To no one’s surprise, the Fed left rates unchanged at their June meeting. Their statement contained the following analysis of the U.S. economy:

Information received since the Federal Open Market Committee met in April indicates that the pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up. Although the unemployment rate has declined, job gains have diminished. Growth in household spending has strengthened. Since the beginning of the year, the housing sector has continued to improve and the drag from net exports appears to have lessened, but business fixed investment has been soft. Inflation has continued to run below the Committee's 2 percent longer-run objective, partly reflecting earlier declines in energy prices and in prices of non-energy imports. Market-based measures of inflation compensation declined; most survey-based measures of longer-term inflation expectations are little changed, on balance, in recent months.

Let’s add some detail to the Fed’s observations. Not only was the latest employment report disappointing, with the economy creating a paltry 38,000 jobs, but the 2 previous months’ job growth estimates were lowered a combined 59,000.

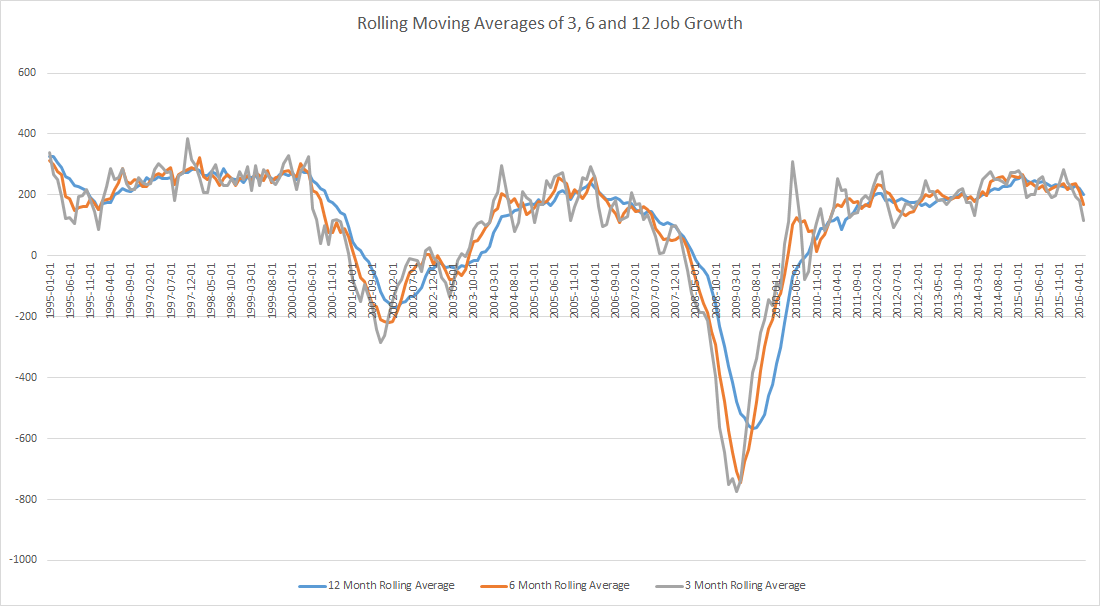

Since March, the participation rate has declined .4% while the employment/population ratio has dropped .2%. The unemployment rate dropped due to people leaving the labor force, not because there was a meaningful increase in employment. And the 3, 6, and 12 month rolling averages for job creation are dropping at a concerning rate:

The employment situation’s internals are becoming concerning. And because the Fed’s somewhat rosy analysis is based on the employment situation, the growing internal weakness should be concerning.

Household spending has been positive: real retail sales have increased smartly over the last two months and durable goods purchases, which were weak in February and March, increased a strong 2.2% in April.

