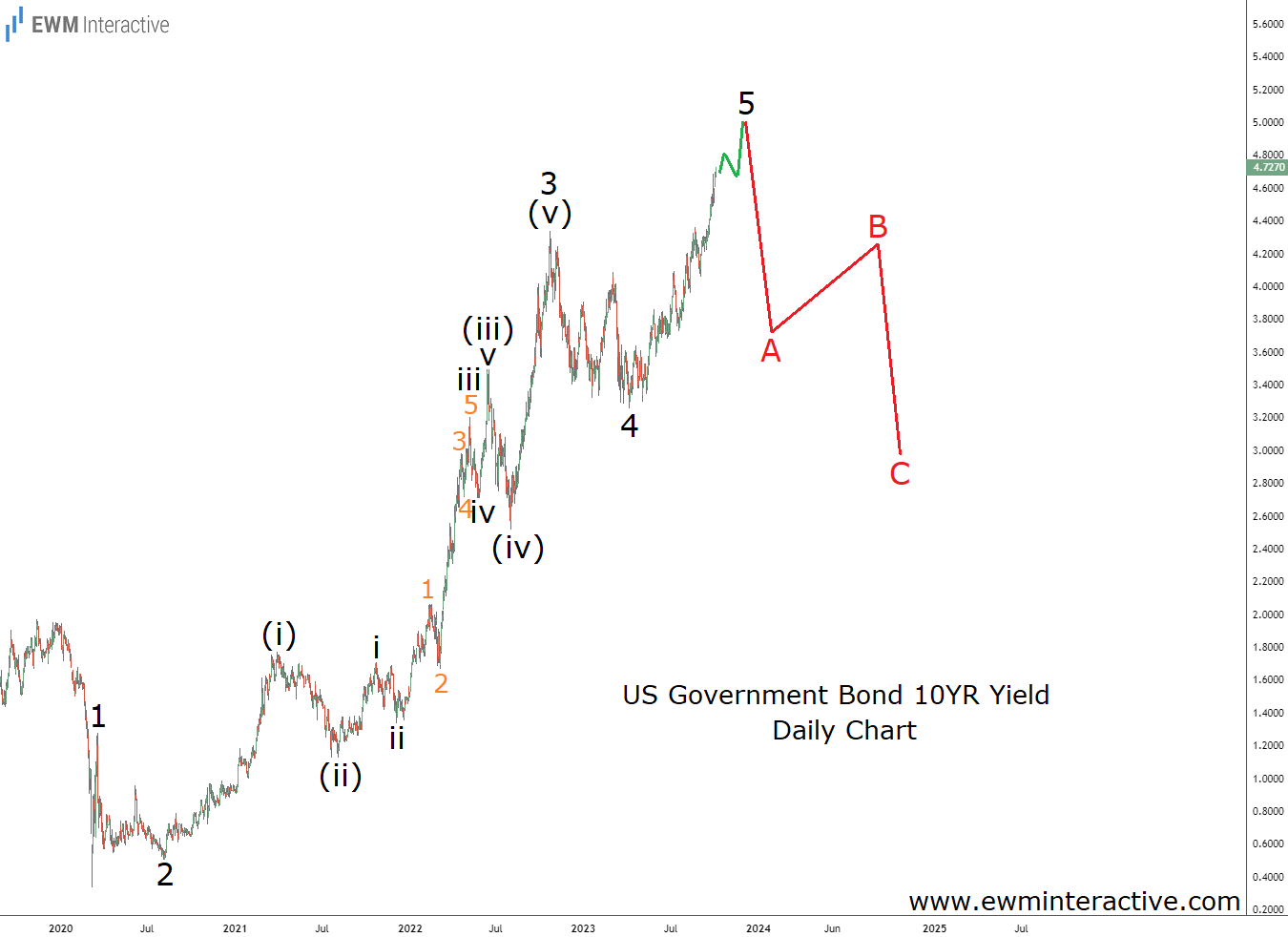

A year ago, in early-October, 2023, when the 10-Year US bond yield was at 4.73%, we wrote that it was likely to peak around 5%, before heading back down to 3%. Since we don’t have any special insights into the black box that is the FOMC, that prediction was based entirely on the Elliott Wave structure of the rally from 0.3330% in 2020. It revealed a complete five-wave impulse pattern, after which, according to the theory, a three-wave correction follows.

And indeed, the US10Y yield topped at 5.0210% twenty days later so the first part of the prediction was spot on. The second part, however, was only a partial success. There have been two notable declines over the past year, the second of which dragged the yield down to 3.5990% last month. The unexpectedly strong September NFP data, however, pushed it back up to nearly 4% again, so perhaps an update is due.

The first rule of Elliott Wave analysis is to adapt the count as soon as the market inspires a better idea. Here, the first thing to notice is the relabeling of the sub-waves of the third wave. The decline from 5.0210% can already be seen as a complete three-wave correction, marked (a)-(b)-(c). Instead of retracing the entire impulse pattern, however, the new labeling suggests that it is only wave 4 of the still ongoing recovery from 0.3330%. This implies more upside for the US10Y yield in wave 5 to a new high near 5.50%, before the impulse is over and the corrective phase of the cycle can really drag it back down to 3% or lower.