Near-Term US 10-Year Note Yield Outlook:

The Oct 26 note said that there was scope for further upside, but gains above the Oct 17th high at 1.81% may be limited. The market did indeed rally from there, breaking just above that 1.81% (reached 1.88% on Oct 28) and before quickly stalling. Though there is still no confirmation of even a shorter term top "pattern-wise" (and potential for upside pressure as the US election approaches next week), lots of negatives argue that any further gains will again be limited. Note that technicals have not confirmed the recent gains (see bearish divergence on the daily macd), the whole upside from July is seen as a large correction, and lots of important resistance lies just above all the way up to the 1.95% area (top of channel from July, top of smaller channel from Oct and a number of longer term resistance, see longer term below). Nearby support is seen at the base of the channel from Oct (currently at 1.76/78%) with a break/close below arguing that top is in place. Bottom line: still no confirm of even a short term top, but further near term gains above 1.88% would likely be limited.

Strategy/Position:

Still long from the Oct 26th buy at 1.79% and for now would use an aggressive stop on a close .02 below the base of the channel from Oct to reflect that risk that further, near term upside may be limited.

Long-Term Outlook:

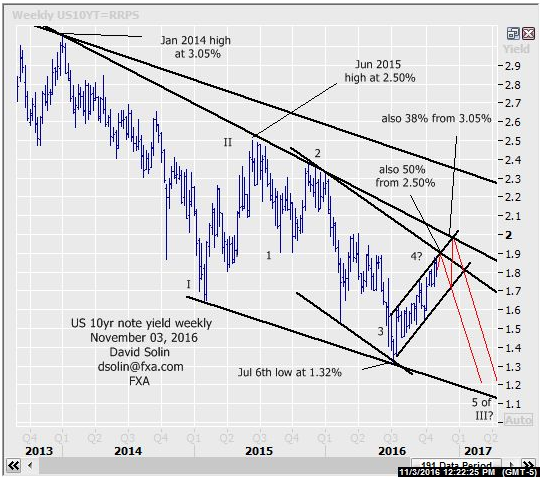

No change as the view over the last few months of an extended period of upward ranging continues to play out. However, these gains are seen as a large correction (wave 4 in the decline from the Jun 2015 high at 2.50%) and with eventual new lows below the July 1.32% low after. Finally approaching those 2 potential, "ideal" areas to form such a top at 1.88/95% area (both a 50% retracement from the Jun 2015 high at 2.50%, ceiling of bear channel from Nov 2015, as well as the shorter term factors above) and then the 1.98/03% area (both the bearish trendline and 38% retracement from the Jan 2014 high at 3.05% and likely max upside in this scenario). Could see a more extended period of ranging/firmness as the US election approaches/passes and potential Dec Fed rate hike also approaches, and before a such a peak is finally seen (see in red on weekly chart/2nd chart below, buy the rumor/sell the fact ?). Bottom line : upside action from July seen as a large correction with eventual new lows below 1.32% after, but scope for another month or so of this broad, ranging upward first.

Strategy/Position:

Eventual new lows below 1.32% favored, but likely at least some further, upside ranging first. So for now, would be patient for higher confidence that this 3 month correction is nearing its completion to switch to bearish.

Current:

Nearer term : only if more aggressive, still long Oct 26th at 1.79%.

Last : short Oct 3 at 1.62%, stopped Oct 6 above top of channel from Feb (1.72%, closed 1.74%).

Longer term: gains from July seen as a large correction but no confirm of even a short term top so far.

Last : bearish bias Oct 3rd at 1.62% to neutral Oct 6th at 1.74%.