Market movers today

Today's main even is the announcement around midday of the next UK Conservative Party leader , who is also going to succeed Theresa May as Prime Minister. Everyone expects it to be Boris Johnson. While Boris Johnson is more pro-Brexit than Theresa May, the arithmetic in the House of Commons is unchanged making it difficult for him to force a no-deal Brexit despite it being the default option from a legal point of view. Noticeably, pragmatic Conservative Philip Hammond has said he will step down as Chancellor if Boris Johnson wins and has not ruled out he will bring down his own government if necessary to prevent a no-deal Brexit.

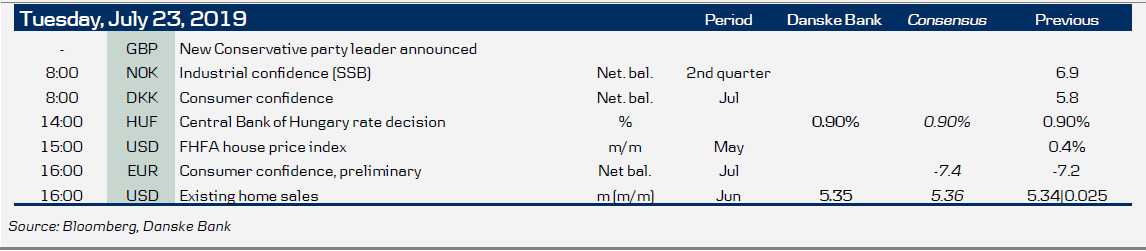

In terms of economic data releases it is a quiet day. To highlight a few, the preliminary euro area consumer confidence indicator for July, the US Richmond Fed manufacturing index for July and US existing home sales are due today at 16:00.

Today IMF is releasing an update to its World Economic Outlook.

The US corporate earnings season continues today .

This week's main event is the ECB meeting, where we expect tweaks to the forwarding guidance setting the scene for a comprehensive easing package to be unveiled in September, see ECB preview: Warming up for Draghi's Grande Finale , 22 July.

In Spain, parliament will today vote on Pedro Sanchez’ bid to form a government. In a first vote, Sanchez will need support from an absolute majority of MPs. Should that fail, a second vote will be held Thursday where only a simple majority is required. If Sanchez fails to get parliamentary backing this week, Spain is expected to head for new elections in the autumn. Similarly, markets will keep an eye on Italy, where the two Deputy Prime Ministers Salvini and Di Maio will meet today in an attempt to resolve their row. News about an imminent collapse of the government already spooked Italian yields late last week.

Selected market news

Late yesterday, US President Trump announced a bipartisan budget deal was finalised. This makes it possible for the House to pass the necessary legislation before its summer recess starts on Friday while the Senate will vote on it next week. As it is bipartisan, we think it would make it through congress despite some concerns among both Republicans and Democrats. The deal includes two important things. First, the debt limit will be suspended until 31 July 2021 (i.e. after the presidential election), which means the US Treasury can soon start issuing bonds in a normal fashion again and also rebuild its cash buffer. Second, the automatic reduction of the so-called spending caps, which should have kicked in on 1 October and would have reduced total government spending by more than USD100bn, has been cancelled. This means fiscal policy will not go from being very expansionary to very contractionary but instead become neutral. Despite the agreement on overall funding, there is still a risk of a government shutdown by 1 October if Congress has not passed spending bills.

In Europe, risk is increasing that the river Rhine must close for sea transport in a few weeks , Bloomberg reports. The combination of little rainfall and soon a heatwave means that the water level risks falling below 50cm (already fallen to around 150cm). Last year, the low water level in the Rhine was viewed by many as a contributing factor to the economic slowdown in Europe despite companies' attempt to activate contingency plans by transporting goods by train or trucks (which, however, is much more expensive) and stockpiling.

Key figures and events