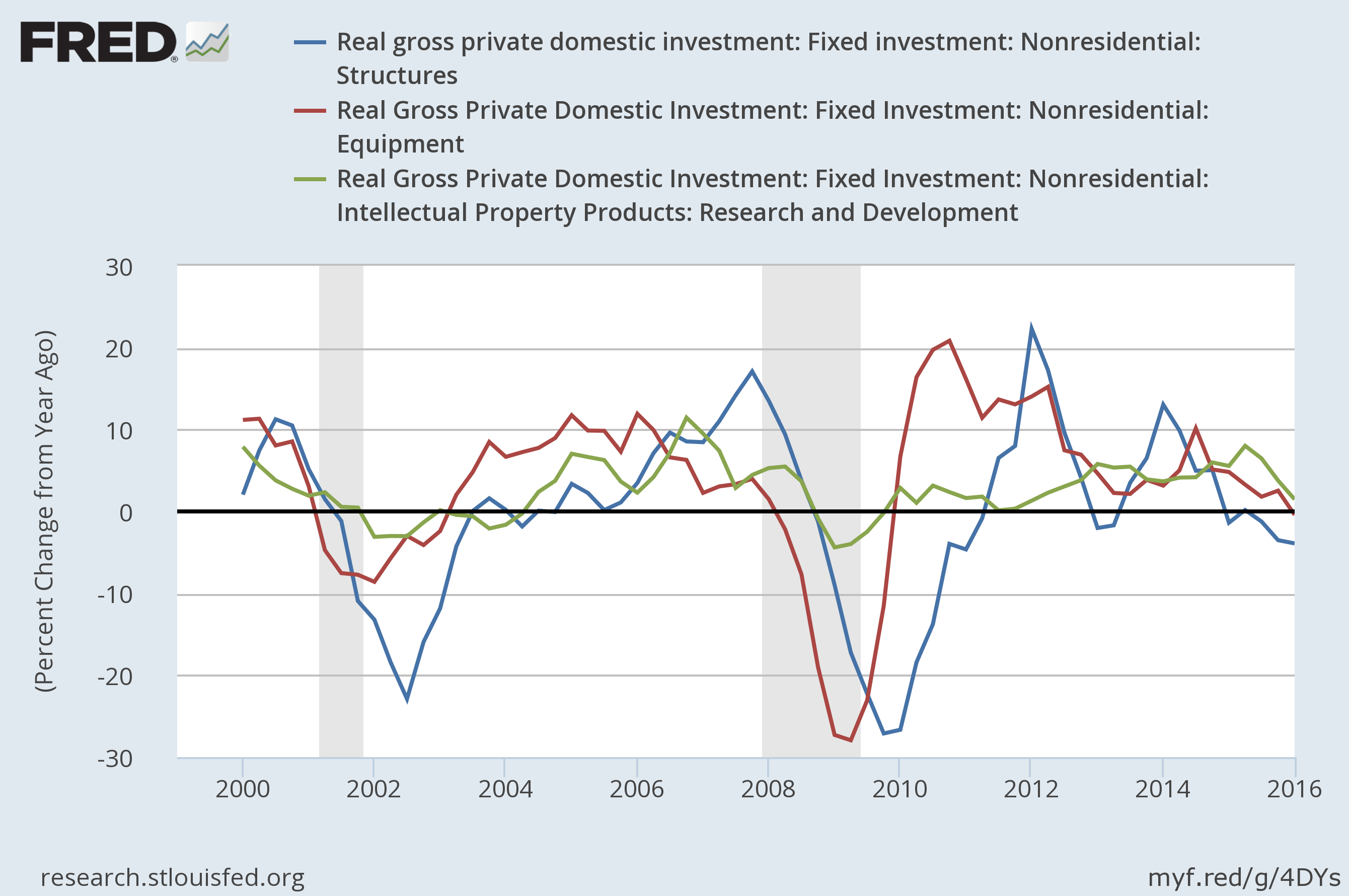

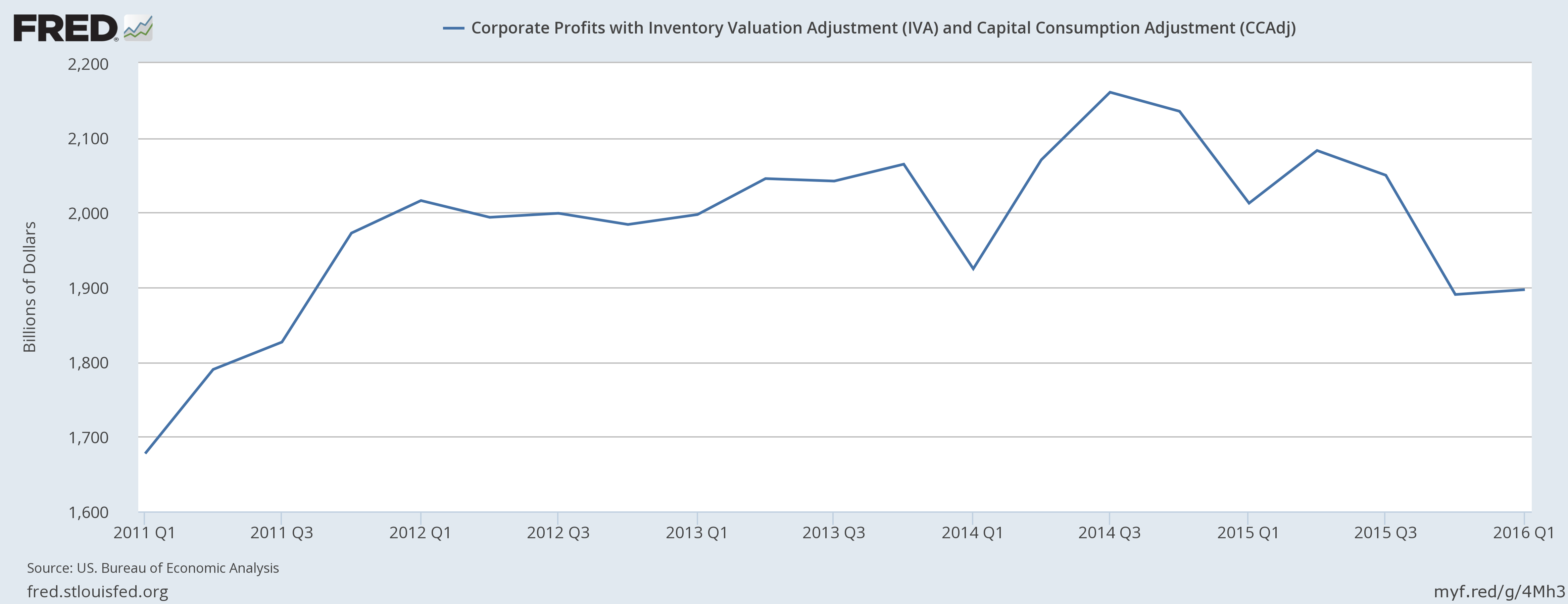

Housing has been the one economic sector providing very positive news, with residential investment rising 17.1% in 1Q16. Business investment, however, is weak (top chart) probably as a result of slowing corporate profits (second chart):

