Yesterday, the US released a few important economic data sets, which overall showed decent results. During the early hours of the European morning, the United Kingdom released its retail sales numbers for the month of August. The eurozone is set to deliver its core and headline MoM and YoY inflation numbers for August.

US Retail Sales Come Out Higher

Yesterday, the US released a few important economic data sets, which overall showed decent results. We start off with the labour market numbers, such as initial and continuing jobless. The initial ones, came out as a disappointment, overshooting not only the previous adjusted 312k figure, but also the forecast of 330k. However, the continuing jobless claims figure showed an improvement, as it came out at 2665k. The initial expectation was for a 2785k and the previous adjusted number was at 2852k.

At the same time, we received the country’s retail sales numbers for the month of August, which managed to surprise market participants in a good way. Initially, the MoM figure was expected to appear in the negative territory, the same as the previous time. However, it shifted strongly above zero, showing up at +2.5%. The YoY one was also a no-disappointment and came out at +0.7%, beating the initial forecast of -0.8%. The rise in sales was mainly attributed to high demand for furniture, general merchandise, building material and garden equipment, and for food and beverages. That said, we saw declines in sales of electronics, books and cars. The drop in sales of the latter one came because of the shortage of produced new vehicles, as the industry is suffering from a lack of semiconductor chips. This forced consumers to refer to the used car market.

The US indices eventually remained flat for the day, after losing ground in the beginning of their trading session. The fear of the Fed eventually stepping in and raising rates, due to improving economic indicators, made investors worry, forcing the indices to drift lower. One of the benefiters of the good data was the US dollar, which popped higher against all of its major counterparts.

