Another round of central bank easing is underway. So why are bond yields rising?

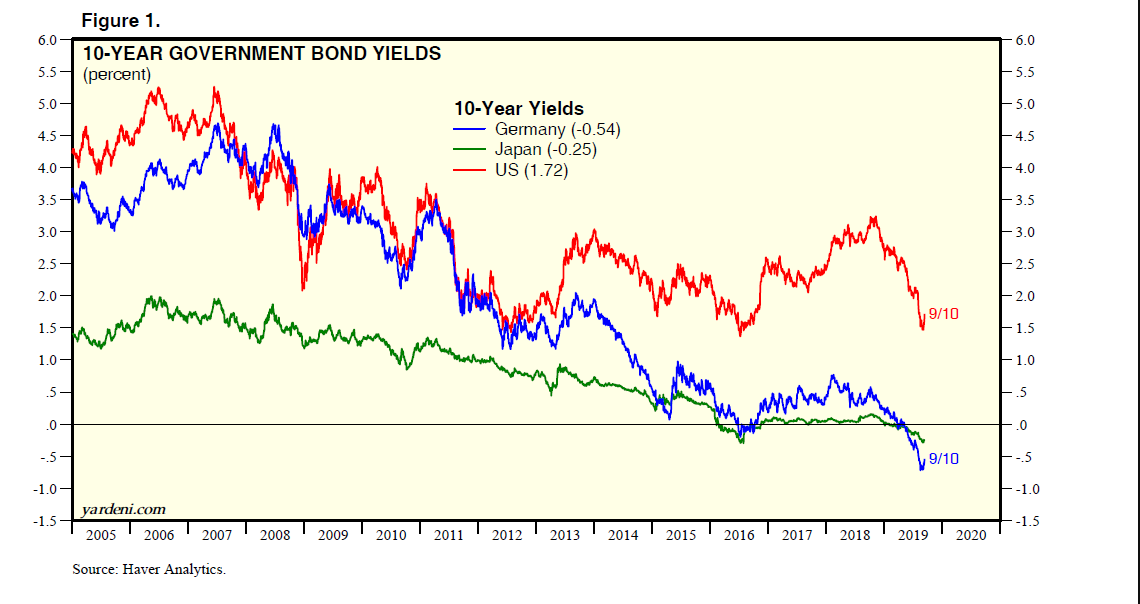

The 10-year US Treasury bond yield rose from a recent low of 1.47% on 9/4 to 1.72% on Tuesday. The record low was 1.37%, hit on 7/8/16 just after the Brits voted to leave the European Union (EU). The risks of a no-deal Brexit have eased in recent days, though it still could happen next month. A hard Brexit could cause the bond yield to retest its recent low.

In any event, the main reason that the US bond yield has moved higher in recent days has more to do with Germany than the UK. The 10-year German government bond yield has risen from a recent record low of -0.71% on 8/30 to -0.54% Tuesday. Reuter’s reported: “Germany’s 30-year government bond yield briefly rose into positive territory on Tuesday for the first time in over a month, lifted by expectations for fiscal stimulus and caution over the scale of stimulus the European Central Bank might deliver this week.”

During a parliamentary budget debate on Tuesday, Germany’s Finance Minister Olaf Scholz said that Germany can counter a possible recession with a big stimulus package. On Monday, Reuters reported that Germany was considering creating a “shadow budget” to boost public investment above and beyond limits set by its national debt rules, sparking a bond sell-off.

European Central Bank (ECB) President Mario Draghi has been lobbying for fiscal policy to turn more stimulative to support the ECB’s ultra-easy monetary policies. Germany has resisted doing so and even questioned whether the ECB’s asset purchase program could legally buy sovereign bonds. Germany’s fiscal and monetary conservatives might be starting to waver as a result of Germany’s intensifying manufacturing recession, with factory orders and production down 5.6% and 4.8% y/y through July.

Last year, when there was widespread bearishness in the bond market, with some predicting that the US yield would rise from 3% to 4%-5%, I observed that the US bond yield might be “tethered” to the comparable German and Japanese yields, which were barely above zero. This year, both have dropped solidly below zero.

During the Q&A portion of his 7/25 press conference, Draghi pleaded for more fiscal stimulus, especially from Germany:

“What’s hitting the manufacturing sector in Germany and [elsewhere in Europe is] an idiosyncratic shock. Here what becomes really very important is fiscal policy. [T]he mildly expansionary fiscal policy is supporting activity in the euro area. But if there were to be a significant worsening in the Eurozone economy, it’s unquestionable that fiscal policy … becomes of the essence. … I started making this point way back in 2014 in a Jackson Hole speech: monetary policy has done a lot to support the euro area … but if we continue with this deteriorating outlook, fiscal policy will become of the essence.”