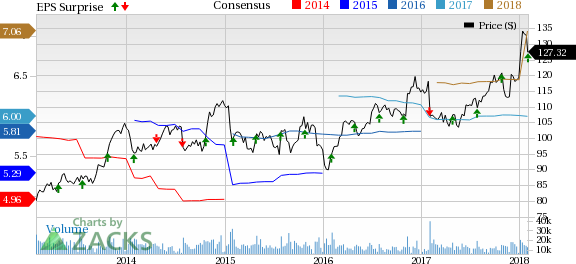

United Parcel Service (NYSE:UPS) reported fourth-quarter 2017 earnings of $1.67, beating the Zacks Consensus Estimate of $1.65 per share. The bottom line also increased 2.5% on a year-over-year basis. Results were aided by higher revenues.

Revenues improved 11.2% to $18,829 million from the year-ago quarter, outpacing the Zacks Consensus Estimate of $18,190.5 million. The upside was driven by growth across all key segments of the company.

Segmental Details

U.S. Domestic Package revenues climbed 8.4% year over year to $11,835 million in the reported quarter. The improvement was owing to strong performances primarily in the Deferred Air and Ground units. On the contrary, segmental operating profit (adjusted) decreased marginally to $1,264 million due to high costs.

Segmental average daily package volumes increased 5.4% backed by a 5.7%, 4.9% and 2.2% rise in Ground products, Next Day Air services and Deferred Air products, respectively. Average revenue per piece for the segment was up 2.9%.

International Package revenues improved 12.5% to $3,753 million. Daily export volumes rose 16% in the quarter on the back of growth in all regions. Segmental operating profit (adjusted) increased 7.6% to $760 million as well.

Supply Chain and Freight revenues increased 20.8% to $3,241 million. Segmental results were aided by better market conditions among other factors. Operating profits in the segment increased significantly to $270 million in the reported quarter.

Other Details

In 2017, this Zacks Rank #1 (Strong Buy) company spent $5.2 billion as capital expenditure. Also, UPS paid approximately $2.9 as dividend to shareholders. Notably, it bought back 16.1 million shares for approximately $1.8 billion in the same time period.

In fact, the company’s efforts to reward shareholders consistently, through buybacks and dividend payouts, are impressive. You can see the complete list of today’s Zacks #1 Rank stocks here.

Outlook

The package delivery company expects 2018 adjusted earnings per share between $7.03 and $7.37. The guidance includes approximately $200 million of additional pre-tax pension expense owing to lower discount rates. The Zacks Consensus Estimate for 2018 is currently pegged at $7.06 per share. Capital expenditures lie within the range of $6.5-$7 billion for the current year, bulk of which will be directed toward new technology, aircraft and automated capacity.

Upcoming Releases

Investors interested in the broader Zacks ransportation sector are keenly waiting for fourth-quarter earnings reports from the key players like Spirit Airlines (SAVE), Ryder System (NYSE:R) and Expeditors International of Washington (EXPD).

Spirit Airlines, Ryder System and Expeditors will report on Feb 6, Feb 16 and Feb 20, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Spirit Airlines, Inc. (SAVE): Free Stock Analysis Report

Ryder System, Inc. (R): Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD): Free Stock Analysis Report

United Parcel Service, Inc. (UPS): Free Stock Analysis Report

Original post

Zacks Investment Research