Investing.com’s stocks of the week

The near-term positivity that the results of the European banking stress tests lasted all of an hour of the European session yesterday. Any good feeling that the news had afforded European assets was quickly beaten back by results of the latest German IFO economic sentiment survey. The survey fell for the sixth month in a row, falling to the lowest level since December 2012.

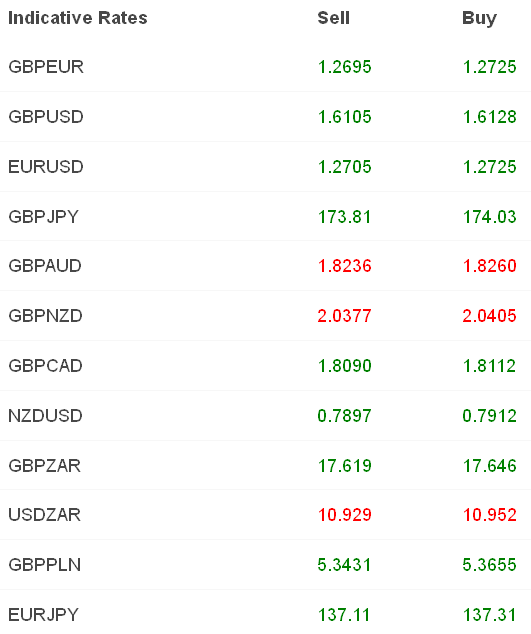

With the contraction in growth in Q2 in Germany alongside the very real issue of possibly no additional growth in the 2nd half of the year, the situation could be described as worrisome. The first reading of Q3 German GDP is due November 14th. The IFO Chief Economist stated after the release that there were “almost no bright spots” in German industry at the moment and that Q4 growth could also be flat. This brought EURUSD back below the 1.27 level and peaked GBPEUR back above the same. As the markets regain focus of the data dependency of the recovery, further euro losses should be on the cards.

The dollar weakened into the afternoon session however as the last buying operation of the Federal Reserve’s current asset purchase plan took place. POMOs or Permanent Open Market Operations, have been taking place on an almost daily basis to allow the Fed to invest the funds of its asset purchase program. Should the Federal Reserve decide to end their QE plan this Wednesday, as is widely expected, then yesterday’s will be the last. Stocks rallied and the dollar fell as traders took the money out ‘once more for old time’s sake’.

The conversation must now move to how the Fed conducts itself in a post-asset purchase landscape. When the tapering away of asset purchases was first announced a fair few commentators emphasised that “tapering was not tightening” in a bid to embolden the Fed’s dovish credentials. This is nonsense of course. Reducing the amount of monetary policy easing is a de facto tightening of policy, no matter how marginal that tightening in financial conditions may be.

Of course, while the US economy is reaching a point where rates should start to be moving higher, the natural dovishness of the Federal Reserve remains coursing through policy. As such, despite the end of the asset purchase program, we are still some distance away from seeing an increase in the Fed Funds rate. Current market expectations sit around 11 months from now.

Some of the dollar weakness seen could easily be traders looking for Janet Yellen to further soothe markets following their favourite toy being taken away.

Today’s US data should be USD positive in our eyes. The latest consumer confidence measure, due this afternoon, should show an improvement given recent advances in wages, jobless claims and increased purchasing power effects from cheaper gasoline and food. It should at least stymie some of the dovish pressure on the USD through today’s markets.

Elsewhere, focus is on the world’s oldest central bank this morning as the markets look for a rate cut. The Swedish Riksbank is expected to cut rates to a record low of 0.1% this morning in an attempt to fight off deflation in the country. Year-on-year deflation is currently running at 0.4%, something that will likely be perpetuated by the slowing of the Eurozone economy once again and the falls in global energy prices. If this doesn’t work a currency floor, such as the one that has been operation in Switzerland since 2011 could be imposed to devalue the SEK and create inflation in the country.