On Wednesday, US Gold December futures at New York Mercantile Exchange has risen $0.11 to $32.59 in electronic trading thanks to recovery in US equities which augurs well for the white metal’s industrial demand. On Tuesday trading, it outperformed gold at times reaching the highest level since October 19th.

On the daily charts, Comex Silver December has seen an wedge formation in November till date suggesting that break of resistance at $33 levels could signal further upward movement to $34 or $35 levels in the near-term. But a rising wedge is indicate of a bearish pattern emerging in silver, so investors need to watch out closely for any reversals at present levels. MACD is in positive territory raising prospects of further gains in prices. (See Charts at bottom). At present levels, silver is trading above 4,9, 18 day moving averages suggestive of a bullish trend emerging in the near-term. Altogether, signals appear mixed with no clear pattern emerging so far.

Silver has also been supported by India festival demand which has pushed prices higher for gold in both spot and futures. Silver prices rose 20% in the past two months to Rs 62,300 as higher gold prices and higher rural demand for the white metal on weaker rains during the Kharif season (June to September) caused demand to rise comparative to gold. Silver in India gave 12.84 per cent returns in Samvat 2068 to end the year at Rs 62,365 a kg from Rs 55,270 a kg the same day of the previous year.

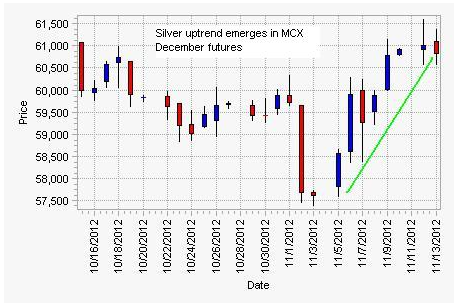

At India’s Multi Commodity Exchange, Silver December chart is also seeing an uptrend thanks to festival demand but volumes and open interest which hit highs just ahead of Diwali has now weakened. On Wednesday trade at noon, Silver December futures have risen 0.50% to 61109 with near term support seen at Rs 60,000, 59,500 levels while resistance is seen at 61500, 62,000 levels.

By Sreekumar Raghavan

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US, India Silver Futures May Witness Further Upward Movement

Published 11/15/2012, 12:25 AM

Updated 05/14/2017, 06:45 AM

US, India Silver Futures May Witness Further Upward Movement

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.