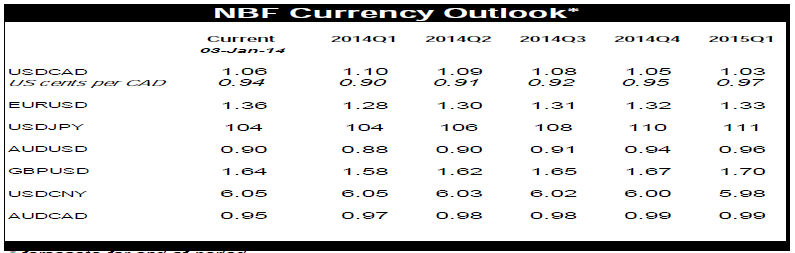

With the exception of the yuan, whose near-term targets have been adjusted up a bit to reflect recent

strength, we’ve left our currency forecasts unchanged from last month. We continue to expect the US dollar to strengthen in the early part of 2014 as the Fed tapers its asset purchase program en route to ending QE entirely by the end of the year. However, the end of the Fed’s currency debasement policies doesn’t mean the US dollar will soar to new heights in 2014. The FOMC’s new guidance “to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6.5%” suggests the Fed’s target rate will remain glued at zero for at least another year.

The longer the euro remains at such heights, the longer it will take for the zone’s economy to recover. While 2014 will see GDP growth for the first time in three years, it won’t be stellar. Structural problems will continue to put a speed limit on the zone and fuel the threat of deflation. The European Central Bank may have no choice other than ease monetary policy further via another round of liquidity injections. The combination of Fed tapering and a more dovish ECB will be negative for the common currency and we’re, therefore, maintaining our 1.28 end-of-Q1 target for EURUSD.

A perfect storm hit the Canadian dollar last year as it depreciated 3% against the USD (2013 average versus 2012 average), the worst performance since 2009. A more dovish central bank, combined with soft commodity prices and bearish analyst reports caused sentiment to turn against the Canadian currency. During 2013, speculators held net short CAD positions for 45 consecutive weeks, the longest stretch on records going back to 1996. Our 1.10 end-of-Q1 target for USDCAD reflects the persistence of negative sentiment towards the loonie, although we anticipate the currency to stabilize later in the year as foreign investors eventually realize that Canada remains an attractive destination with its AAA-rating, growing resources sector, and strong ties to a US economy which is now on the upswing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Updated FX Table

Published 01/05/2014, 02:32 AM

Updated 05/14/2017, 06:45 AM

Updated FX Table

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.