European Central Bank President Mario Draghi will turn his attention to nursing the euro region back to economic health this week as the urgency to deploy crisis measures recedes after three years. While policy makers will likely keep interest rates unchanged for now, the threat of unlimited bond purchases has bought time to focus more on ending the region’s looming recession.

Draghi and European policy makers are returning to work with the turmoil that has ravaged the region’s bond markets at bay. Even so, they face potential pitfalls arising from widening debt in Spain, next month’s election in Italy and continuing austerity in Greece.

GBP/USD

Prime Minister David Cameron predicted a difficult year for the U.K. economy that will require maintaining the current mix of low interest rates and budget-deficit reduction. Cameron indicated that he would like to stay in office another seven years, even as an opinion poll suggested his Conservative Party will lose power in 2015.

To keep borrowing costs down, the coalition government must sustain a “credible strategy” for controlling the budget deficit, that’s the absolute key. The real test is what are the interest rates the rest of the world is demanding in order to own your debt, and our interest rates are extremely low, the lowest they’ve been really for centuries.

USD/JPY

The yen traded near a 2 1/2 year low as speculation grew that Japan’s Prime Minister Shinzo Abe will ramp up efforts to spur growth, paring demand for refuge assets. Demand for the yen was supported after a technical gauge showed it was the most oversold against the greenback in a decade. The yen weakness against the dollar may take a little breather; the yen has been looking oversold above 85 per dollar. Japan’s currency was little changed at 88.06 per dollar.

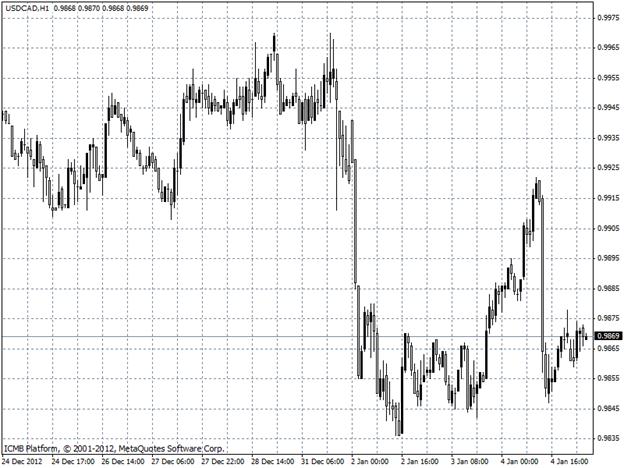

USD/CAD

The Canadian dollar posted its biggest gain versus its U.S. counterpart in almost five months as employers in December added almost twice the number of jobs forecast, lending weight to the government’s view that business investment will fuel an economic rebound. The currency ended the week higher versus the majority of its 16 most-traded peers after a report yesterday showed Canada’s unemployment rate unexpectedly fell to a four-year low in December and hiring rose for a fifth month.

Policy makers project employers to lead the nation out of a slump that slowed annualized growth to 0.6 percent in the third quarter. The Canadian dollar gained 1 percent this week to 98.72 cents per U.S. dollar.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Urgency To Deploy Crisis Measures In Eurozone Begins To Recede

Published 01/07/2013, 04:00 AM

Updated 04/25/2018, 04:40 AM

Urgency To Deploy Crisis Measures In Eurozone Begins To Recede

EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.