Preliminary sales data indicates that good times for major auto manufacturers--with a few exceptions--returned in April as analysts forecast a 5% sales increase for the overall industry over the past month.

“Following a disappointing March, we expect sales to get back on track in April with SAAR in the mid-17 million range,” Tim Fleming, analyst for Kelley Blue Book, said in an email. “Increased fleet sales and rising incentive spending among automakers remain the factors to watch, but retail demand appears to be holding steady, signaling the industry’s strong run isn’t over quite yet.”

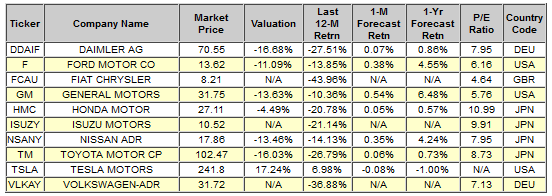

Fiat Chrysler Automobiles (NYSE:FCAU) NV Pref (NYSE:FCAM) posted a 4.6% gain, Nissan Motor Co Ltd (OTC:NSANY) posted a 13% increase, Honda Motor Company Ltd (NYSE:HMC) sales were up 12%, Toyota Motor Corp Ltd Ord (NYSE:TM) had a 4.8% pick up, and Ford Motor Company (NYSE:F)saw a 4.5% leap in April sales.

On the other hand, Volkswagen (DE:VOWG_p) is in trouble in the US due to the continued fallout from their emissions-cheating scandal. General Motors Company (NYSE:GM) once again lagged their competitors with a decline of 2.3% overall despite an increase in sales on the retail end for several of its brands. Fleet sales hampered them overall. And of course, trouble-wracked VW trailed all competitors with a decline of 2.6%.

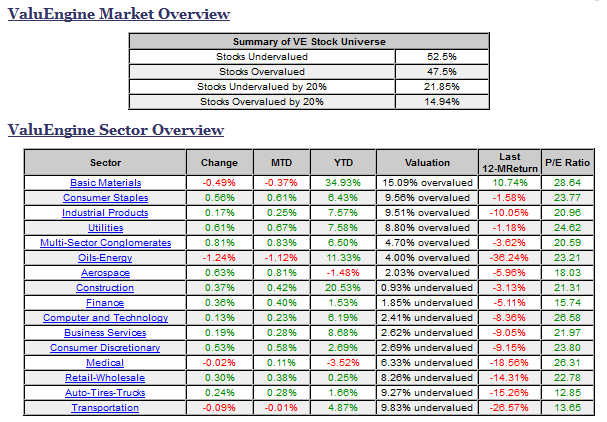

Credit seems to be driving these strong sales figures, as low interest rates and favorable, long-term financing deals are causing customers to finance cars for even longer periods of time. Some consumers are now taking out seven-year car loans! We also see some warning signs from sub-prime car loans, with more delinquencies there. When we query our systems for the auto industry today, we find the following data on the firms discussed above and a few other top companies.

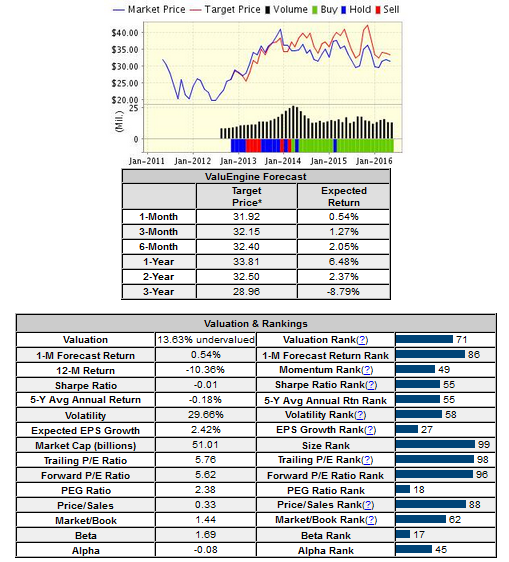

Here Is complete data on one of our top Auto stocks:

General Motors Company (NYSE:GM) is engaged in the designing, manufacturing and retailing of vehicles globally including passenger cars, crossover vehicles, and light trucks, sport utility vehicles, vans and other vehicles. Its business is organized into three geographically-based segments- General Motors North America (GMNA), General Motors International Operations (GMIO) and General Motors Europe (GME). General Motors Company is headquartered in Detroit, Michigan, the United States of America.

ValuEngine continues its BUY recommendation on GENERAL MOTORS for 2016-05-02. Based on the information we have gathered and our resulting research, we feel that GENERAL MOTORS has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

You can download a free copy of detailed report on General Motors from the link below.