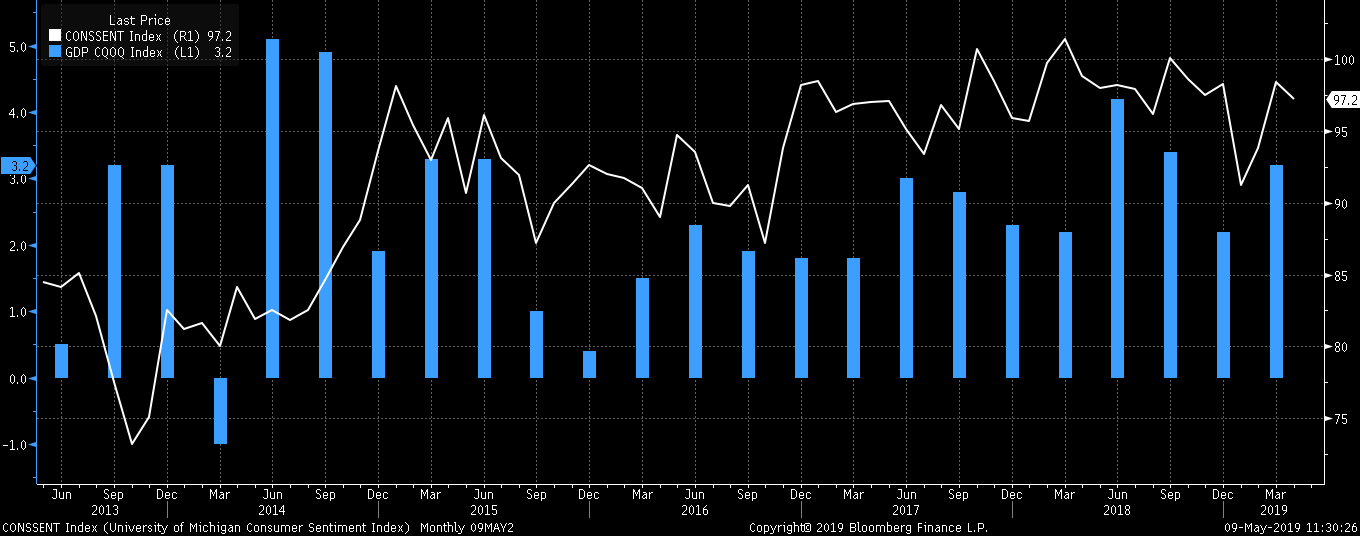

The University of Michigan’s consumer sentiment index is forecast to rise in May following the decline in April. Economists forecast that consumer sentiment will improve to 97.8 for the current month. This follows the declines in April where consumer sentiment fell to 97.2.

The UoM’s measure of consumer sentiment fell for the first time in April, after rising for three consecutive months. The data missed the estimates of an increase to 98.1.

As a result, economists have scaled back their optimism on the index. The data for May is forecast to show only a modest pickup from April. Focus will be on the underlying index gauges. For example, despite the dip in April, the current conditions index remained firm. There was also optimism among consumers.

It wasn’t surprising, then, to see this reflecting in other economic data points such as the retail sales report. With the general consensus pointing to tame inflation, consumer spending and optimism could maintain the trend.

The Trump administration implemented tax cuts across the board in a bid to prop up the economy late last year. While this gave an initial boost to the consumer sentiment, the effects are starting to fade.

Tax Cut Stimulus Starting to Fade – April Survey

One of the leading causes for the decline in the consumer sentiment index was that consumers felt that the tax cut stimulus effects were fading.

Data for the previous month revealed that tax refunds fell compared to the same period a year ago. While this might prove to dent the overall report, American consumers were confident in their personal finances. The prospects for the year ahead remained elevated, reflecting the conditions on the ground.

UoM Consumer Sentiment Index, April 2019

UoM Consumer Sentiment Index, April 2019

According to the survey report for April, data showed that the gauge of current conditions index rose to a four-month high of 112.3.

But expectations on future conditions fell to 85.8. The decline in the sentiment index underlined the anticipated weakness in the economy. This could partially be explained by the fact that consumers were gearing up for a weaker growth patch. But data for the first quarter proved to be otherwise. The US economy was seen rising at a pace above 3% comparing to the estimates of a 2% growth rate on average.

The broader index levels reveal that optimism among consumers still remains strong. At the center of this optimism is the US labor market. Jobs were seen to be plentiful, as determined by the weekly jobless claims. Initial claims fell to historic lows during April. Consumers were also buoyed by the fact that the U.S. could negotiate a trade deal with China.

The official of the University of Michigan’s consumer sentiment index was that consumer optimism did not waver much. Despite the miss in the estimates and some minor concerns, confidence was still high.

As a result, the official view that the decline in April was rather insignificant.

This view could be put to the test as the data comes out later today.

Higher Chances for Consumer Sentiment to Rebound

Another monthly decline on the index could start to raise concerns. With the U.S. economy seen starting the first quarter on a firm footing, growth could remain within the 2% – 3% range for the current second quarter.

The Fed pledged to keep rates unchanged at its big meeting March. The next major policy meeting will be in June. Yet, consumers do not see the Fed to raise rates. The survey for April saw only 55% of respondents expecting a rate hike. Although this is well above the 50% benchmark, it is still low by historical standards.

Until then, with the status quo remaining stable, the consumer confidence report is unlikely to spring a downside surprise.