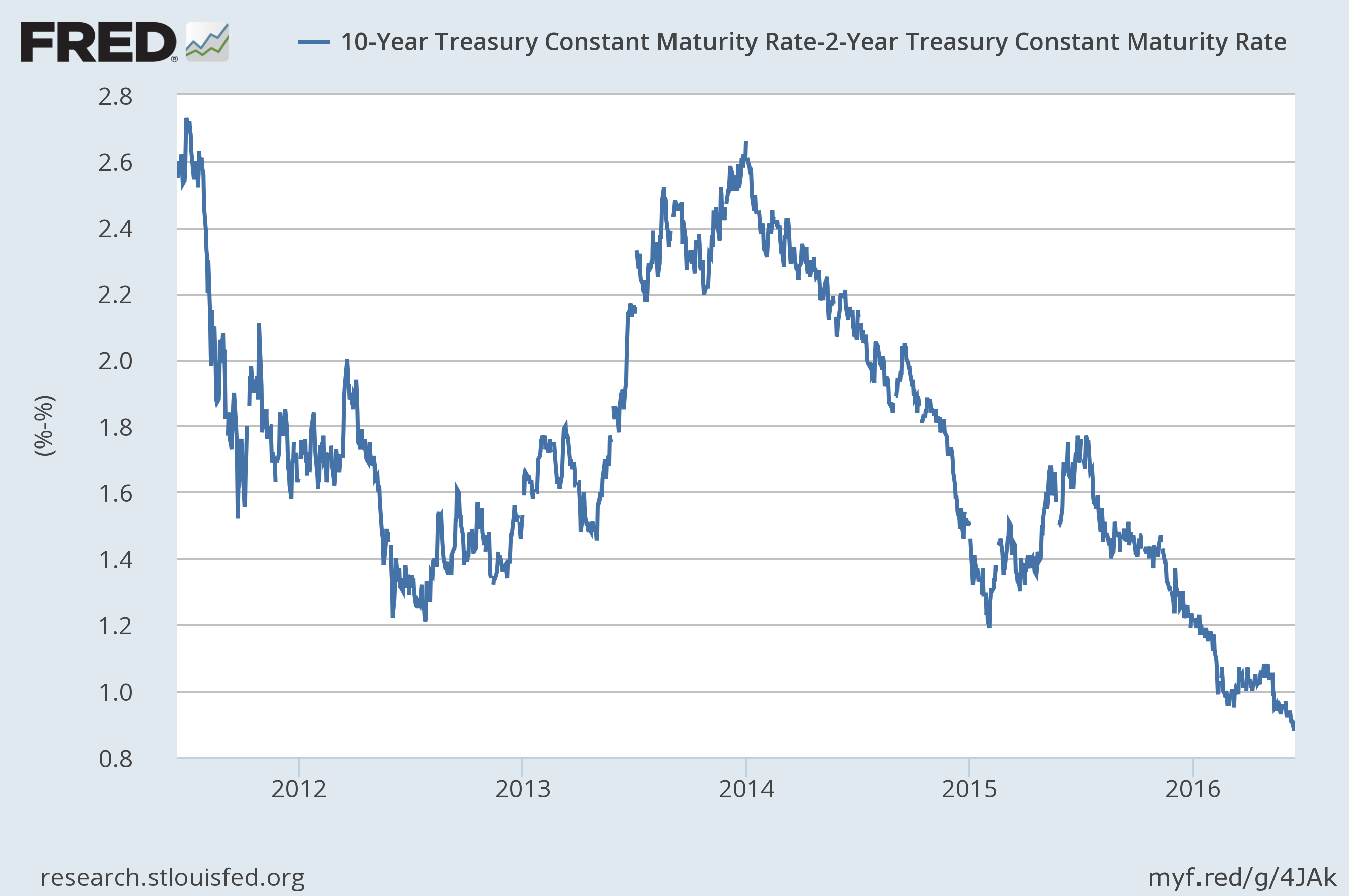

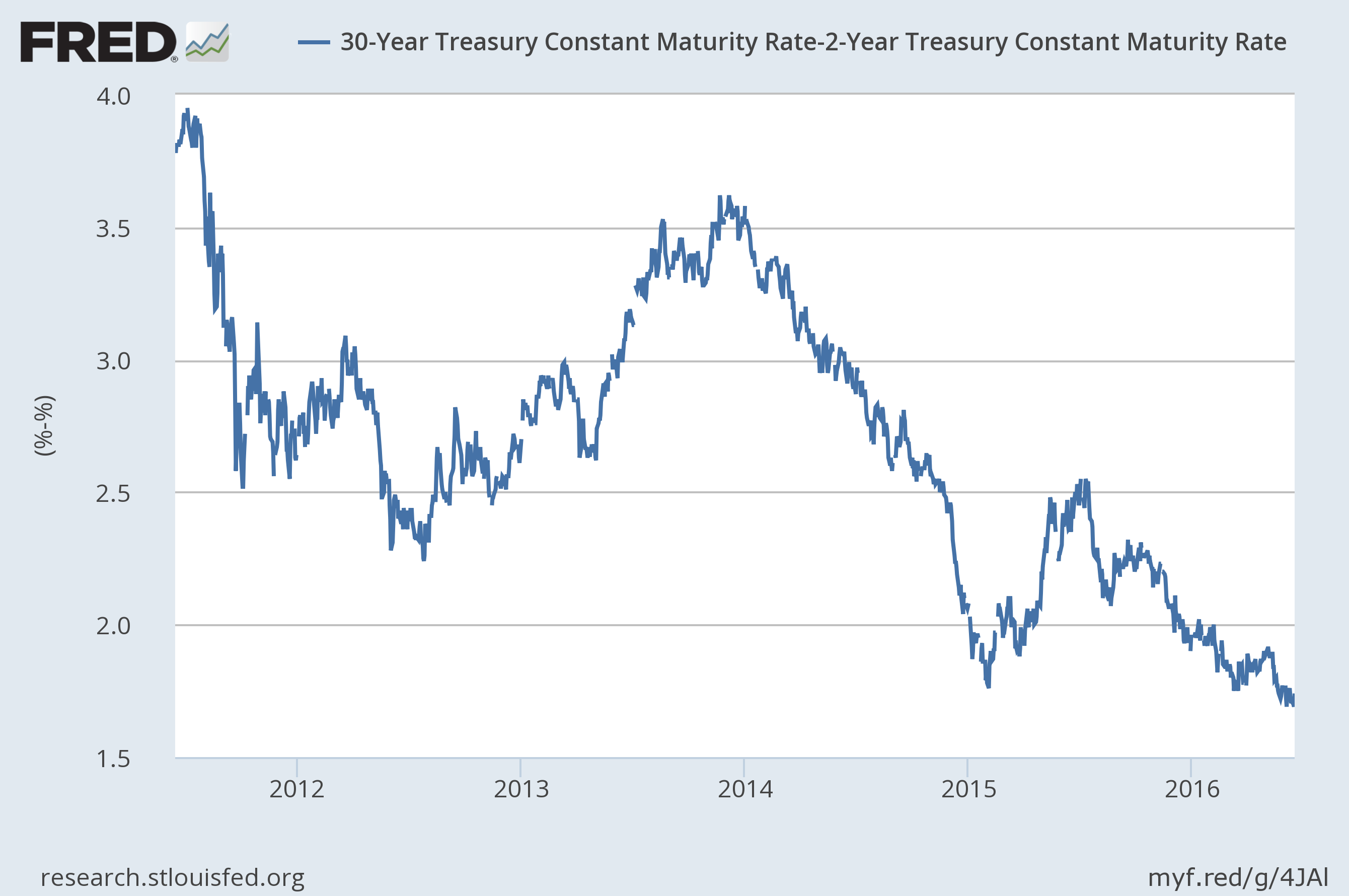

As for topline growth, the Atlanta Fed’s GDP now model predicts 2Q growth of 2.8%, while the NY Fed’s model is slightly over 2%. These forecasts are clearly in-line with the Fed’s predictions. The bond market, however, is far less optimistic. The 10-2 and 30-2 spreads are near 5-year lows, indicating bond traders see low growth and weak inflation:

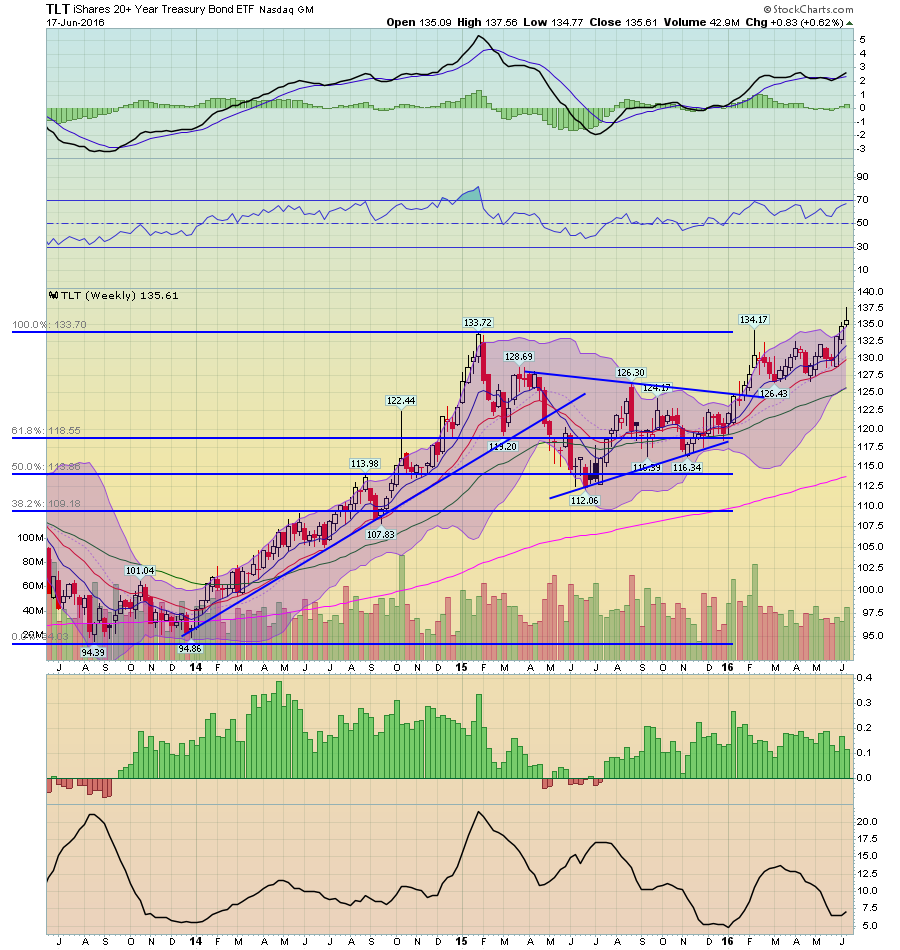

And the weekly charts for the iShares 7-10 Year Treasury Bond ETF (NYSE:IEF) and iShares 20+ Year Treasury Bond ETF (NYSE:TLT) show both securities are near multi-year highs:

While the Fed is arguing for a somewhat benign economic outlook, there are potential problems lurking underneath the surface. The employment situation may be weaker than the central bank thinks; business investment is very low and the bond market sees weak top-line growth and very low inflation.

In this environment, it's easy to wonder exactly why the Fed seems almost desperate to raise rates.