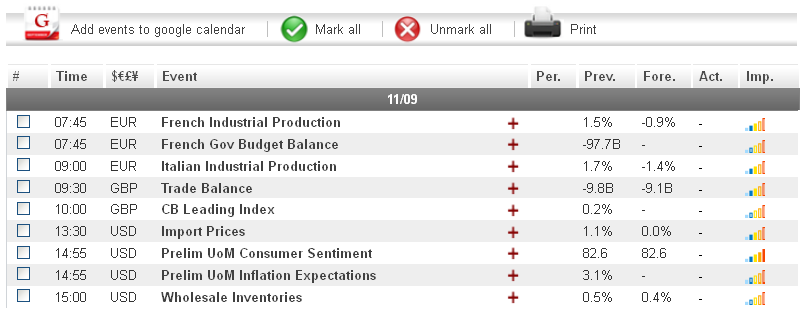

The euro fell to a fresh two-month low against the US dollar yesterday, as investors shifted their funds to safe-haven assets amid signs of economic turmoil in the US and euro-zone. The threat of the US slipping back into recession due to the impending “fiscal cliff,” coupled with signs of an economic slowdown throughout the EU, were mostly responsible for the risk aversion in the marketplace. Today, the main piece of news is likely to be the US Prelim UoM Consumer Sentiment figure, set to be released at 14:55 GMT. Better than expected news could lead to risk taking among investors and help the euro.

Economic News

USD - “Fiscal Cliff” Worries Causes USD/JPY to Extend Losses

The US dollar took minor losses against the Japanese yen yesterday, as concerns regarding the impending “fiscal cliff” in the United States caused investors to shift their funds to safe-haven assets. The “fiscal cliff,” which threatens to send the US back into recession, is $600 billion in spending cuts and tax increases set to be enacted if congress cannot agree to a deficit reduction plan by the end of the year. The USD/JPY fell close to 20 pips yesterday, eventually trading as low as 79.80. The dollar had slightly better luck against the Swiss franc. The USD/CHF advanced more than 30 pips during the European session to trade as high as 0.9477.

Today, the US Prelim UoM Consumer Sentiment figure, set to be released at 14:55 GMT, is forecasted to be the highlight of the trading day. Should the indicator come in above the expected 82.6, the greenback may be able to recover some of its recent losses against the JPY. In addition, traders will also want to monitor announcements regarding a slowing down in the euro-zone economic recovery, which could lead to further risk aversion and boost the USD against its higher-yielding currency rivals.

EUR - Euro Remains Bearish vs. USD and JPY

Risk aversion due to a slowing down in the euro-zone economic recovery, combined with the prospect of the US slipping back into recession if the US congress fails to reach a deal on deficit reduction, caused the euro to extend its recent bearish trend yesterday. Against the US dollar, the euro fell as low as 1.2722 during mid-day trading, a two-month low. The EUR/JPY hit a near one-month low at 101.62 before bouncing back to the 101.80 level.

Today, euro traders will want to continue monitoring any developments out of the euro-zone, particularly with regards to the economic situations Spain. It now appears that Spain is hesitant to request a bailout package to help relive its massive debt. Any signs that the Spanish government is going to continue holding off on the bailout request is likely to drive higher-yielding assets, like the euro, lower before markets close for the weekend.

Gold - Gold Range Trades amid Euro-Zone Worries

Gold spent most of the day range trading yesterday, as investors shifted their attention from US President Obama's re-election to the euro-zone debt crisis. Investor fears that Spain will hold off on requesting a bailout for the time being caused the precious metal to fall close to $5 an ounce, eventually reaching the $1714 level. That being said, gold prices were quickly able to recover and by the end of European trading had reached $1718.

Today, any announcements out of the euro-zone regarding Spanish and Greek debt are likely to have the biggest impact on gold prices. Any signs that the debt situations in either Spain or Greece is worsening could result in gold reversing some of its recent gains before markets close for the weekend.

