Investing.com’s stocks of the week

Summary

- Anecdotal data contained in the latest Beige Book was modestly bearish.

- Leading indicators are also flashing yellow.

- The Fed's dot indicates the Fed may raise rates to such a degree that they'll invert the yield curve next year.

Let's place the latest Fed decision into a short-term historical context. The general U.S. economic backdrop is weakening. The Fed's rate increases have lifted 15- and 30-year mortgage rates, which is slowing the housing market. Auto sales have probably peaked for this cycle. The yield on higher-risk debt is increasing, the yield curve is flattening and the stock market is in a clear correction. For the first time this cycle, the latest Beige Book's economic summation paragraph contained modestly bearish language [empahsis added]:

Most of the twelve Federal Reserve Districts reported that their economies expanded at a modest or moderate pace from mid-October through late November, though both Dallas and Philadelphia noted slower growth compared with the prior Beige Book period. St. Louis and Kansas City noted just slight growth. On balance, consumer spending held steady – District reports on growth of nonauto retail sales appeared somewhat weaker while auto sales tended to improve, particularly for used cars. Tourism reports varied but generally kept pace with the economy. Tariffs remained a concern for manufacturers, but a majority of Districts continued to report moderate growth in the sector. All Districts reported growth in nonfinancial services – ranging from slight to strong. New home construction and existing home sales tended to decline or hold steady, while construction and leasing of nonresidential structures tended to rise or remain flat. Overall, lending volumes grew modestly, although a few Districts noted some slowing. Agricultural conditions and farm incomes were mixed; some Districts noted impacts from excessive rainfall and from tariffs, which have constrained demand. Most energy sectors saw little change or modest growth. Most Districts reported that firms remained positive; however, optimism has waned in some as contacts cited increased uncertainty from impacts of tariffs, rising interest rates, and labor market constraints.

Economic data typically starts being reported anecdotally, as key players begin to voice concerns and observations about the economy. If this continues for a sufficient time, it influences sentiment, which then leads to slower activity. While the above paragraph is the first such documentation this cycle in the Biege Book, it's not the first documentation of bearish sentiment. For the last several months, the anecdotal comments to the ISM's manufacturing data have expressed concerns about tariffs and the inability to find qualified labor. Markit's US manufacturing report has reported similar sentiment.

Despite this report, the Fed's latest policy statement contained a very strong assessment of the US economy [emphasis added]:

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

In the space of three sentences, the Fed used the word "strong" four times - a very odd development for an organization that is normally extremely cautious in its tone. It can also be argued that it runs counter to some of the breadth of the economic softening we're now seeing in the data. By only focusing on coincidental data, the Fed is overlooking the implications of the leading data.

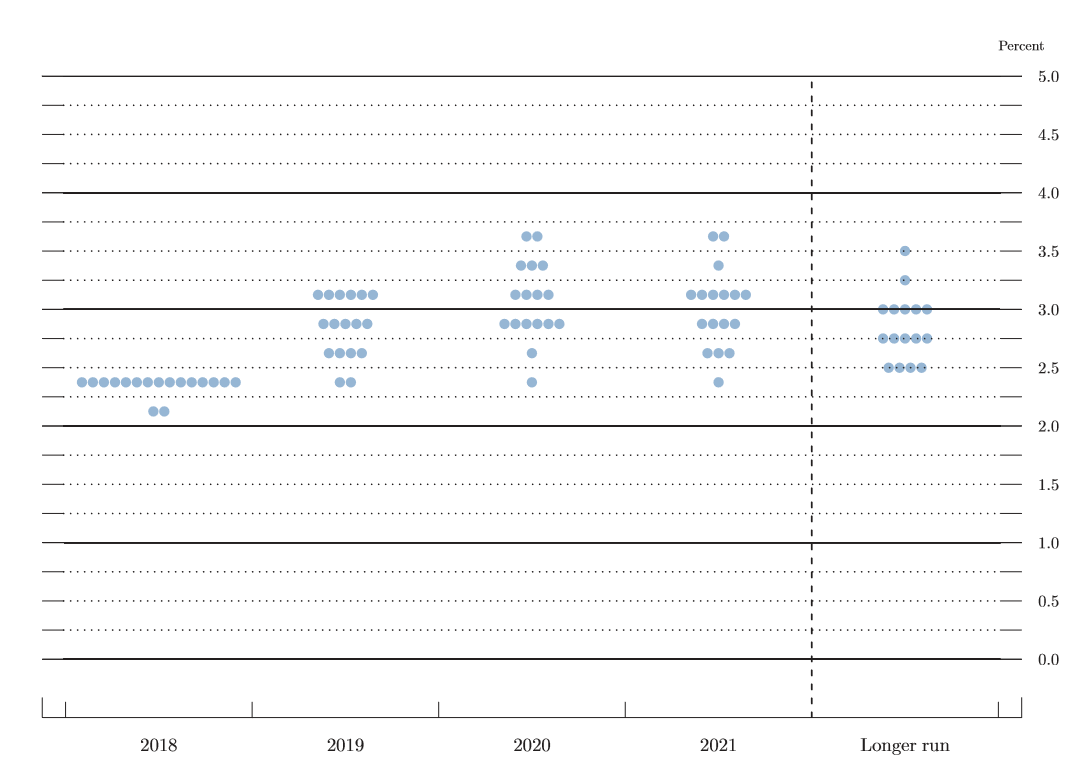

The real concern is the "dot plot," which shows where various Fed governors see interest rates over the intermediate term:

