US economic growth remains sluggish, hinting at the possibility that a new recession may be near. But the numbers don’t align with a pessimistic intuition. The probability is extremely low that April marked the start of an NBER-defined downturn, based on published reports to date. Projecting a broad set of indicators into the near-term future suggests that the US will continue to sidestep a macro slump. Yes, the outlook could deteriorate if the incoming numbers stumble. But for the moment, recession risk remains low.

In fact, the prospects look encouraging for a modest rebound in economic activity in the second quarter, based on the Atlanta Fed’s latest nowcast. Although yesterday’s GDPNow estimate ticked down to a projected 2.5% increase for Q2 (as of May 17), that’s still a solid bounce higher from Q1’s tepid 0.5% advance. Forecasts aren’t written in stone, but the current forecast offers support for expecting some degree of improvement in output after a disappointing Q1.

The main caveat: a string of surprisingly weak reports in the days and weeks ahead could alter the current calculus. The recent run of weak numbers for several indicators leaves the trend in precarious state. If the incoming figures stumble, the outlook could suffer. Forward momentum at the moment isn’t strong enough to survive another wave of disappointment in the economic reports. The near-term projections suggest that’s not likely to happen, but no one really knows what the future will bring and so the current optimism that the US will sidestep recession is a shallow affair.

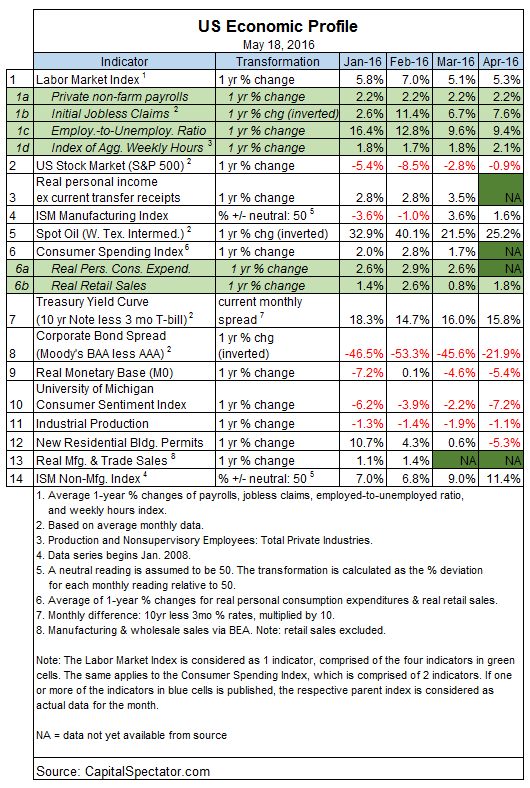

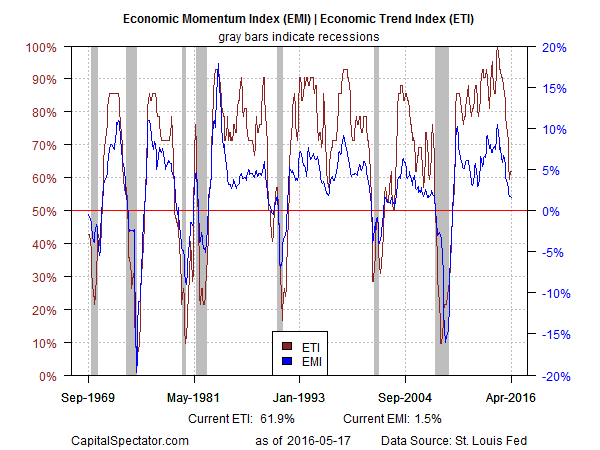

Nonetheless, the current profile based on the numbers in hand show that the US macro trend remains positive, albeit at diminished pace relative to recent history. The analysis is based on a methodology outlined in Nowcasting The Business Cycle: A Practical Guide For Spotting Business Cycle Peaks. The Economic Trend and Momentum indices (ETI and EMI, respectively) have fallen in recent months but remain at levels that still equate with expansion. Here’s a summary of recent activity for the components of ETI and EMI:

