We continue to find more good news for auto manufacturers as the preliminary sales results indicate that they had their best February in 15 years. February was nice for big auto makers because it included an extra day--thanks to leap year, some pent up demand due to bad weather in January, and lots of President's Day sales, which all led to great numbers for many.

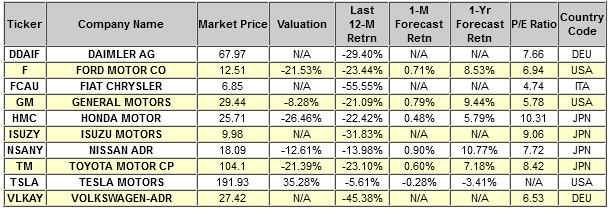

Fiat/Chrysler posted a 12% gain, Nissan was similar with an 11% increase, and Ford led the way with a giant 20% leap in February sales. Ford did great thanks to sales of its hugely popular F-Series trucks and other SUVs.

On the other hand, Volkswagen (DE:VOWG_p) is in trouble in the US, due to the continued fallout from their emissions-cheating scandal. General Motors (NYSE:GM) also had some trouble, with a slight dip in sales year-over-year--1.5%.

As we have reported over the past few months, low interest rates, a better overall labor market, and low gas prices are making the bigger cars, SUVs, and trucks popular once again. Those vehicles are the most-profitable for manufacturers, so this environment is particularly kind to the bottom line.

Of course, one wonders how long this trend can continue, given the fact that the big profits are based on vehicles which will most certainly fall out of favor as soon as gas prices return to more "normal" levels. Drivers seem to have short memories. Investors should remember the sort of angst out there when people were trying to fill the tanks of Hummers at $5/gallon.

When we query our systems for the auto industry today, we find the following data on the firms discussed above and a few other top companies.

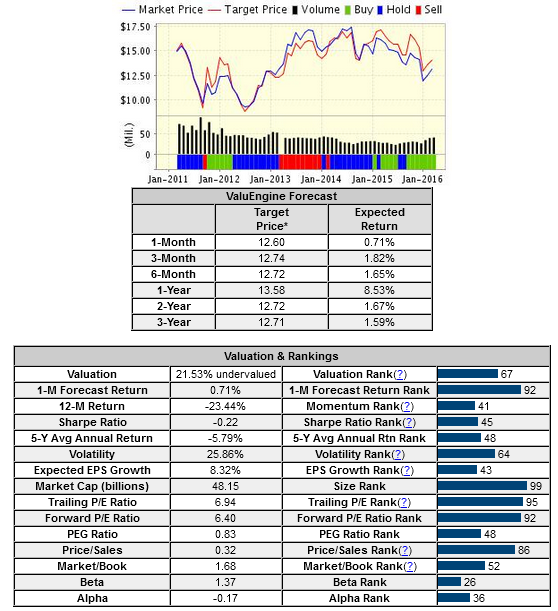

Here Is complete data on one of our top Auto stocks:

Ford Motor Company (NYSE:F) produces cars and trucks. The company and its subsidiaries also engage in other businesses, including manufacturing automotive components and systems and financing and renting vehicles and equipment. The company is divided up into the following four operating segments: Automotive, Visteon Automotive Systems, Ford Motor Credit Company, and The Hertz Corporation.

ValuEngine continues its BUY recommendation on FORD MOTOR CO for 2016-02-29. Based on the information we have gathered and our resulting research, we feel that FORD MOTOR CO has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.