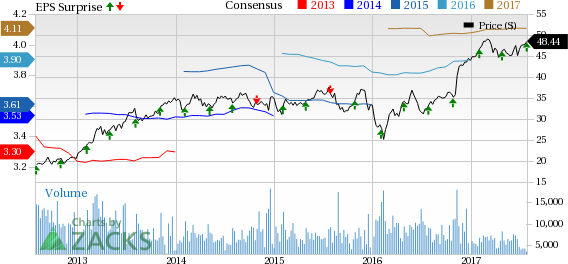

Unum Group’s (NYSE:UNM) second-quarter 2017 operating net income of $1.05 per share beat the Zacks Consensus Estimate of $1.01 4. The bottom line also improved 7.1% year over year.

Strong performance at Unum U.S. and Colonial Life segments was partially offset by weakness at Unum U.K. business.

In the reported quarter, the company displayed growth and disciplined execution of strategy. It also efficiently returned capital to shareholders.

Including after-tax realized investment gains of 2 cents, net income grew 7% year over year to $1.07 per share.

Total operating revenue of Unum Group was $2.8 billion, up 1.5% year over year. Revenues were in line with the Zacks Consensus Estimate. Premium income improved, whereas net investment income declined, both on a year-over-year basis.

Total benefits and expenses were up 2.3% year over year to $2.5 billion. Rise in benefits and change in reserves for future benefits, commissions, amortization of deferred acquisition costs and other expenses led to overall increase in costs.

Quarterly Segment Update

Unum U.S.: Premium income was $1.4 billion, up 4.5% year over year. Operating income grew 9.1% year over year to $247.8 million.

Unum U.K.: Premium income decreased 9.9% year over year to $126.8 million. In local currency, premium inched up 1% year over year to £99.1 million. This was mainly due to growth in the group life and supplemental line of business on favorable persistency and sales improvement.

Operating income was $28.9 million, significantly down 21.7% year over year. In local currency, the figure declined 12.1% year over year to £36.9 million.

Benefit ratio was 75.6%, up 550 basis points (bps). This was owing to unfavorable claims solutions and the impact of inflation-linked increases in benefits. Also, lower discount rate implemented in the second quarter of 2017 across several of the company’s products added to this downside.

Colonial Life: Premium income increased 7.1% year over year to $376.3 million on sales growth in recent quarters and stable persistency. Operating income grew 5% to $81.8 million.

Benefit ratio deteriorated 20 bps year over year to 51.3%.

Closed Block: Premium income decreased 3% from the year-ago quarter. This decline stemmed from expected policy terminations and maturities for the individual disability line of business. Nonetheless, improvement in premium income for the long-term care line of business, owing to premium rate increases on certain in-force policies, limited the downside.

Operating income was $32.6 million, flat year over year.

Corporate: The segment incurred an operating loss of $37.6 million, narrower than an operating loss of $39.7 million in the year-ago quarter.

Capital Management

As of Jun 30, 2017, the weighted average risk-based capital ratio for Unum Group’s traditional U.S. insurance companies was in excess of 395%. Unum Group exited the quarter with cash and marketable securities worth $757 million.

Book value per share of Unum Group increased 5.8% year over year to $41.21 as of Jun 30, 2017.

The company spent around $100 million to buy back about 2.2 million shares in the quarter.

Guidance Up

Unum Group projects 2017 operating earnings per share growth between 5-8%, increased from the prior guidance of growth between 3-6%.

Zacks Rank

Unum Group currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings so far, both Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc’s. (NYSE:FNF) bottom line beat their respective Zacks Consensus Estimate, while The Progressive Corp. (NYSE:PGR) missed.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Unum Group (UNM): Free Stock Analysis Report

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research