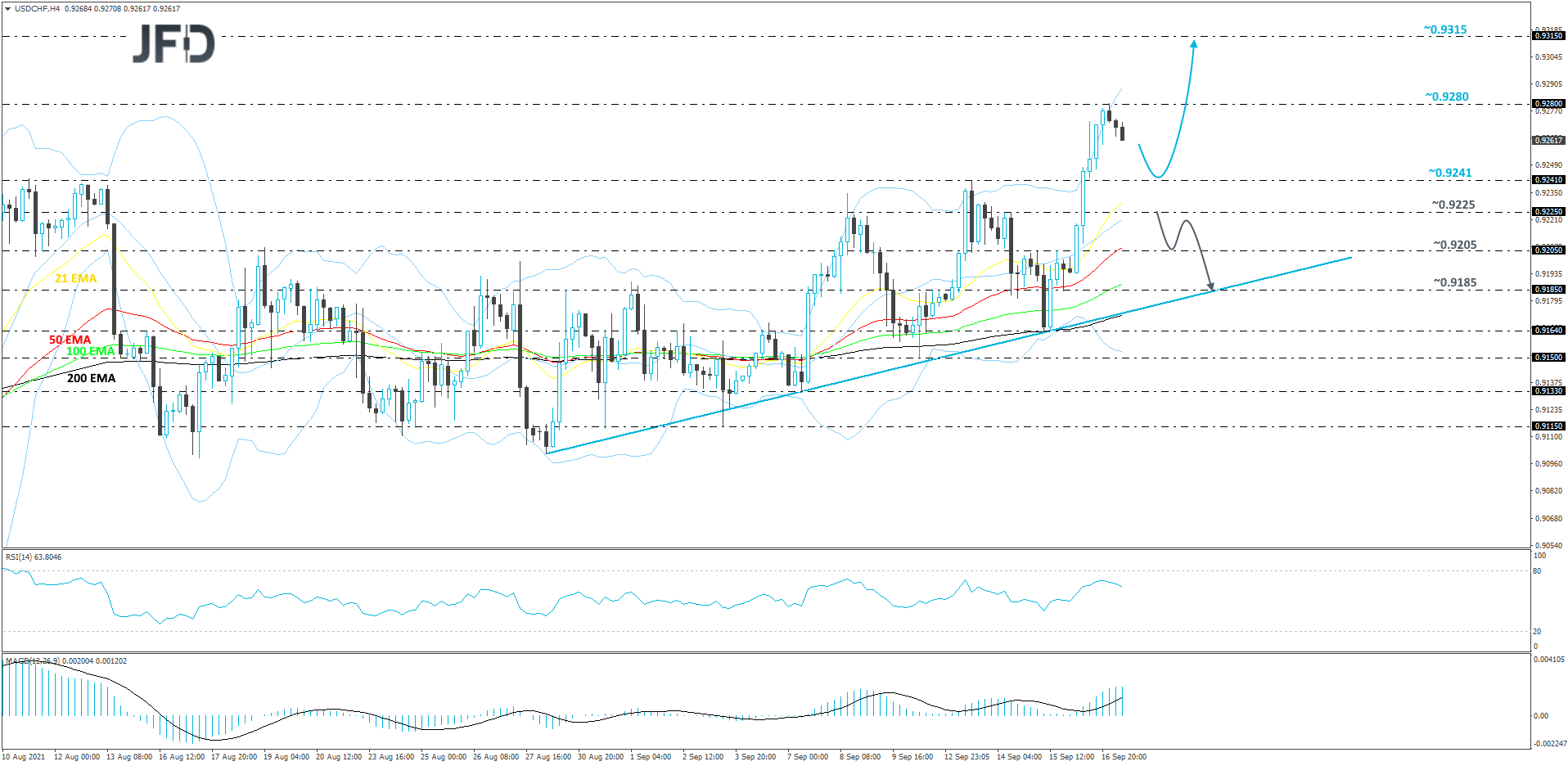

USD/CHF Technical Outlook

USD/CHF got a boost yesterday, where it managed to overcome last week’s high, at 0.9241. The rate continues to trade well above a short-term upside support line taken from the low of Aug. 30. The pair is now seen to be correcting slightly lower, but if it stays above the that 0.9241 hurdle, the buyers could remain in control in the near term.

A small decline might bring the pair closer to the aforementioned 0.9241 zone, which if acts as a good support area this time, could invite the bulls back into the game. If so, USD/CHF may rise back to the current highest point of this week, at 0.9280, a break of which would confirm a forthcoming higher high. The next potential resistance target could be at 0.9315, marked by the high of Apr. 7.

Alternatively, if the rate falls back below the high of last week, at 0.9241, this could lead to a larger correction lower, especially if the pair also moves below the 0.9225 hurdle, marked by an intraday swing high of Sept. 14. USD/CHF may then slide to the 0.9205 obstacle, or even to the 0.9185 level, marked by an intraday swing low of Sept. 15. Slightly below it runs the previously mentioned upside line, which could get tested as well.

UK Retail Sales Disappoint

During the early hours of the European morning, the United Kingdom released its retail sales numbers for the month of August. UK’s figures were not as reassuring as the US ones. The UK actual core and headline readings, on MoM and YoY basis, came out below their initial forecasts, which might have been a bit too optimistic. Most of the actual readings remained in the negative territory, as last time. The British pound reacted slightly in the negative way, losing ground against some of its major counterparts. But this could just be a temporary effect, if market participants had already considered a possibility of the numbers being on the weaker side.

Eurozone Inflation On The Agenda

The eurozone is set to deliver its core and headline MoM and YoY inflation numbers for August. The current expectation is for all the figures to show up better than their forecasts. For example, the core YoY reading is believed to have improved significantly, going from +0.7% to +1.6%. The headline MoM number is expected to go out of the negative territory and to show up somewhere around the +0.4%. If the numbers show up the same as forecasted, or better, this would be inline with the ECB’s policy, where it has set an inflation target at 2.0%. If the numbers beat their expectations, the euro might receive a good boost against some of its major counterparts.

