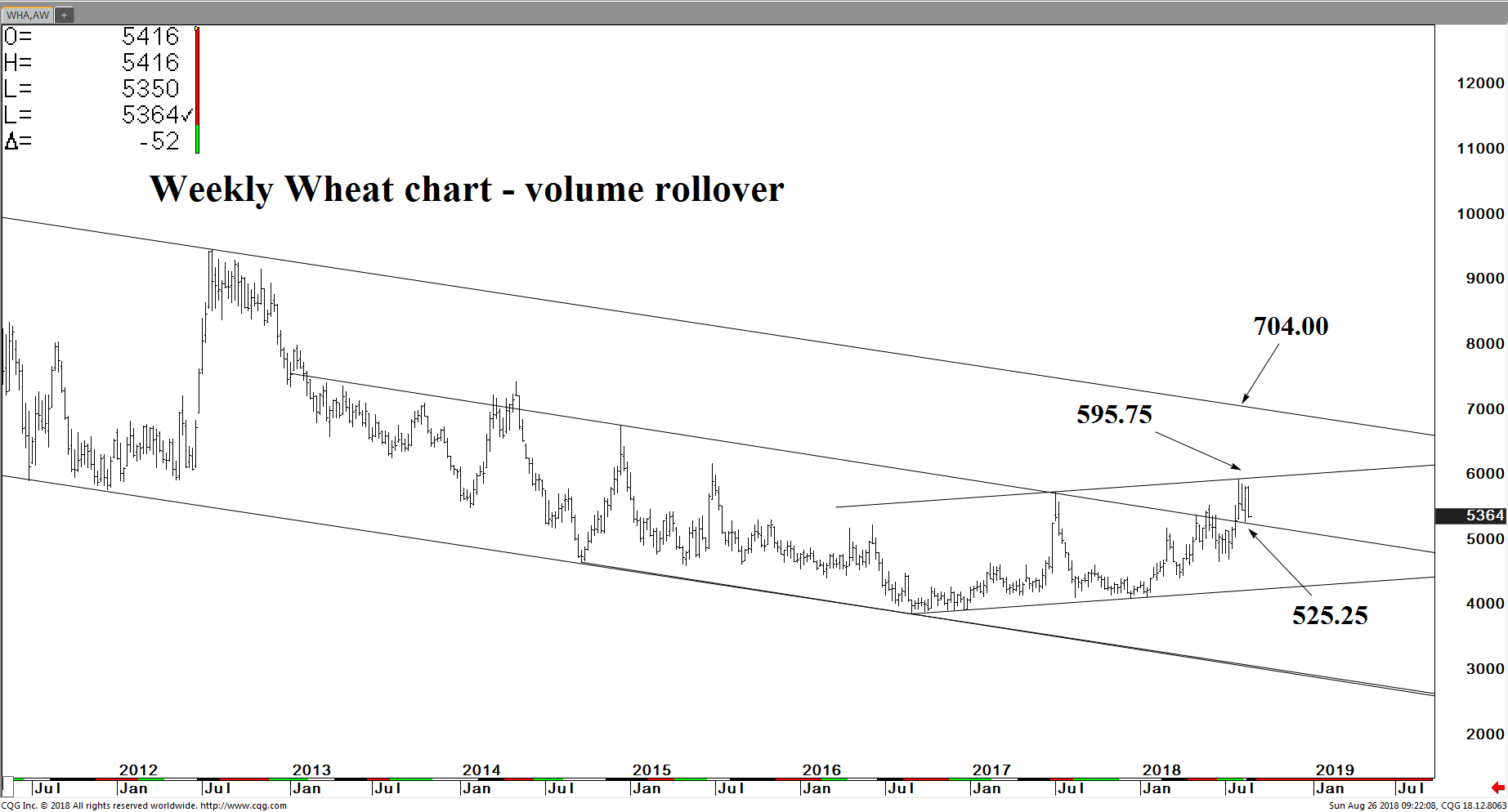

WHEAT TODAY AND THE NEXT 2-3 WEEKS

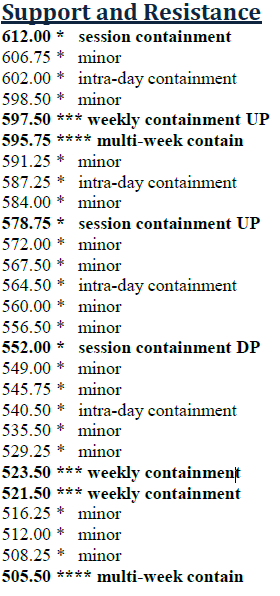

For Tuesday, 540.50 can contain initial strength, the 521.75-523.50 region in close reach and able to contain selling through next week, and the level to settle below for yielding the targeted 506.00 within 3-5 more days. Upside today, pushing/opening above 540.50 allows 552.00 where the market can place a daily high. Closing today above 552.00 indicates 564.25 within several days, likely to contain session strength when tested and the level to settle above for yielding the more meaningful 595.75 within several more days (pg 2).

2-3 WEEKS AND BEYOND

The 595.75 formation can contain annual buying pressures, below which 506.00 remains a 3-5 week target, potentially yielding 421.25 long-term support in reach over the next 3-5 months. The 506.00 formation can absorb monthly selling pressures when tested, while a daily settlement below 506.00 signals 421.25 within 5-8 weeks, where the broader complex can bottom out into next summer. Upside, a weekly settlement above 595.75 maintains a bullish dynamic into later contract life, 704.75 ultra-long-term resistance then expected over the next 3-5 months (weeks?), where the broader Wheat market can top out through next year.

Hedger's Highlights

Remain hedged below 595.75 as 505.50 remains a 3-5 week target where hedges can be lifted through October trade. Reset hedges following daily settlement below 505.50, as 421.25 becomes a 5-8 week target where long-term hedges can be lifted into next summer. Upside, lift hedges following weekly settlement above 595.75, as 704.75 becomes a 2-3 month (possibly 3-5 week) target where hedges can be set into next summer.