After a strong run last week, September Unleaded Gasoline traded sharply lower in overnight trading, as traders set aside concerns about a Middle East conflict while turning their focus on Spain’s problems and the slowing U.S. economy.

Spain is at the forefront, today, because of fears it may need massive aid after two major regions sought financial assistance from the central government. These worries are encouraging investors to shed riskier assets and seek the shelter of the U.S. dollar. As the Greenback rises, commodities priced in dollars get more expensive, putting pressure on demand.

Traders could also be taking profits following a sizable run-up and in anticipation of more bearish news from China and Europe tomorrow regarding the state of the global economy.

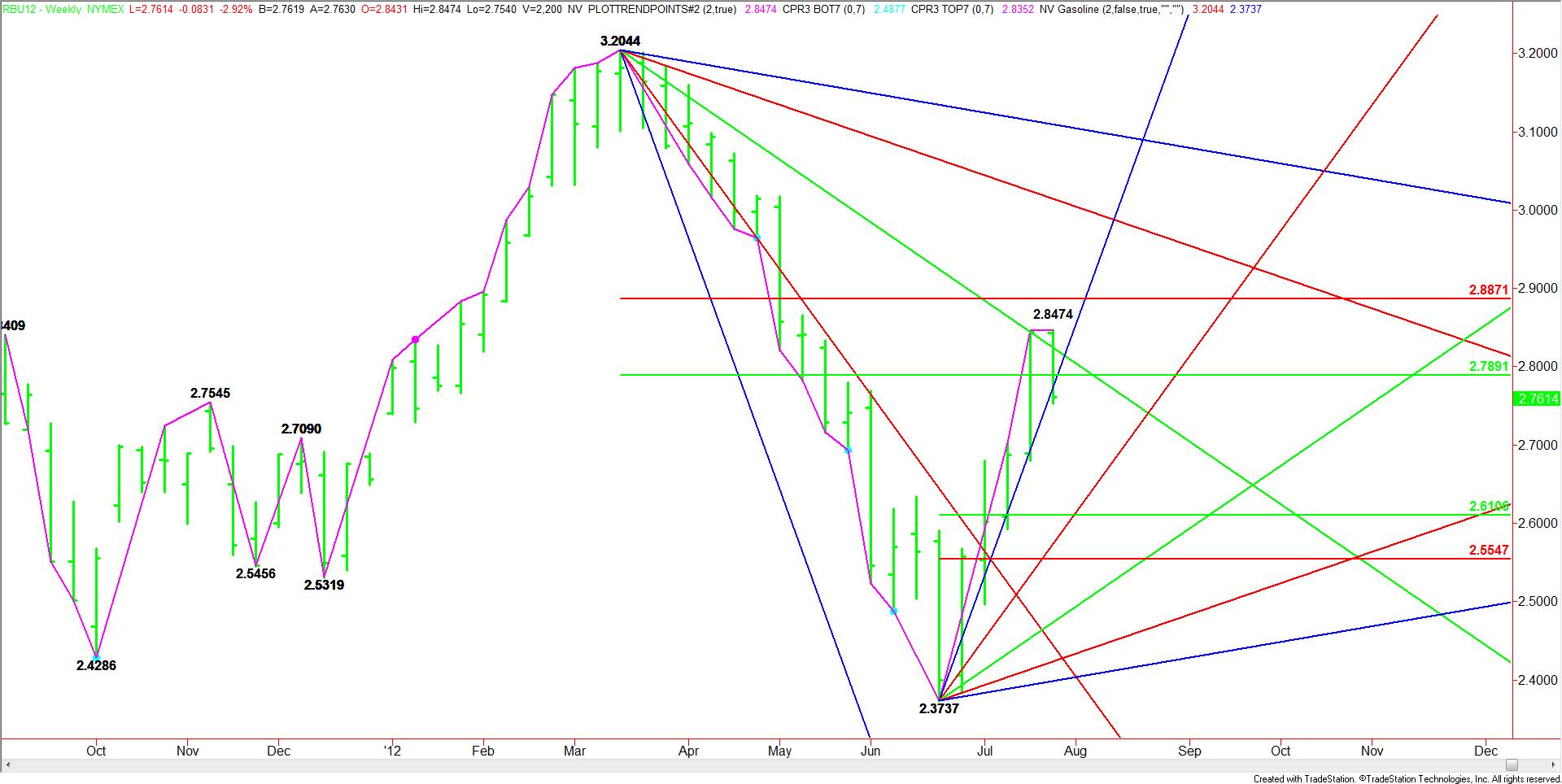

Technically, September Unleaded Gasoline reached a major retracement zone created by the 3.2044 to 2.3737 range. This 50%- to 61.8% retracement zone is 2.7891 to 2.8871 respectively. A trade through the lower boundary puts the market on the weak side of the retracement and may be an indication of lower prices to follow. In addition to the retracement zone, the market also reached resistance at a downtrending Gann angle at 2.8244 this week.

Additionally, after walking up a steep Gann angle from the 2.3737 bottom for five weeks, unleaded gasoline is struggling to hold on to this support. The angle is at 2.7737 this week. A break through could attract additional selling pressure with another angle at 2.5737 the next likely downside target.

Short-Term Range

Further technical analysis of this chart pattern indicates the formation of a possible short-term range of 2.3737 to 2.8474. This range has created a retracement zone at 2.6106 to 2.5547. This zone is the eventual downside target if the market begins a sharp sell-off. Because this week’s high is slightly above last week’s high, the current sell-off is helping to form a potentially bearish closing price reversal top, but this will not be completed unless Friday’s close is below 2.8445.

Since the market is trading below a key 50% level and in a position to break a support angle, a strong bias to the downside is developing. Long traders should consider trailing their stop or exiting at current levels. Short-term conditions may be oversold because of last night’s sell-off. This could trigger an intraday reversal shortly after the opening, but if the market is truly getting ready to rollover to the downside, look for this rally to attract fresh selling pressure.

Spain is at the forefront, today, because of fears it may need massive aid after two major regions sought financial assistance from the central government. These worries are encouraging investors to shed riskier assets and seek the shelter of the U.S. dollar. As the Greenback rises, commodities priced in dollars get more expensive, putting pressure on demand.

Traders could also be taking profits following a sizable run-up and in anticipation of more bearish news from China and Europe tomorrow regarding the state of the global economy.