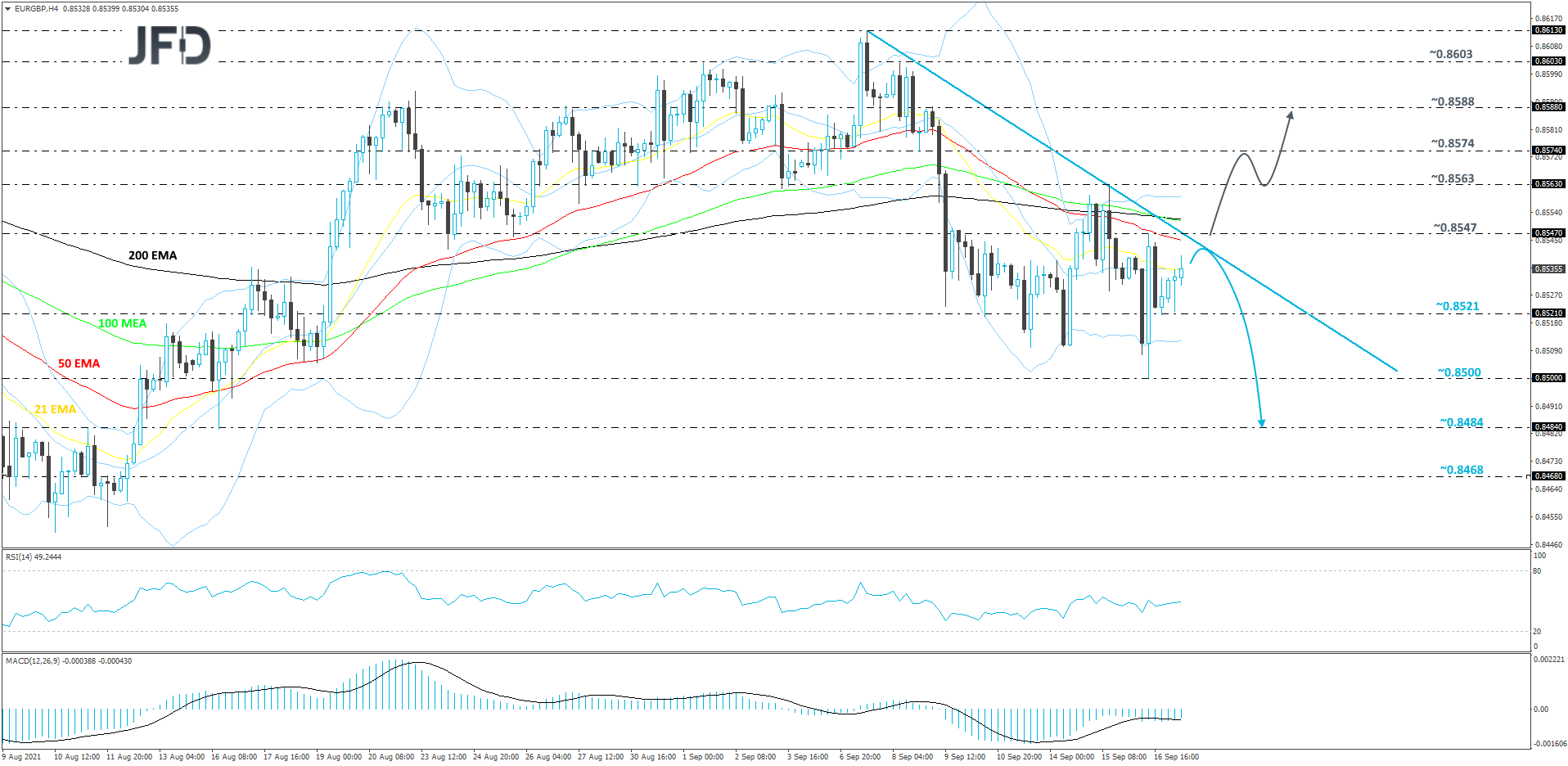

EUR/GBP Technical Outlook

EUR/GBP continues to trade below a short-term tentative downside resistance line taken from the high of September 7th. Despite the recent correction slightly higher, if that downside line remains intact, the near-term outlook could stay bearish.

A failure to break above the aforementioned downside line could bring the rate back to the 0.8521 hurdle, marked by an intraday swing low of Sept. 16. If the slide continues, the next possible support area might be seen at the psychological 0.8500 zone, which is also the current lowest point of September. If there are still no bulls in sight at that rate, the pair may drift further south, potentially aiming for the 0.8484 level, marked near the low of Aug. 16.

On the upside, if the previously mentioned downside line breaks and the rate rises above the 0.8547 hurdle, marked by yesterday’s high, that could invite more buyers into the arena. EUR/GBP could travel to the current highest point of this week, at 0.8563, a break of which may clear the way to the 0.8574 zone, which is the inside swing low of Sept. 8. If that doesn’t stop the bulls, the next possible target could be the 0.8588 area, marked by the high of Sept. 9.

As For The Rest Of Today’s Events

There are no other major events on the economic calendar.