Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

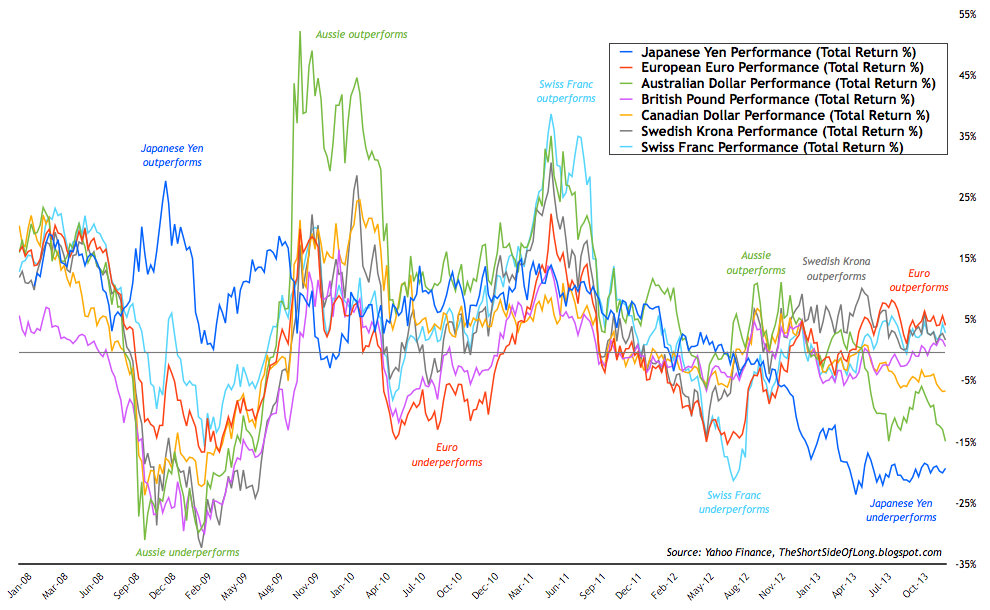

Chart 1: Apart from the yen, commodity currencies have under performed:

As the year draws to a close, it is important for us to see how various currencies performed during the last 12 months. Apart from the Japanese yen, surpassingly (for some) Aussie and Canadian dollars have under-performed the rest of the majors this year. These currencies have been some of the best performers since the start of the investment cycle in early 2009. The commodity currencies are currently underperforming the European currencies in a big way, which looks to be a mean reversion of what we saw during 2011 and 2012 as the EU Crisis plagued some of these majors (euro, pound, krona, franc etc.).

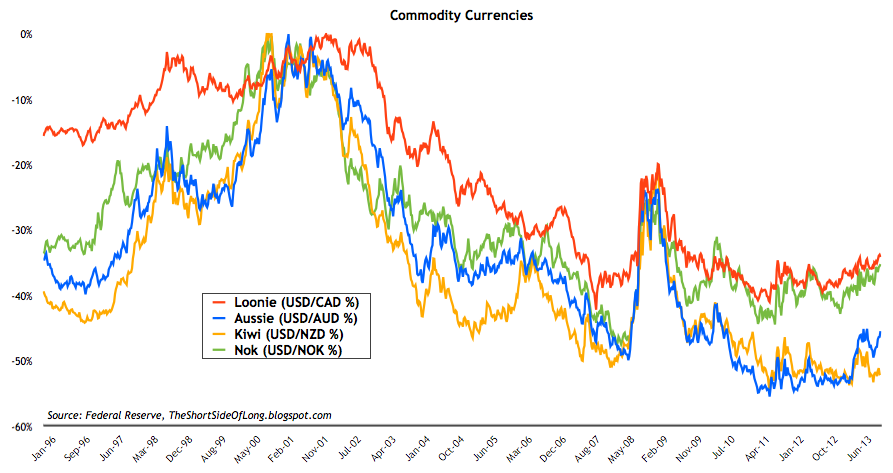

Chart 2: Commodity currencies performed superbly during the 2000s:

However, over the long term, commodity currencies have performed superbly relative to the low interest rate yielding, money printing nations from Europe to the US and Japan. In other words, currencies from Canada, Norway and Australia have just about outperformed the G3 majors, which have been used as carry trade funding currencies for a while now.

The question that now needs to be answered is whether or not these currencies have peaked out from a longer term perspective? After a decade long outperformance, could we see a major mean reversion? If they have, then a much bigger correction could occur in coming months and quarters, similar to what we saw during 2008 global financial crisis.