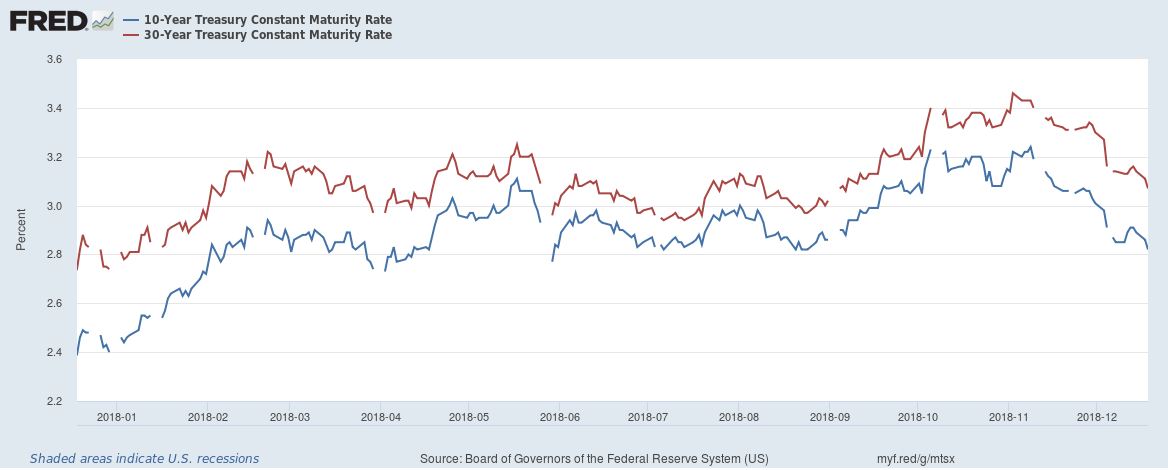

Next year, a majority of Fed governors are projecting that the short-term rate will be between 3% and 3.25%. Let's place that into a yield curve context. The long-end of the curve appears to have peaked this cycle and is now coming in:

The 30-year Treasury was a little above 3.4% in November but has since moved below 3.2%. At the same time, the 10-year declined from 3.2% to slightly over 2.8%. The combination of the long-end rallying and the stock market sell-off indicates that traders are now universally predicting slower economic growth. The stock market sees slower growth causing lower corporate profits while the treasury market interprets lower growth as lower inflation. Either way, we now have a coordinated market signal that says, "investor sentiment sees weaker activity and is acting accordingly."

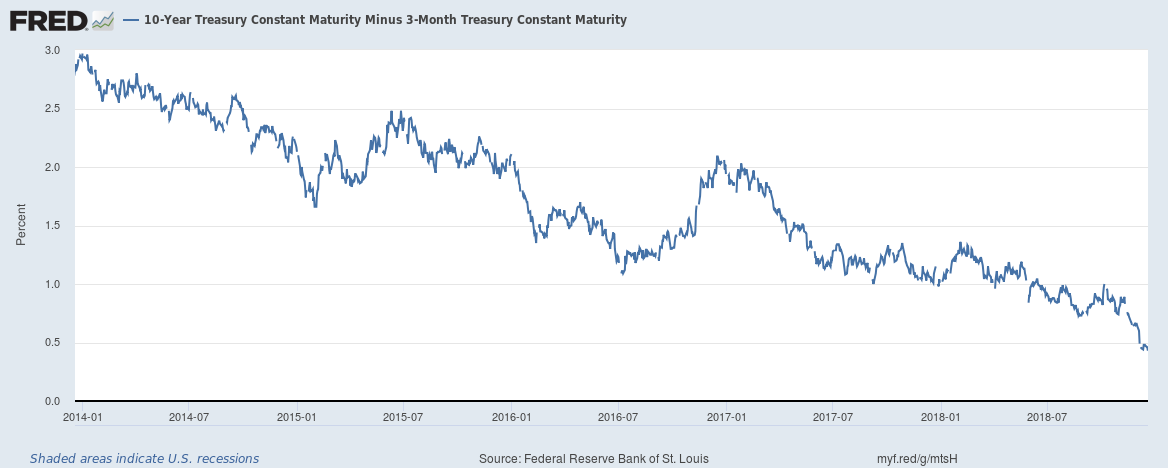

Lower long-term rates and rising short-term rates are flattening the yield curve:

The 10-year-3-month spread is around 50 basis points. It is clearly declining.

And that spread is what should be causing consternation. Assuming

- The Fed hawks have their way and short-term rates rise to 3%-3.25% and

- Long-term remain at current levels,

- We'll see an inverted yield curve sometime next year.

At this point, some will argue that the Fed's quantitative easing program sufficiently changed the yield curve's dynamic to limit an inversion's predictive capability. But that overlooks that the curve is currently flattening for the same reasons it always does at this time in the cycle: the Fed is raising short-term rates while traders, seeing diminished inflation, are buying the long-end. Put another way, let's put the theory to the test one more time. I'm certain we'll get the same result.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.