The Fed’s consensus is now for additional rate hikes. Cleveland President Mester – who is a non-voting member – argued for 3 rate hikes this year in addition to a reduction in the Fed’s balance sheet. Chicago Fed President Evans – who does vote on interest rate policy – is arguing for 2 additional hikes. Kansas Fed President George – another non-voting member – hedged her bets, saying the Fed has to strike a balance between letting the economy overheat and not unnecessarily slowing down growth.

The reasons given are now standard; in most cases, low unemployment and inflation fluctuating around 2% provide all the needed econometric support. But there is also a growing sense that perhaps the Fed is behind the ball and needs to play catch-up so that they are not caught flat-footed about inflation.

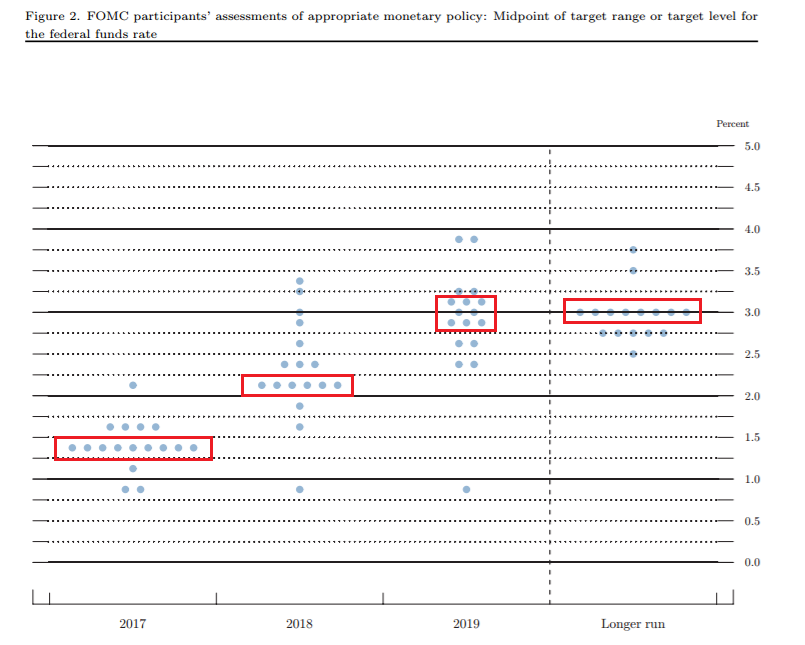

The Fed’s dot plot contains the following interest rate projections for the next 24-36 months:

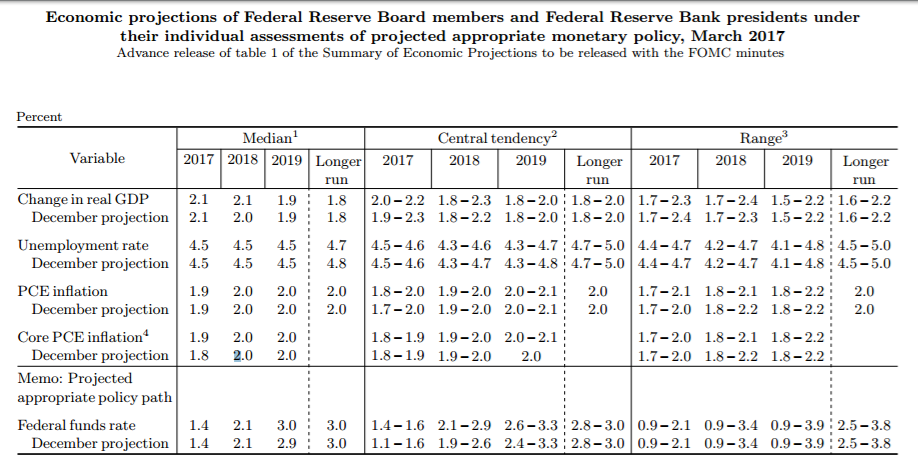

The consensus is for 2 rate hikes in 2018 and 3 in 2019. By the end of 2019 rates will be more or less normalized, with the short end of the curve near 3%. This is consistent with the Fed’s economic projections, which call for moderate growth and inflation:

In general, the Fed sees more of the same: moderate growth ranging between 1.8% and 2.3%. Note the wider projections in 2018 and the lower projections for 2019.

The Fed does not think that the proposed changes to the tax code, lowering the regulatory burden nor proposed infrastructure boost will meaningfully impact growth. It’s important to add this caveat: the Fed’s projections have been notoriously off after the recession. However, there are few if any non-Fed analysts predicting a large increase in growth; instead, nearly everyone is calling for more of the same.