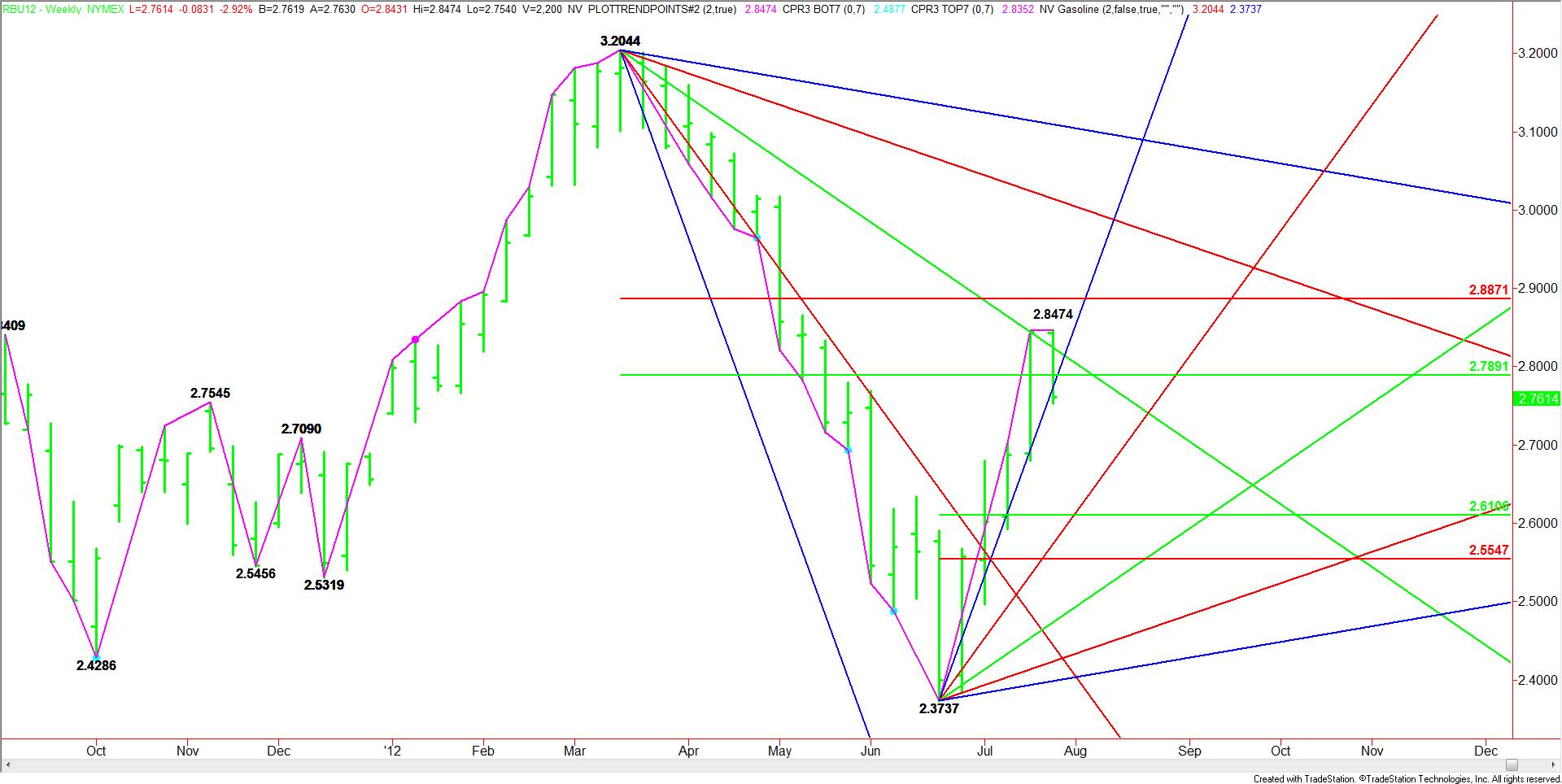

Technically, September Unleaded Gasoline reached a major retracement zone created by the 3.2044 to 2.3737 range. This 50%- to 61.8% retracement zone is 2.7891 to 2.8871 respectively. A trade through the lower boundary puts the market on the weak side of the retracement and may be an indication of lower prices to follow. In addition to the retracement zone, the market also reached resistance at a downtrending Gann angle at 2.8244 this week.

Additionally, after walking up a steep Gann angle from the 2.3737 bottom for five weeks, unleaded gasoline is struggling to hold on to this support. The angle is at 2.7737 this week. A break through could attract additional selling pressure with another angle at 2.5737 the next likely downside target.

Short-Term Range

Further technical analysis of this chart pattern indicates the formation of a possible short-term range of 2.3737 to 2.8474. This range has created a retracement zone at 2.6106 to 2.5547. This zone is the eventual downside target if the market begins a sharp sell-off. Because this week’s high is slightly above last week’s high, the current sell-off is helping to form a potentially bearish closing price reversal top, but this will not be completed unless Friday’s close is below 2.8445.

Since the market is trading below a key 50% level and in a position to break a support angle, a strong bias to the downside is developing. Long traders should consider trailing their stop or exiting at current levels. Short-term conditions may be oversold because of last night’s sell-off. This could trigger an intraday reversal shortly after the opening, but if the market is truly getting ready to rollover to the downside, look for this rally to attract fresh selling pressure.