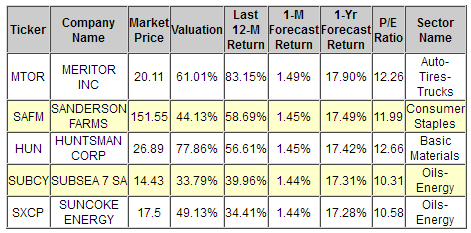

For today's edition of our upgrade list, we used our website's advanced screening functions to search for UPGRADES to STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. All or our upgrades shown below are STRONG BUY stocks..

For today's bulletin, we take a look at Sanderson Farms (NASDAQ:SAFM). Sanderson Farms Inc. is a fully-integrated poultry processing company engaged in the production, processing, marketing and distribution of fresh and frozen chicken products. The company sells ice pack, chill pack and frozen chicken, in whole, cut-up and boneless form, primarily under the Sanderson Farms7 brand name to retailers, distributors, and fast food operators principally in the southeastern, southwestern and western United States.

Sanderson posted decent results last week for Q3 2017. Net sales for the third quarter of fiscal 2017 were $931.9 million compared with $728.0 million for the same period a year ago. For the quarter, the Company reported net income of $115.8 million, or $5.09 per share, compared with net income of $54.7 million, or $2.42 per share, for the third quarter of fiscal 2016. These numbers were better than expected for the company and the shares got a nice bump as a result of the good results last week.

Driving these numbers were a chicken craze in the US that shows no signs of abating. Healthy eaters provide a strong base for the boneless-breast meat business while other eaters continue to gobble up chicken wings in ever larger numbers. It still is interesting to consider the fact that chicken wings, once considered a throw-away product, now command higher prices than other chicken parts--including breast meat. The media is awash in click-bait stories of shortages for this part any time there is a big sporting event in the US.

The CEO of Sanderson, Joe Sanderson, told investors:

Sanderson Farms’ financial results for the third quarter of fiscal 2017 reflect a continued favorable balance of supply and demand for fresh chicken sold to retail grocery store customers. That balance was reflected in relatively strong market prices for that product during the current third fiscal quarter. Market prices for boneless breast meat, bulk leg quarters and jumbo wings produced at our plants that process a larger bird were all higher this year when compared to last year’s third fiscal quarter. Food service traffic and demand in the United States remain below pre-recession levels, but demand from and the popularity of local chain concepts and restaurants that focus on wings are offsetting reduced traffic at casual dining restaurants. This demand contributed to a good supply and demand balance during the quarter.

Moving forward, Sanderson will be bringing a new plant online in Texas in the coming months and will reach maximum production levels from a recently completed plant in North Carolina soon. Increased production should allow the company to boost its profits and meet additional demand for the high-value items like boneless breasts and wings.

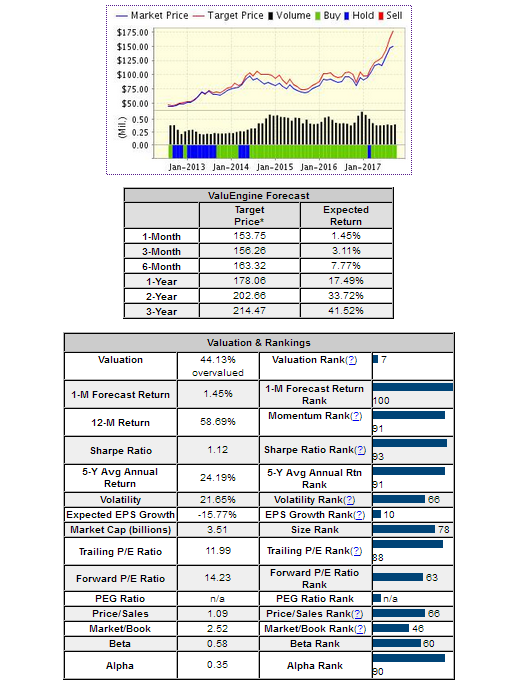

Below is our latest data for Sanderson Farms (SAFM):

ValuEngine updated its recommendation from BUY to STRONG BUY for Sanderson Farms on 2017-09-01. Based on the information we have gathered and our resulting research, we feel that Sanderson Farms has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Sharpe Ratio and Momentum.

You can download a free copy of detailed report on Sanderson Farms (SAFM) from the link below.