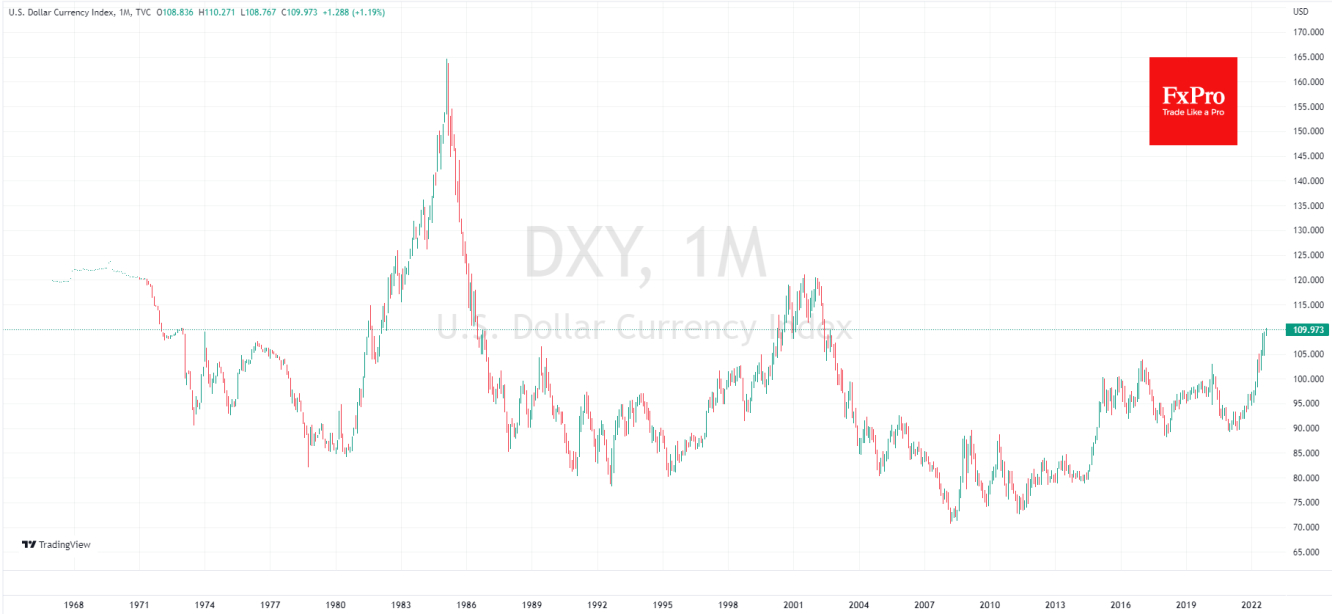

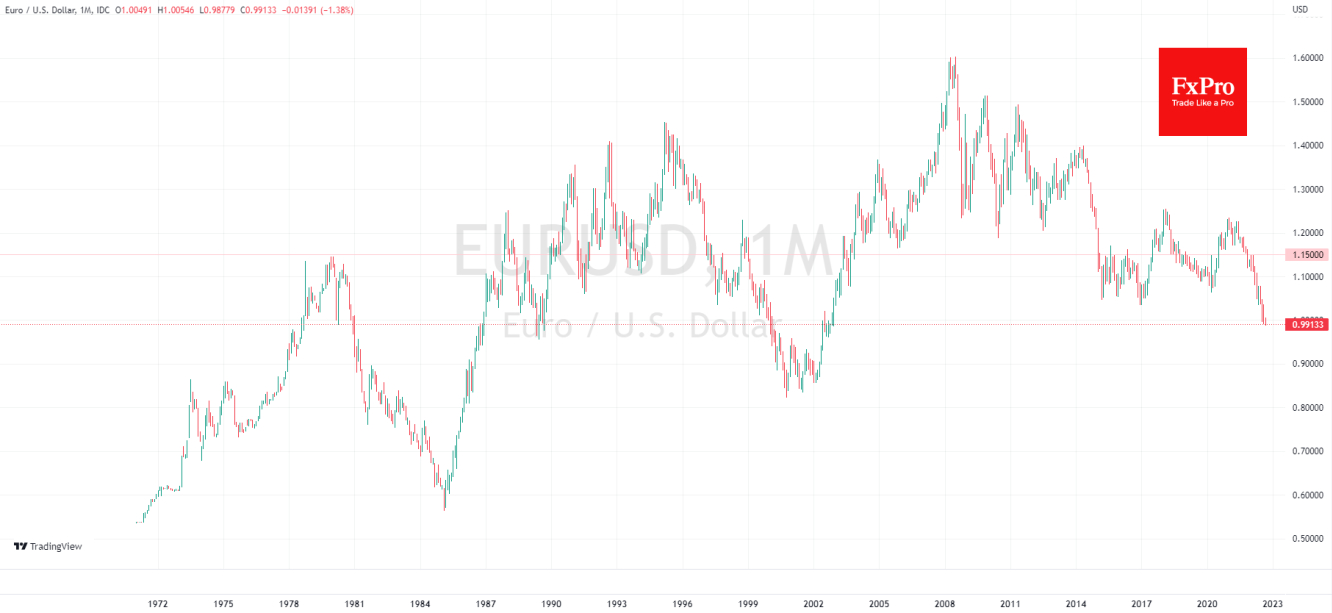

The dollar index rose above 110, updating 20-year highs on Monday morning as a flash reaction to increased pressure on the euro and British pound. European currencies are selling off amid an energy crisis related to Russian gas supplies, which have entirely halted through the Nord Stream pipeline.

Although it caused an emotional response at the start of the day, this news fits in with the long-term upward trend of the dollar since the middle of last year, when all current drivers of the currency market were formed, and their effect remains in force.

The monetary policy differential is the most apparent growth driver for the dollar against the euro and the pound. The ECB is two steps behind the Fed, though it implemented a rare 50-point rate hike in July and is expected to raise it 50-75 points this coming Thursday. The differential between key rate and inflation in the US is lower compared to Europe, and potentially, this differential will only widen in the coming months.

The second important factor is economic resilience. America sells energy to Europe, thereby working to reduce its trade deficit and maintain interest in the extractive industries. In the long run, such a disposition will not allow the ECB to raise and hold rates as high and as long as the Fed can do without risking a deep economic downturn.

A weaker currency often increases the currency's competitiveness, which restarts the economy. This was the case even during the Greek debt crisis when the cheap euro generated a vast surplus in the balance of payments of Germany and other euro-region core countries.

However, the burden of high energy bills now exceeds the benefit of a weaker single currency, so there is still no sign that the euro has reached a fundamental bottom. We can repeat the same story with minor adjustments for the pound and the yen.

This creates a bullish outlook for the USD index, which might continue to rise to 120, i.e., +9% of the current levels, into the area of the 2001-2002 peaks. In an extreme scenario, such a rate could be reached by the end of the year, although it is more reasonable to expect such an increase in the next six months.

For EUR/USD, such prospects open up the potential for a failure below 0.9000. GBP/USD could then go to 1.00-1.05, and USD/JPY could break 150. It seems to us that approaching these levels will seriously put the issue of excessive dollar growth, as it was in the mid-1980s, back on the agenda of G7 financial leaders.

But that is a matter for the distant future. For now, the dollar trend may well gain traction by helping to reduce inflation in the US.