Summary

- The yield curve has hit a steady-state equilibrium.

- The short-end of the curve is doing the heavy lifting when it comes to yield curve compression.

- Chicago Fed President Evans argues that the Fed is now back to a more normal central bank position in the economy as a whole.

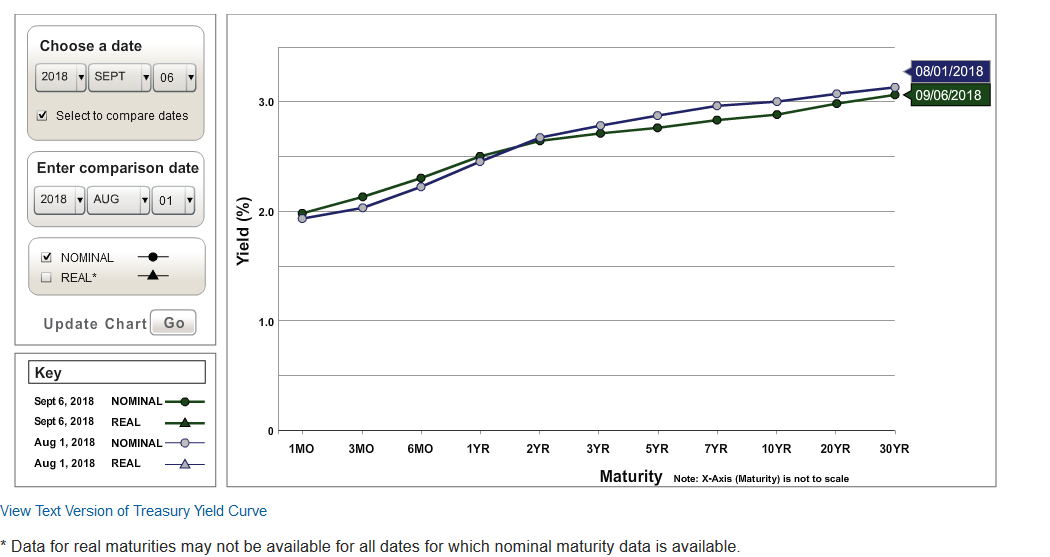

Over the last few months, the bond market has returned to its old, stodgy, slow-moving self. A comparison of the yield curves over two time periods illustrates the situation:

The latest yield curve (above in green) is much higher than the curve at the beginning of the year (in blue). But when we compare today's yield curve with that at the beginning of August, there is far less of a difference:

In fact, the latest yield curve (in green) is actually a touch lower than that of early August (in blue).

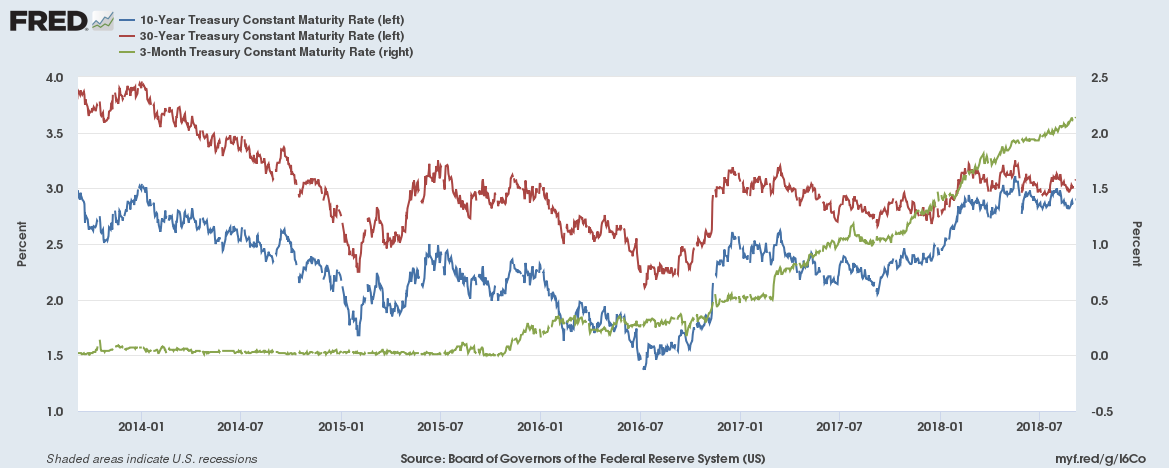

The following chart shows the situation from a different perspective:

The above chart contains the 30-year (in red), 10-year (in blue), and 3-month (in green) Treasury yields. The 10- and 30-year yields use a left-hand scale while the 3-month uses a right-hand scale. The 30-year has been very consistent since the beginning of 2017, trading right around the 3% level. The 10-year hit that level in the late spring and has stayed there. This has narrowed the 30-10 spread to under 30 basis points. The 3-month Treasury—which has rallied in conjunction with the Fed's rate-hiking policy—has done the heavy lifting.

All of this leads nicely into a discussion about Chicago Fed President Charles Evans' latest speech, titled "Back to the Future of Monetary Policy," in which he argues that the Fed is now returning to its more normal policy position of "leaning against the wind," or "taking away the punch bowl."

What exactly is a conventional monetary policy according to Evans? It's where the Fed plays a supporting role in the market economy and the federal government. Evans believes (correctly, I might add) that individual businesses and people are best able to determine where to allocate resources. He also argues that it's the government's job to create and provide a supportive environment for this activity. The Fed essentially nips and tucks around the edges:

As a supporting actor, monetary policy focuses on 1) assessing the various headwinds and tailwinds influencing the economy and 2) moving policy into a modestly accommodative or modestly restrictive stance, when appropriate, to help the main actors achieve maximum employment and price stability. I am not saying monetary policy can fine-tune outcomes-the world is far too complicated for that. The broad goal is for policy settings that-in the absence of unforeseen shocks to the economy-are consistent with reaching these employment and inflation objectives within a reasonable amount of time.

He then noted that this was the primary way the U.S. economy operated during the great moderation. This ended with the global financial crisis, where all the public policy actors were forced into very extreme positions to prevent an all-out depression. But Evans argues that now the Fed can move back into a more support role:

Today, long after the financial crisis and the Great Recession, we find ourselves stepping back into this role of supporting actor: With the unemployment rate at 3.9 percent and core inflation at 2 percent, our job is to facilitate the long-run, sustainable achievement of maximum employment and price stability.

Given the outlook today, I believe this will entail moving policy first toward a neutral setting and then likely a bit beyond neutral to help transition the economy onto a long-run sustainable growth path with inflation at our symmetric 2 percent target.

In other words, Evans believes the Fed should continue to raise rates gradually over the next few years. This is the position that Chairman Powell advocated in his latest speech at Jackson Hole.

As of now, most/all of the Federal Reserve presidents believe interest rates should continue to move modestly higher over the next few years.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.