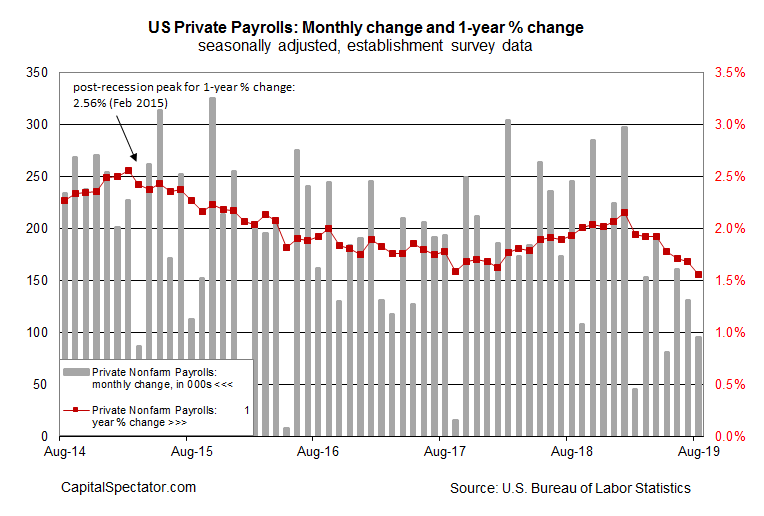

Private payrolls rose 96,000 in August, moderately below expectations, according to the update from the Labor Dept. The soft gain fans worries anew that the recent slowdown in the economy will bring a recession at some point in the near future. The one-year trend still ranks as healthy growth, but the downside bias is starting to look worrisome.

Payrolls increased 1.6% in August, essentially posting the slowest gain in two years. Notably, the current trend marks the point when the previous slowdown re-accelerated soon after. If the latest dip to a 1.6% gain gives way to softer numbers this time, the decline may mark the point of no return.

The case for expecting the labor market’s trend to stabilize or improve is still a viable possibility, however, or so this week’s stronger ADP Employment Report for August suggests. In contrast with today’s data from Washington, ADP’s employment estimate showed an ongoing acceleration in job growth, lifting the one-year change slightly to 1.7%.

“Businesses are holding firm on their payrolls despite the slowing economy,” says Mark Zandi, chief economist of Moody’s Analytics, which co-produces ADP’s data. “Hiring has moderated, but layoffs remain low. As long as this continues recession will remain at bay.”

But today’s numbers hint otherwise, and so all eyes will be watching the next round of economic reports for clarity.

Meantime, optimism is on the defensive. “The bottom line is that payroll growth is slowing and that is a worrying trend,” says Torsten Slok, chief economist at Deutsche Bank (DE:DBKGn). “The general picture here is certainly of a slowing economy.”

It’s still open for debate if the slowdown will continue, and trigger an NBER-defined recession, but today’s data doesn’t offer much comfort for thinking positively.

We may have reached the tipping point, although knowing that with a high degree of confidence will take several weeks at the least (and more likely several months of additional economic numbers).

Meantime, today’s numbers are “consistent with slowing US growth,” notes Brian Coulton, chief economist at Fitch Ratings in New York. “But it doesn’t look anything like impending recession territory.”

Will next week’s economic numbers agree? Two key labor market reports deserve close attention: the Job Openings and Labor Turnover Survey for July and a new weekly jobless claims update. To date, both series paint an upbeat outlook.

Pay close attention to next Friday’s retail sales reports for August, too. The consumer is still spending at a moderate pace, but if that gives way in the upcoming release even the staunchest optimists are going to have a tough time staying upbeat.