The folks over at Elliot Wave International caught my attention yesterday with a recently published article on the growing risks for bond investors.

In our own work, I have warned investors that it would indeed be both foolish and dangerous to extrapolate the past 30 years of bond returns into any future modeling. The primary question for many bond investors has been “are we going to experience a prolonged period of near zero rates, deja vu Japan, or should we be prepared for hyperinflation and spiking interest rates?

During market pullbacks, financial advisors use a boilerplate response: “Let’s rebalance the portfolio.” Investors have heard that one for years.

The recommended allocation varies depending on a client’s age and risk tolerance, but it typically involves shifting funds from stocks to bond holdings.

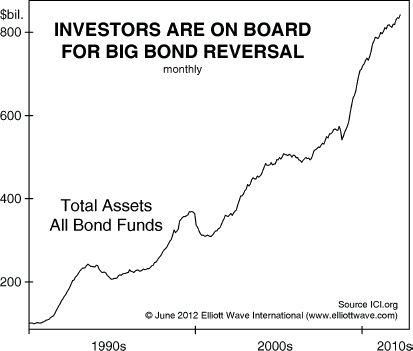

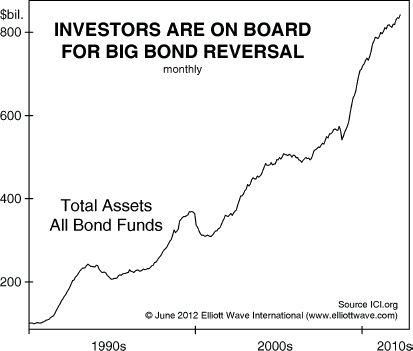

The evidence shows that many investors did just that in response to the 2007-2009 financial crisis – at the fastest rate in decades. Bond fund assets have risen eight-fold over the past 22 years.

Investors now hold more than $800 billion in bond funds. Just take a look at this chart from a June 6, courtesy Elliott Wave Theorist Special Report.

Investors who increased their bond allocation probably feel financially safer.

After all, bond funds have been more stable than stock funds, and they provided higher returns than money market funds.

Yet extrapolating the past into the future is often a major mistake.

During the coming collapse in the value of debt, investors’ interest in diversified funds of all stripes--debt, equity and commodity--will fall precipitously. The drop will come as a shock, especially to those who “rebalanced” from stocks and commodities to bonds after the markets panicked in 2008.

In our own work, I have warned investors that it would indeed be both foolish and dangerous to extrapolate the past 30 years of bond returns into any future modeling. The primary question for many bond investors has been “are we going to experience a prolonged period of near zero rates, deja vu Japan, or should we be prepared for hyperinflation and spiking interest rates?

During market pullbacks, financial advisors use a boilerplate response: “Let’s rebalance the portfolio.” Investors have heard that one for years.

The recommended allocation varies depending on a client’s age and risk tolerance, but it typically involves shifting funds from stocks to bond holdings.

The evidence shows that many investors did just that in response to the 2007-2009 financial crisis – at the fastest rate in decades. Bond fund assets have risen eight-fold over the past 22 years.

Investors now hold more than $800 billion in bond funds. Just take a look at this chart from a June 6, courtesy Elliott Wave Theorist Special Report.

Investors who increased their bond allocation probably feel financially safer.

After all, bond funds have been more stable than stock funds, and they provided higher returns than money market funds.

Yet extrapolating the past into the future is often a major mistake.

During the coming collapse in the value of debt, investors’ interest in diversified funds of all stripes--debt, equity and commodity--will fall precipitously. The drop will come as a shock, especially to those who “rebalanced” from stocks and commodities to bonds after the markets panicked in 2008.