Key Points:

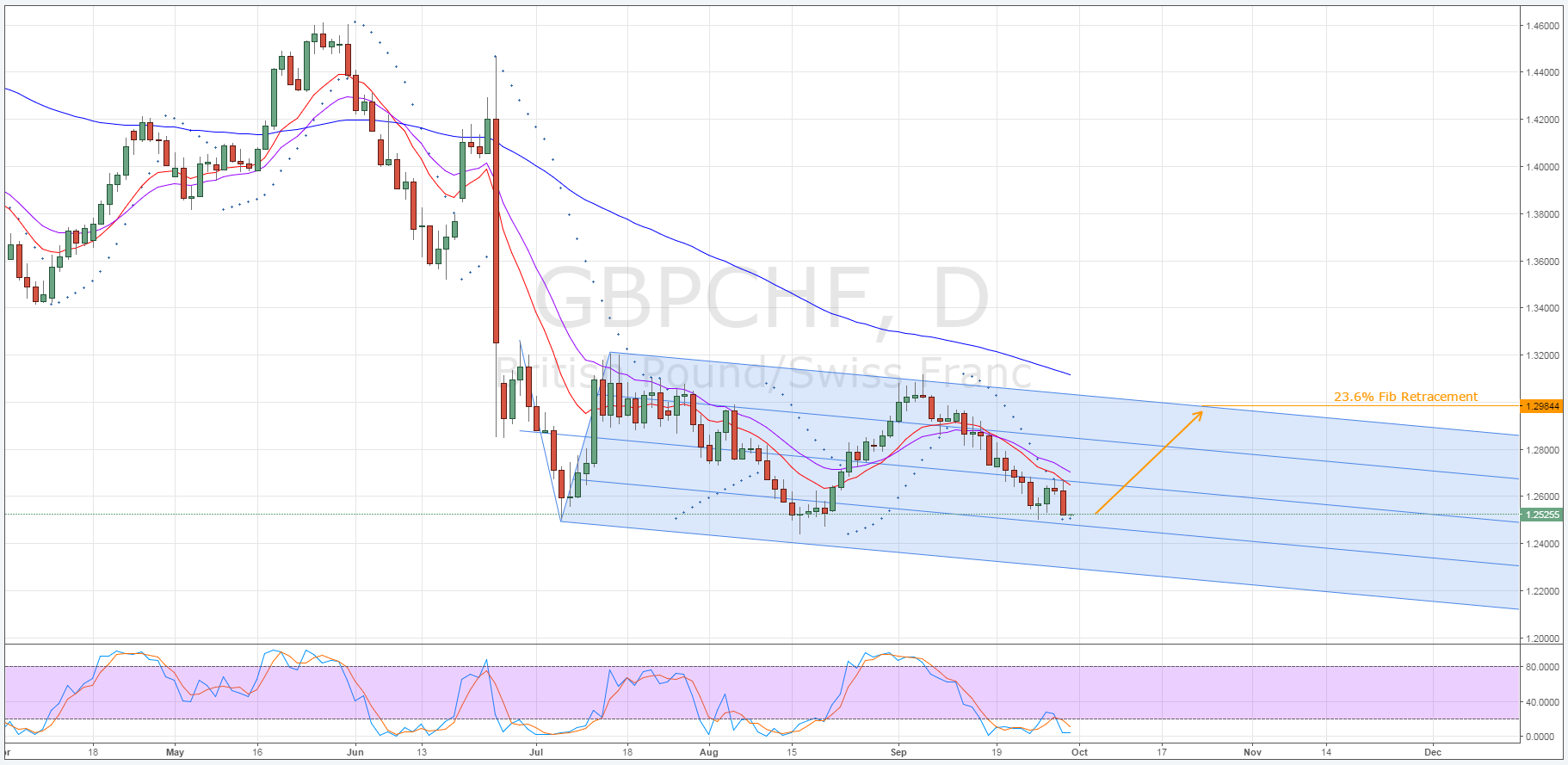

- Schiff pitchfork remains in place.

- Parabolic SAR bias has reversed.

- Stochastics are now heavily oversold.

The embattled pound continues to contend with the Swiss franc and could be readying itself for another short-term victory. Specifically, the pair is setting up for what could be another appreciable rally as it challenges a historically robust zone of support. Additionally, the shift in Parabolic SAR bias and the movement of stochastics into oversold territory should see buying pressure mount as the week comes to a close.

Firstly, as is shown on the daily chart, the pair has more or less been following a Schiff pitchfork lower over the past few weeks. As a result of this, the GBP/CHF is expected to continue to find support and resistance around the levels forecasted by the pitchfork and reverse accordingly.

At present, the pair is sitting just above the first zone of support which also coincides with another historically robust support level around the 1.25 handle. Consequently, a reversal should begin before the close of trading today or in the early stages of next week.

Further evidence suggestive of a reversal to the upside can be found by taking a look at both the Parabolic SAR reading and the Stochastic Oscillator. Starting with the Parabolic SAR, the last two sessions have seen the indicator’s reading switch from a bearish to bullish bias. As a result of the switch, negative sentiment should begin to evaporate as the week winds down.

Likewise, the movement of the daily stochastics into oversold territory will see selling pressure abate and could give the bulls the break they need to claim back control of the pair.

From a fundamental perspective, a number of important releases are due by the end of the week which should significantly impact the pair. On the UK side of things, the Final GDP and House Prices data are the most important indicators to keep an eye on.

Any substantial deviation from the current forecast for these figures could either kick start the reversal or see the lowest support of the pitch fork challenged. Alternatively, any upsets in the Swiss KOF Economic Barometer could have similar effects so it should also be monitored closely.

Ultimately, keep an eye on this pair as, despite its ongoing weakness, it could still provide some decent upside potential. However, don’t expect to see the upside of the pitchfork broken anytime soon as the CHF is enjoying the benefits of it safe haven status at this point in time.