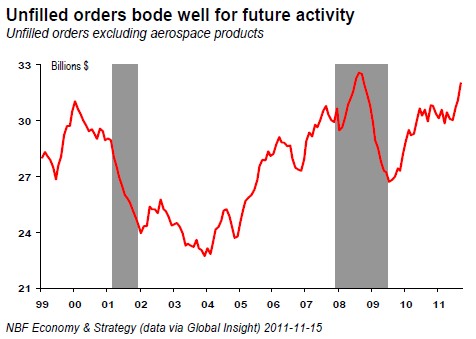

FACTS: Canada’s manufacturing sales jumped 2.6% in September, on the back of a 1.4% increase in August (top chart). In September, higher sales were reported in 10 of 21 industries, representing 60.5% of total manufacturing. Both durable goods and non-durable goods posted a 2.6% advance. Transportation equipment, the heavyweight in durable goods, surged 7.1% m/m with major gains coming from aerospace product & parts (+17.0%) and motor vehicle (+6.2%). Among non-durable goods sectors, petroleum and coal products (+13.7%) was the top performer. New orders increased strongly in September, up 4.8% after a 0.9% advance one-month earlier. Unfilled orders were up 3.0%, marking a ninth consecutive monthly increase. Inventories increased 0.4% and given this month’s sales increase, the inventory-to-sales ratio decreased to 1.30 from 1.33 a month earlier. In constant dollars, manufacturing sales were up 1.8% m/m after increasing 1.1% in August.

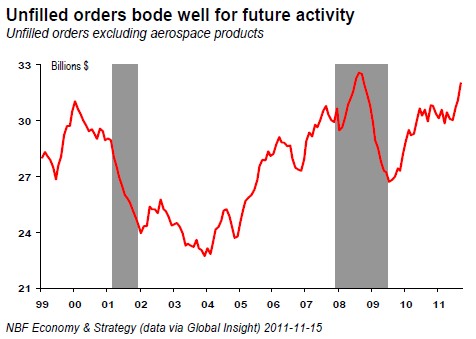

OPINION: September’s manufacturing sales at 2.6% were well above consensus expectations (+1.3%, m/m growth). This is a strong final month in what was an already strong quarter. Petroleum and coal products (+49.8% annualized) and transportation equipment (+38.9%) were the top performers in this quarter. Given the problems related to the Japanese Tsunami in Q2, a rebound was to be expected in Q3, but not as strong. In fact, the manufacturing sector has more than recovered those losses. As a result, both nominal and real sales reached a new high in this cycle. Moreover, the details of the report are encouraging for the coming months. Unfilled orders were up strongly in September in both nominal (+3.0%) and real terms (2.4%). Excluding aerospace products, a better gauge of near term activity, unfilled orders were up a whopping 6.6% over the last three months boding well for Q4. In this context, after its best performance in 2 years (+15.2% ann. in Q3), the manufacturing sector should post a decent growth in Q4 given the good starting point offered by September’s advance (Q4 is already up 6.4% ann. Assuming zero growth in Oct-Dec).

Retail sales in the US surprised to the upside in October, by expanding 0.5%. Auto sales were strong as expected but excluding that category, sales were even better at +0.6%, also topping consensus expectations. Highlighting the resilience of American consumers were the further increase in sales of discretionary items, +0.6% in the month following a 1.5% increase in September.

Assuming a flat print for inflation as per consensus expectations, retail volumes may also have grown 0.5% in October, putting real retail spending on track for annualized growth of over 4% in the final quarter of the year.

As today’s Hot Charts show, that probably means that consumption spending, which helped support GDP in Q3, remained firm in the final quarter of the year as well. So, even though the savings rate has come down (a negative for future consumption spending), it seems that the recovering labour market is providing an offset, helping support America’s main engine of growth, consumers.

FACTS: Canada’s manufacturing sales jumped 2.6% in September, on the back of a 1.4% increase in August (top chart). In September, higher sales were reported in 10 of 21 industries, representing 60.5% of total manufacturing. Both durable goods and non-durable goods posted a 2.6% advance. Transportation equipment, the heavyweight in durable goods, surged 7.1% m/m with major gains coming from aerospace product & parts (+17.0%) and motor vehicle (+6.2%). Among non-durable goods sectors, petroleum and coal products (+13.7%) was the top performer. New orders increased strongly in September, up 4.8% after a 0.9% advance one-month earlier. Unfilled orders were up 3.0%, marking a ninth consecutive monthly increase. Inventories increased 0.4% and given this month’s sales increase, the inventory-to-sales ratio decreased to 1.30 from 1.33 a month earlier. In constant dollars, manufacturing sales were up 1.8% m/m after increasing 1.1% in August.

OPINION: September’s manufacturing sales at 2.6% were well above consensus expectations (+1.3%, m/m growth). This is a strong final month in what was an already strong quarter. Petroleum and coal products (+49.8% annualized) and transportation equipment (+38.9%) were the top performers in this quarter. Given the problems related to the Japanese Tsunami in Q2, a rebound was to be expected in Q3, but not as strong. In fact, the manufacturing sector has more than recovered those losses. As a result, both nominal and real sales reached a new high in this cycle. Moreover, the details of the report are encouraging for the coming months. Unfilled orders were up strongly in September in both nominal (+3.0%) and real terms (2.4%). Excluding aerospace products, a better gauge of near term activity, unfilled orders were up a whopping 6.6% over the last three months boding well for Q4. In this context, after its best performance in 2 years (+15.2% ann. in Q3), the manufacturing sector should post a decent growth in Q4 given the good starting point offered by September’s advance (Q4 is already up 6.4% ann. Assuming zero growth in Oct-Dec).