United Parcel Service Inc (NYSE:UPS) had a huge turn in the earnings confessional last quarter, jumping 8.7% the day after reporting. Traders paying attention to UPS again ahead of the company's earnings release before the open tomorrow, Oct. 22, but the options data doesn't suggest there's much optimism around the equity ahead of the event.

At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), traders have purchased 1.15 puts for every call during the past 10 days, and this put/call volume ratio ranks in the 81st annual percentile -- showing such a preference for puts over calls is rare.

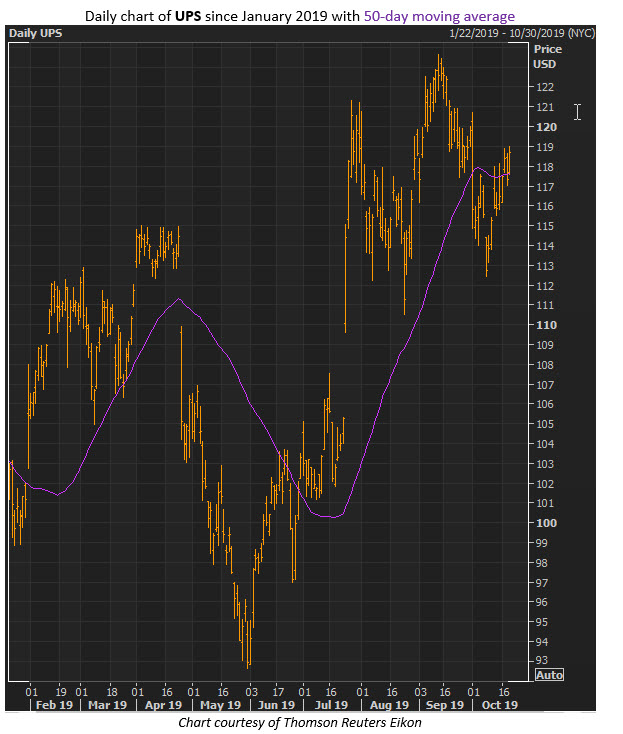

However, the largest increase in open interest during this two-week time period occurred at the November 120 call, where more than 6,000 contracts were added. Next up was for the November 105 put. UPS stock was last seen up 1.1% at $118.68, putting it right above the 50-day moving average, as the shares try to put more distance between themselves and a long-time ceiling around the $115 area that now looks to be acting as support.

From a broader view, the options market is expecting a somewhat larger post-earnings move than normal, compared to what's been seen over the past two years. That is, the shares have averaged a one-day swing of 5.6% after the last eight reports, and this time traders are pricing in a 7.2% move. The stock has been pretty volatile overall in the past year, based on its Schaeffer's Volatility Index (SVI) of 82 out of 100, showing a tendency to make bigger moves than the options market was pricing in.