Weekly CFTC COT Net Speculator Report | 10 Year US Treasury Note

Large Speculators net bearish positions fall to a total of -53,626 contracts

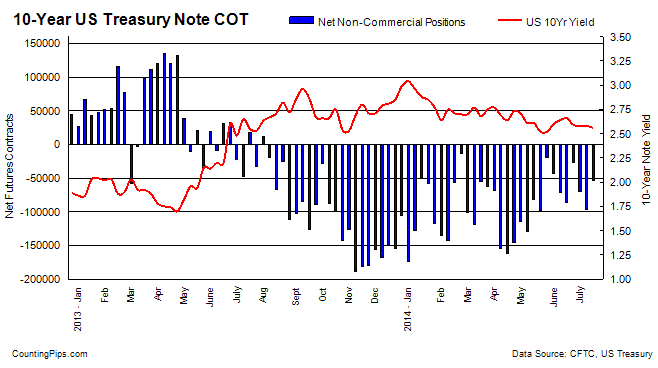

U.S. 10-Year Treasuries: Large futures market speculators cut back on their net bearish bets in the 10-year treasury note futures last week for the first time in three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

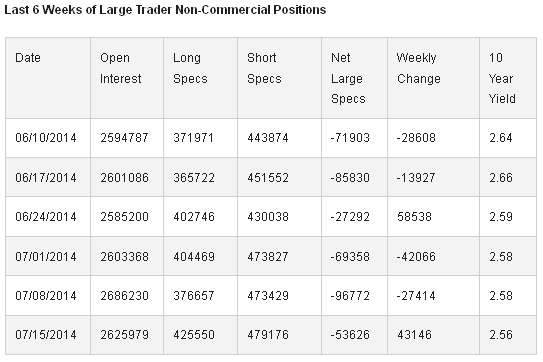

The non-commercial futures contracts of the 10-year treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -53,626 contracts in the data reported for July 15th. This was a change of +43,146 net contracts from the previous week’s total of -96,772 net contracts that was recorded on July 8th.

For the week, long positions in 10 Year futures jumped by 48,893 contracts while the short positions advanced by 5,747 contracts to register an overall net change in of +43,146 contracts on the week. Non-commercial net positions on July 8th were at the most bearish level since May 20th (when net positions totaled -97,895 contracts) before last week’s turnaround.

Over the weekly reporting time-frame, from Tuesday July 8th to Tuesday July 15th, the yield on the 10-Year treasury note dipped from 2.58 percent to 2.56 percent, according to data from the United States Treasury Department.

Disclaimer: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).