Crude Oil - After Brief Gains, Oil Turns Bearish Again

Following significant losses earlier in the week after the results of the US presidential and congressional elections were announced, crude oil was able to stage a brief recovery yesterday. The commodity advanced more than $0.60 a barrel to trade as high as $85.61 before turning bearish once again. By the end of the European session, crude was trading at the $84.85 level.

Turning to today, oil traders will want to pay attention to US consumer sentiment data, set to be released at 14:55 GMT. Should the indicator come in higher than its forecasted level, it may signal to investors that energy demand in the US will go up, which could help crude recover some of its recent losses.

Technical News

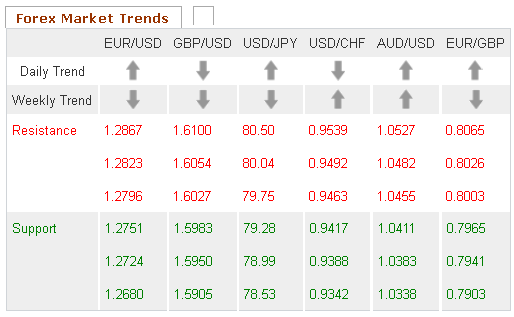

EUR/USD

While the Williams Percent Range on the daily chart is in oversold territory, most other long-term technical indicators show this pair range trading. Traders may want to take a wait and see approach at this time, as a clearer picture is likely to present itself in the near future.

GBP/USD

A bearish cross appears to be forming on the weekly chart's MACD/OsMA, indicating that a downward correction may occur in the coming days. Furthermore, the Williams Percent Range on the same chart is hovering close to overbought territory. Traders will want to keep an eye on these two indicators, as they may soon signal impending bearish movement.

USD/JPY

The daily chart's Relative Strength Index is currently in overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the weekly chart appears close to forming a bearish cross. Opening short positions may be the smart choice for this pair.

USD/CHF

The Slow Stochastic on the daily chart is currently forming a bearish cross, indicating that this pair could see a downward correction in the near future. This theory is supported by the Williams Percent Range on the same chart, which has crossed into overbought territory. Going short may be the wise choice for this pair.

The Wild Card

USD/HUF

The Williams Percent Range on the daily chart has crossed over into overbought territory, indicating that a downward correction could occur in the near future. Additionally, the Slow Stochastic on the same chart has formed a bearish cross. This may be a great time for forex traders to open short positions ahead of possible downward movement.

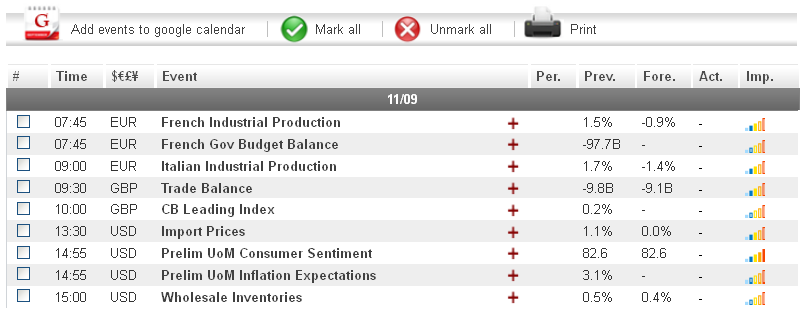

Economic News

USD - “Fiscal Cliff” Worries Causes USD/JPY to Extend Losses

The US dollar took minor losses against the Japanese yen yesterday, as concerns regarding the impending “fiscal cliff” in the United States caused investors to shift their funds to safe-haven assets. The “fiscal cliff,” which threatens to send the US back into recession, is $600 billion in spending cuts and tax increases set to be enacted if congress cannot agree to a deficit reduction plan by the end of the year. The USD/JPY fell close to 20 pips yesterday, eventually trading as low as 79.80. The dollar had slightly better luck against the Swiss franc. The USD/CHF advanced more than 30 pips during the European session to trade as high as 0.9477.

Today, the US Prelim UoM Consumer Sentiment figure, set to be released at 14:55 GMT, is forecasted to be the highlight of the trading day. Should the indicator come in above the expected 82.6, the greenback may be able to recover some of its recent losses against the JPY. In addition, traders will also want to monitor announcements regarding a slowing down in the euro-zone economic recovery, which could lead to further risk aversion and boost the USD against its higher-yielding currency rivals.