Aggregating the current data in the table above into business cycle indexes reflects weaker but still positive trends overall. The latest numbers for ETI and EMI show that both benchmarks are above their respective danger zones: 50% for ETI and 0% for EMI. The margin of comfort with current readings vs. the tipping points, however, has become quite thin, highlighting the possibility for trouble, depending on how the upcoming economic reports fare. When or if the indexes fall below the tipping points, we’ll have clear warning signs that recession risk is at a critical level and a new downturn is likely. (See note at the end of this post for ETI/EMI design rules.)

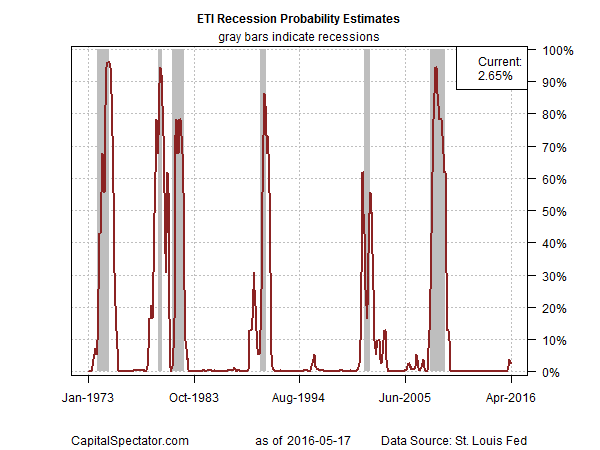

Translating ETI’s historical values into recession-risk probabilities via a probit model also points to low business-cycle risk for the US through last month. Analyzing the data with this methodology shows a slight uptick in risk lately, but the numbers still imply that the odds are low that the National Bureau of Economic Research (NBER) — the official arbiter of US business cycle dates— will declare April as the start of a new recession.

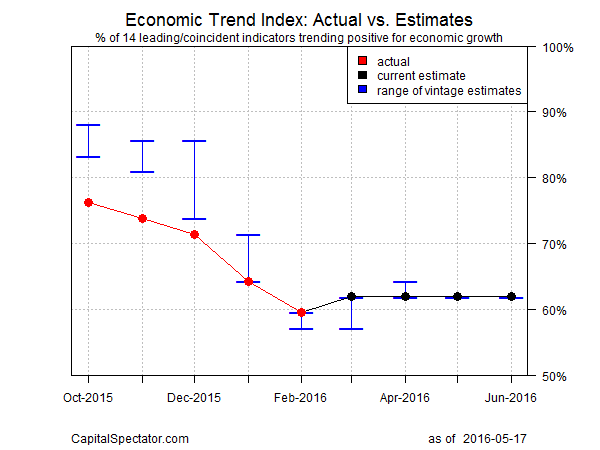

For another perspective, consider how ETI may evolve as new data is published. One way to project future values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on calculations via the “forecast” package for R, a statistical software environment. The ARIMA model calculates the missing data points for each indicator, for each month–in this case through June 2016. (Note that Feb. 2016 is currently the latest month with a complete set of published data.) Based on today’s projections, ETI is expected to remain above its danger zone for the near term by holding above the 50% mark. (Keep in mind that business cycle updates are available throughout each month in The US Business Cycle Risk Report.)

Forecasts are always suspect, of course, but recent projections of ETI for the near-term future have proven to be relatively reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given the broadly diversified nature of ETI. Predicting individual components, by contrast, is prone to far more uncertainty in the short run. The current projections (the four black dots on the right in the chart above) suggest that the economy will continue to expand. The chart above also includes the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data that followed, based on current numbers (red dots). The assumption here is that while any one forecast for a given indicator will likely miss the mark, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable view according to the historical record for the ETI forecasts.