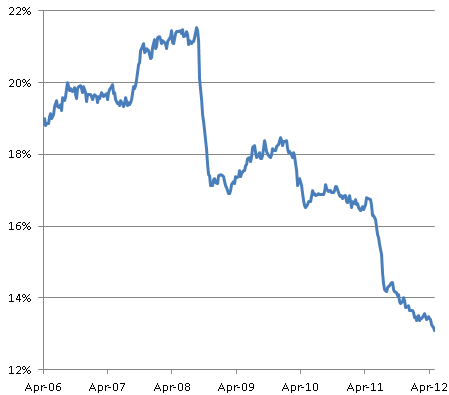

Since the financial crisis, US banks have been rapidly reducing their reliance on wholesale funding. Large time deposits (CDs) went from 21% of the total bank liabilities prior to Lehman to around 13% today (chart below).

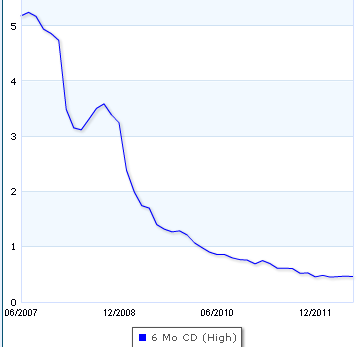

Banks are not marketing these accounts as aggressively as they used to (not offering very attractive rates on CDs as they did in the past) and there is also less customer demand. People are uneasy about locking up their money for six months to earn less than a quarter of a percent. And not many customers want to lock their money up for a longer period. Plus those who have more that $250K on deposit need to worry about bank credit risk on a CD that is locked up for a longer period.

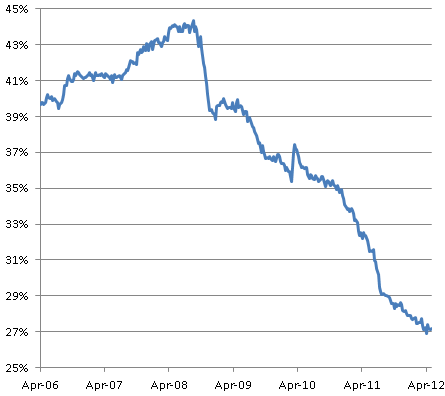

In addition, banks are reducing their reliance on other "non-deposit" funding - such as borrowing from other banks, commercial paper issuance, etc. The chart below shows the total percentage of bank liabilities that would be considered wholesale funding.

The problem with these sources of funding is that they can quickly disappear, as was the case during the 2008/2009 period. Having been burned by not picking up on such bank risks prior to the crisis, rating agencies became aggressive in downgrading banks who have too much reliance on wholesale funding. Here is a recent example.

WSJ: Moody's Investors Service downgraded its long-term ratings on three Swedish banks, reflecting high reliance on wholesale funding, low profit margins and risk to asset quality.

Moody's lowered its ratings on Nordea Bank AB and Svenska Handelsbanken AB (SHB-B.SK) by one notch to AA3, its fourth highest rating. The firm downgraded its ratings on specialized agricultural lender Landshypotek AB by two notches to BAA2, two levels above junk territory. Moody's also affirmed its ratings for SEB at A1 and for Swedbank AB at A2. The outlook is stable on these companies. The ratings actions conclude reviews initiated by Moody's in February.

Moody's noted that Swedish banks rely heavily on wholesale market funds, which the firm views as less stable than retail-sourced funding given the funds' inherent confidence-sensitivity and potential for sharp swings in the availability and costs of such funds.

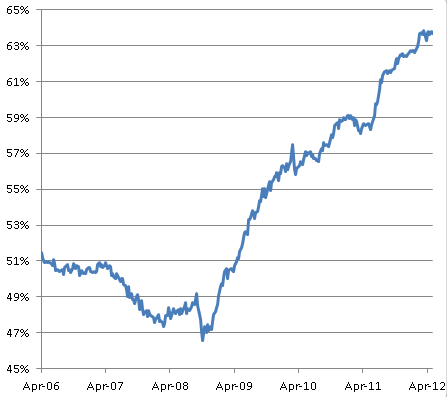

Keenly aware of the situation and downgrade risks, US banks have been moving away from wholesale funding as quickly as possible. As a consequence, standard overnight deposits are becoming an increasingly larger portion of bank liabilities. These run-of-the-mill deposit accounts made up over 80% of total bank liabilities in the early 1970s, dropping down to 47% just before the financial crisis. It now looks like this more "traditional" type of banking is making a comeback.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Banks Moving Away From Wholesale Funding

Published 06/05/2012, 05:11 AM

Updated 07/09/2023, 06:31 AM

US Banks Moving Away From Wholesale Funding

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.