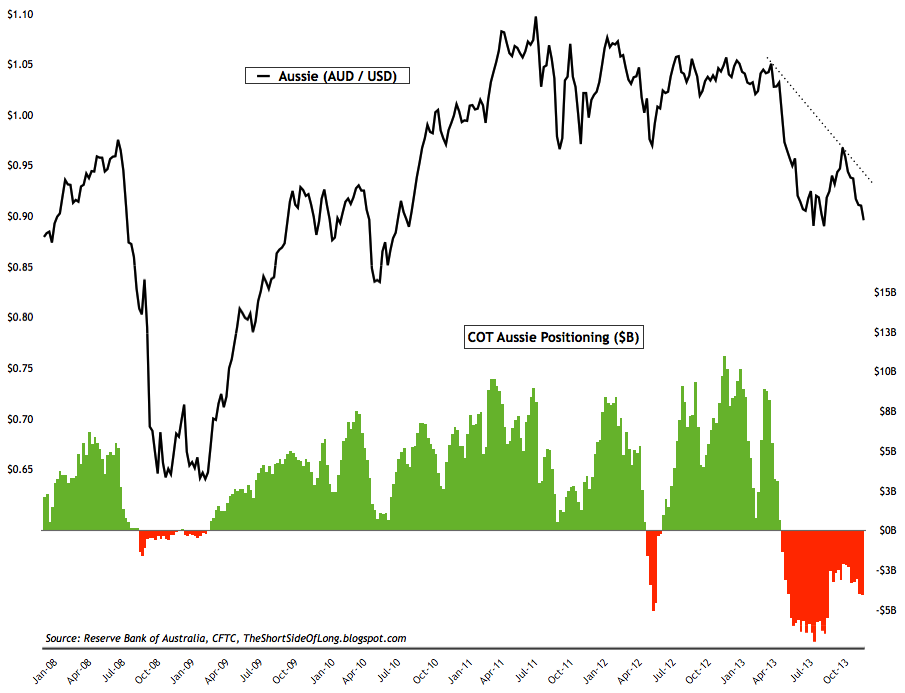

Chart 3 and 4: Hedge funds hold extreme bearish bets on the Aussie and Loonie AUD/USD plus COT Aussie Positioning" title="AUD/USD plus COT Aussie Positioning" height="610" width="990" />

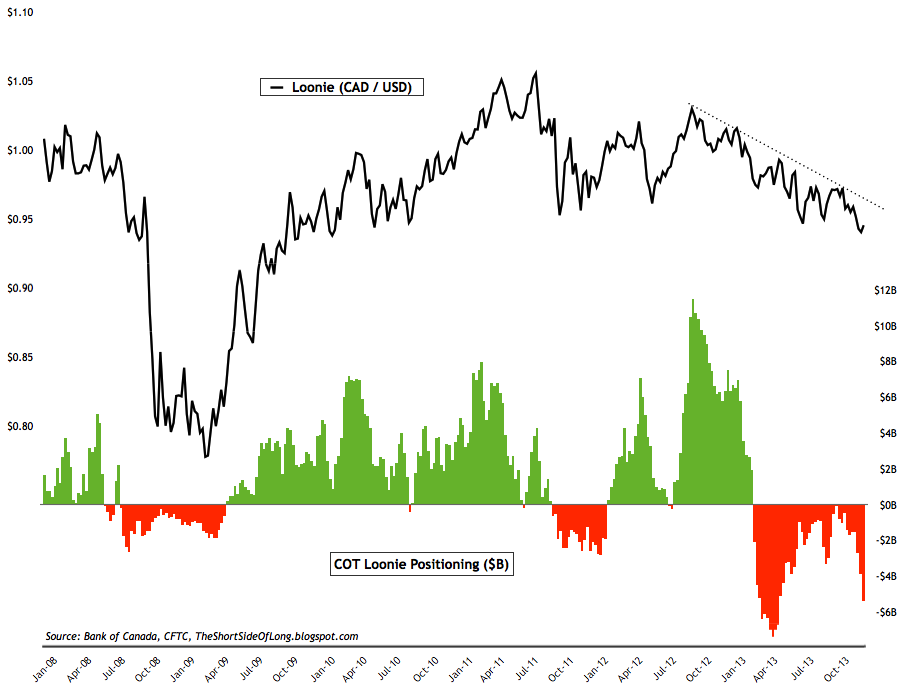

AUD/USD plus COT Aussie Positioning" title="AUD/USD plus COT Aussie Positioning" height="610" width="990" /> CAD/USD plus COT Loonie Positioning" title="CAD/USD plus COT Loonie Positioning" height="610" width="990" />

CAD/USD plus COT Loonie Positioning" title="CAD/USD plus COT Loonie Positioning" height="610" width="990" />

Having said that, I hope that traders do not blindly just bet against these currencies straightaway. While I made it public that I shorted the Australian dollar in November 2012 at around $1.05 vs USD (currently at 0.89 vs USD), what worries me is the huge short position built in with a lot of these commodity currencies. I have not yet covered as I believe the Aussie dollar could make a lower low, but it is becoming a consensus trade. Personally, while I am not the greatest trader in the world, I never like being on the same side of the boat as the majority of momentum players and dumb money herding.