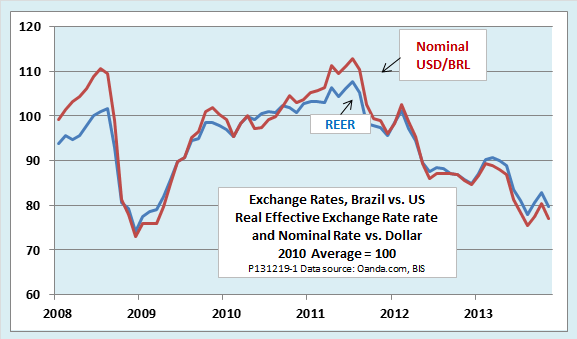

Brazil’s volatile currency is back in the spotlight, thanks to the Fed’s announcement that it will soon begin to taper its program of asset purchases known as Q3. The following chart shows that the exchange rate for Brazil’s currency, the real, is approaching the low reached after the August taper scare and is almost back to the five-year low reached in March 2009.

An article in the Financial Times puts Brazil at the head of what it calls the “fragile five,” along with India, Indonesia, South Africa, and Turkey. To say that the Brazilian government is nervous about the situation would be a grave understatement, with a national election and the World Cup coming up next year.

If the weak real is causing despair in Brazil today, the country must have been dancing in the streets with joy two years ago when the currency was headed for record highs. But now, it was in despair then, too. At that time, its finance minister, Guido Mantega, characterized the Fed’s policy of quantitative easing as a “currency war” at his country’s expense.

What explains the paradox that both appreciation and depreciation of a country’s currency are both perceived as harmful to the economy? I wrote about this back in August when tapering was only a threat on the horizon. Now that it is actually about to start, the issue takeson a new relevance. Here is a somewhat abbreviated version of the earlier post:

Why are currency fluctuations, regardless of direction, so painful, and not just for Brazil? The traditional notion is that exchange rate movements, whether appreciation or depreciation, produce roughly equal gains and losses. Some of them come from the effects on trade in goods and services. When a country’s currency appreciates, its exporters find it harder to sell their products abroad and domestic producers have a harder time competing with imports. They are losers. Meanwhile, firms that use imported inputs and consumers of imported goods are winners. There are also financial effects. People whose foreign currency assets exceed their foreign currency liabilities gain from appreciation of the domestic currency, and those with foreign currency liabilities greater than foreign currency assets lose.

The gains and losses from currency volatility do not depend solely on any one bilateral nominal exchange rate. We can get a broader perspective by looking at a country’s real effective exchange rate (REER), which includes adjustments both for the differences in rates of inflation in different countries, and for the relative importance of various trading partners. As the above chart shows, the ups and downs in Brazil’s REER have been more muted than those in the nominal bilateral dollar-real rate. Still, there is a lot of volatility even in the REER.

In reality, the national angst that has accompanied episodes both of appreciation and of depreciation belies the idea that gains and losses will tend to cancel each other out. I see at least three kinds of asymmetries that cause all exchange rate movements, whether up or down, to produce perceived net losses.

First, there is the psychological factor of loss aversion. Behavioral economists argue that the subjective pain people suffer from a financial loss is about twice as great as the pleasure they get from an equal nominal gain. The result is that when a currency appreciates, exporters howl about lost sales while consumers of imported goods quietly enjoy the lower prices brought on by the appreciation. When the same currency depreciates, exporters and their workers quietly enjoy their gains while consumers take to the streets in protest over prices of imported food and fuel. The asymmetry introduced by loss aversion is amplified by tendencies on the part of the media to emphasize bad news over good in an effort to attract readers and viewers.

The effects of currency fluctuations on inflation introduce a second source of asymmetry. Other things being equal, nominal appreciation of a currency helps keep inflation low by reducing the cost of imported goods, while nominal depreciation spurs inflation. However, central banks do not always allow those effects to play out in full. In Brazil, for example, appreciation of the real helped to slow the rate of inflation during 2009, but throughout 2010 and early 2011, as the appreciation continued, inflation began to rise again. That appears to have happened, at least in part, because the central bank took advantage of slowing inflation to cut its benchmark interest rate sharply during 2009.

Even after inflation turned up again, it raised interest rates only enough to offset about half of the earlier cuts. From late 2011 to the present, the same pattern prevailed. The central bank cut interest rates as soon as inflation began to turn down, but delayed raising them even after inflation turned up again. Now that the currency is plunging, inflation is again a threat and the central bank has raised interest rates. However, elections are due in 2014. [Some observers thought that political pressures would put a ceiling of 10 percent on the permissible rate, even if it were not enough to control inflation. However, in November 2013 it did increase its benchmark policy rate to 10 percent, and it is likely to move higher.]

Unhedged foreign currency borrowing is a third factor we should take into account. In theory, if firms and individuals who borrowed in foreign currencies fully hedged their exposure to exchange rate changes, they would neither suffer from depreciation nor gain from appreciation. Even if they did not hedge, if the their foreign currency borrowing was uncorrelated with movements of exchange rates, there would be as many winners during periods of appreciation as there would be losers during periods of depreciation. However, neither of those things seems to be true. Instead, the temptation to take on unhedged foreign currency debt appears to be strongest just as the domestic currency reaches its peak strength, which means maximum losses on the downside of the currency cycle.

Unfortunately, their ability to adjust to the repercussions of global currency shocks is limited by the well-known “impossible trinity,” according to which countries can chose only two items from a three-part menu consisting of an independent monetary policy, a fixed exchange rate, and open capital markets. (See this earlier post for details.) Brazil and most of the other emerging markets no facing currency woes have opted for floating exchange rates and open capital markets, leaving them little choice but to absorb the pain of devaluation. Some, including Brazil, have experimented with limited, short-term capital controls, but only China has pursued the combination of fixed rates and closed capital markets seriously.

If currency volatility is so painful, why not opt for fixed exchange rates? Some countries have taken that route, including members of the eurozone and countries that link their currencies to the euro, as well as countries like Ecuador and Panama that have dollarized their economies. However, fixed exchange rates have their own set of painful consequences, with the woes of the Eurozone serving as Exhibit A. Even China, often pilloried as the world’s number one “currency manipulator,” has opted only to slow, not to freeze, changes in its real and nominal exchange rates.

And don’t expect the Fed to do much to ease the pain of currency adjustments. As Dennis Lockhart, president of the Atlanta Fed, said last summer:

You have to remember that we are a legal creature of Congress and that we only have a mandate to concern ourselves with the interest of the United States. Other countries simply have to take that as a reality and adjust to us if that’s something important for their economies.