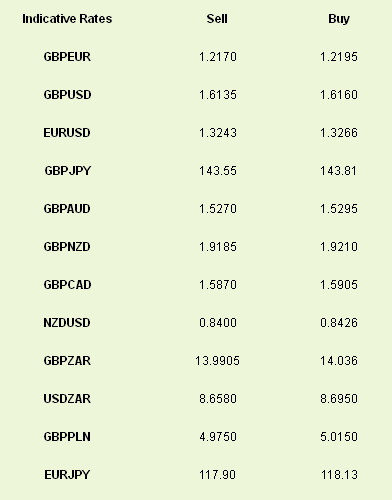

Markets gasped a sigh of relief yesterday, as Draghi took centre stage and gave Europe the warm embrace it so desperately needed. The President did what he does best, he calmed the jitters. He even dabbled with the phrase “positive contagion”. He was quick to point out what had been done. Inflation was on track with the 2% target by year end, stock market volatility was low, equities were up and rates on 10-year Spanish and Italian debt had fallen to 4.97% and 4.35% respectively. EUR pulled on the reigns and gained an entire point over the course of the day, falling below the 1.22 support, to where it currently sits at 1.2165 just shy of an 8 month high against GBP. EURUSD gained over a per cent to low 1.33 levels.

Employment Sobers The Party

Before we all get carried away, let’s not forget about employment, or lack thereof. The figures were sobering to say the least. Jobless figures in Greece surpassed 26.8% (October) overtaking Spain’s 26.6% with youth unemployment in Greece hitting 56.6%. The ECB however, unlike the FED, does not have a direct mandate to reduce unemployment, it is a national directive with the ECB acting as more of a facilitator than instigator.

While the ECB president was generally upbeat this time around, he wasn’t naïve or in any way trying to suggest we’re on the road to recovery but more that the worst is behind us and we’re finding some level ground at last. Structural and fiscal reform needs to continue and balance sheets must continue to shrink. The central bank unanimously held rates at .75% with no additional asset purchasing likely in the coming months. He ended with the ever familiar rhetoric that the bank is ready to assist when called upon.

Japan's Stimulus

Japan unveiled a 10.3 trillion yen stimulus package overnight, it is expected to create 600,000 new jobs and boost GDP by 2%. The picture in Japan is a fragile one. Things will have to get worse before they can get better but the newly elected president had no choice but to act. The monetary committee meet later this month to continue plans of debasing the national currency in a hope to ignite its export driven recovery. With inflation close to zero, the committee has some wiggle room to tinker with policy. JPY fell another point during Thursday trading.

Initial jobless figures from the U.S. showed a slight increase last week with continuing figures down by 127,000 for the month. USD had a tough time yesterday bearing the brunt of a bullish ECB meeting. The BoE met yesterday but the banks recent inflation report was the real page turner with yesterday’s meeting adding little to the equation. Rates were held at .5% with asset purchases held at 375bn.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Upbeat Draghi Sends EUR Soaring

Published 01/11/2013, 05:08 AM

Updated 07/09/2023, 06:31 AM

Upbeat Draghi Sends EUR Soaring

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.