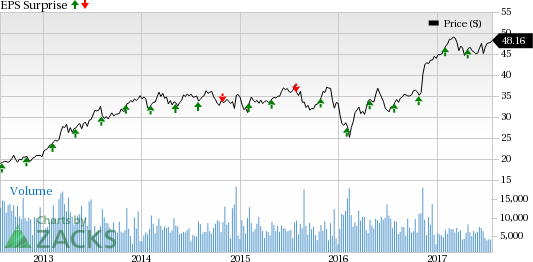

Unum Group (NYSE:UNM) is slated to report second-quarter 2017 results on Jul 27, after the market closes. Last quarter, the company delivered a positive earnings surprise of 2.00%. Let’s see how things are shaping up for this announcement.

Factors to be Considered this Quarter

Unum Group is likely to witness a decline in operating income at its Unum U.K. business in the soon-to-be-reported quarter. The company is also likely to have experienced lower sales volume in this segment in the second quarter.

Further, the company is likely to report lower premium income at its Closed Block segment, owing to expected policy terminations and maturities for the individual disability line of business. In addition, the company’s Corporate unit has likely incurred an operating loss in the soon-to-be reported quarter.

Also, Unum Group might have experienced a higher debt level, which in turn will increase interest expenses. The company is also likely to record a rise in total benefits and expenses in the second quarter.

However, the company has likely reported better-than-expected results at its Unum U.S. and Colonial Life units, fueled by improved premium income.

Additionally, continued share buybacks should have boosted the bottom line.

With respect to the surprise trend, the company delivered positive surprises in all of the last four quarters with an average beat of 3.39%.

Earnings Whispers

Our proven model does not conclusively show that Unum Group is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: Unum Group has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.01. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Unum Group carries a Zacks Rank #4 (Sell).

Note, that we caution against all Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Some better-ranked companies from the insurance industry with the right combination of elements to come up with an earnings beat this quarter are as follows:

CNA Financial Corporation (NYSE:CNA) is set to report its second-quarter earnings on Jul 31 with an Earnings ESP of +4.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sun Life Financial Inc. (TO:SLF) has an Earnings ESP of +2.74% and a Zacks Rank #2. The company is set to report its second-quarter earnings on Aug 9.

Manulife Financial Corporation (NYSE:MFC) has an Earnings ESP of +10.00% and a Zacks Rank #1. The company is slated to report its second-quarter earnings on Aug 9.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Unum Group (UNM): Free Stock Analysis Report

Manulife Financial Corp (MFC): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

Original post

Zacks Investment Research