EUR - Euro Remains Bearish vs. USD and JPY

Risk aversion due to a slowing down in the euro-zone economic recovery, combined with the prospect of the US slipping back into recession if the US congress fails to reach a deal on deficit reduction, caused the euro to extend its recent bearish trend yesterday. Against the US dollar, the euro fell as low as 1.2722 during mid-day trading, a two-month low. The EUR/JPY hit a near one-month low at 101.62 before bouncing back to the 101.80 level.

Today, euro traders will want to continue monitoring any developments out of the euro-zone, particularly with regards to the economic situations Spain. It now appears that Spain is hesitant to request a bailout package to help relive its massive debt. Any signs that the Spanish government is going to continue holding off on the bailout request is likely to drive higher-yielding assets, like the euro, lower before markets close for the weekend.

Gold - Gold Range Trades amid Euro-Zone Worries

Gold spent most of the day range trading yesterday, as investors shifted their attention from US President Obama's re-election to the euro-zone debt crisis. Investor fears that Spain will hold off on requesting a bailout for the time being caused the precious metal to fall close to $5 an ounce, eventually reaching the $1714 level. That being said, gold prices were quickly able to recover and by the end of European trading had reached $1718.

Today, any announcements out of the euro-zone regarding Spanish and Greek debt are likely to have the biggest impact on gold prices. Any signs that the debt situations in either Spain or Greece is worsening could result in gold reversing some of its recent gains before markets close for the weekend.

Crude Oil - After Brief Gains, Oil Turns Bearish Again

Following significant losses earlier in the week after the results of the US presidential and congressional elections were announced, crude oil was able to stage a brief recovery yesterday. The commodity advanced more than $0.60 a barrel to trade as high as $85.61 before turning bearish once again. By the end of the European session, crude was trading at the $84.85 level.

Turning to today, oil traders will want to pay attention to US consumer sentiment data, set to be released at 14:55 GMT. Should the indicator come in higher than its forecasted level, it may signal to investors that energy demand in the US will go up, which could help crude recover some of its recent losses.

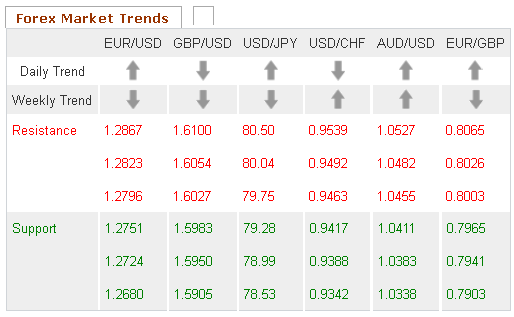

Technical News

EUR/USD

While the Williams Percent Range on the daily chart is in oversold territory, most other long-term technical indicators show this pair range trading. Traders may want to take a wait and see approach at this time, as a clearer picture is likely to present itself in the near future.

GBP/USD

A bearish cross appears to be forming on the weekly chart's MACD/OsMA, indicating that a downward correction may occur in the coming days. Furthermore, the Williams Percent Range on the same chart is hovering close to overbought territory. Traders will want to keep an eye on these two indicators, as they may soon signal impending bearish movement.

USD/JPY

The daily chart's Relative Strength Index is currently in overbought territory, indicating that a downward correction could occur in the near future. Furthermore, the Slow Stochastic on the weekly chart appears close to forming a bearish cross. Opening short positions may be the smart choice for this pair.

USD/CHF

The Slow Stochastic on the daily chart is currently forming a bearish cross, indicating that this pair could see a downward correction in the near future. This theory is supported by the Williams Percent Range on the same chart, which has crossed into overbought territory. Going short may be the wise choice for this pair.

The Wild Card

USD/HUF

The Williams Percent Range on the daily chart has crossed over into overbought territory, indicating that a downward correction could occur in the near future. Additionally, the Slow Stochastic on the same chart has formed a bearish cross. This may be a great time for forex traders to open short positions ahead of possible downward movement.