Universal Technical Institute, Inc. (NYSE:UTI) reported wider-than-expected loss in the third quarter of fiscal 2017, mostly because of its sluggish performance in terms of enrollment.

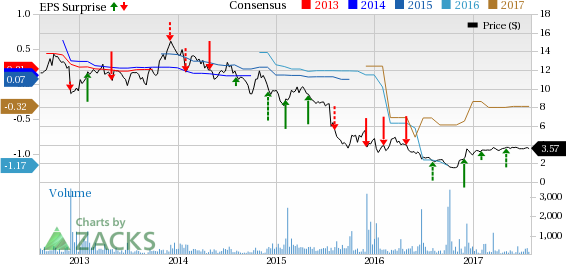

The company’s adjusted loss of 21 cents per share in the quarter was wider than the Zacks Consensus Estimate of a loss of 16 cents by 31.3%. In the year-ago quarter, the company had posted loss per share of 20 cents.

Revenues & Enrollment

Revenues of $76.3 million in the third quarter fell 7.3% from the prior-year quarter revenue figure of $82.3 million. Apart from that, students participating in the company’s proprietary loan program amounting $4.0 million in the third quarter 2017, compared to $4.2 million in the prior-year quarter.

Universal Technical reported a nearly 10% drop in average undergraduate full-time enrollments in the quarter. However, total starts increased 12.5% from the year-ago quarter. After the sluggish enrollment for Universal Technical for several quarters, the company started offering new courses in Avondale for quite a few months now and also initiated their need-based institutional grant. Since the initiative is still in its early stages, it needs further modification to find the right balance between the costs of the grants with the contributions from increased enrollment.

Operating Highlights

Operating expenses contracted 11% to $79.0 million on lower compensation expenses and improved operating efficiencies following the implementation of the Financial Improvement Plan.

The company reported operating loss of $2.8 million in the quarter as compared with an operating loss of $5.5 million in the prior-year quarter. The improvement mirrors significant cost reductions and an increase of $1.1 million of operating income from the Long Beach campus.

Earnings before interest, taxes, depreciation and amortization (EBITDA) was $2.1 million, compared to a loss of $0.6 million in the prior-year quarter.

Financials

The company had cash and cash equivalents and investments of $84.5 million as of Jun 30, 2017, compared with $120.7 million as of Sep 30, 2016. The decline can be attributed to collateral requirements for surety bonds renewed in the second quarter of fiscal 2017 and changes in working capital.

FY17 Guidance

Universal Technical revised its outlook for student starts growth for the remaining of fiscal 2017, projecting a decline of mid-to-high-single digits for the full year (as compared to the prior guidance of high-single digit decline).

The average student population is likely to decline low double digits from the fiscal 2016 level.

Revenues are expected to be down in the mid-to-high single digits in fiscal 2017.

Universal Technical expects its Financial Improvement Plan to generate annualized cost savings at the high end of the $30 million to $40 million range, same as the previous guidance.

Capital expenditures are expected to be approximately $10.5 million to $11.5 million for the year ending Sep 30, 2017 compared with $10.0 million to $11.0 million projected earlier.

Zacks Rank & Peer Release

Universal Technical currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Capella Education Company (NASDAQ:CPLA) reported adjusted earnings of 90 cents in the second quarter of 2017, which surpassed the Zacks Consensus Estimate of 80 cents by 12.5%. Adjusted earnings however decreased 3.2% year over year.

Upcoming Peer Releases

Adtalem Global Education Inc. (NYSE:ATGE) is scheduled to release its quarterly numbers on Aug 17. The Zacks Consensus Estimate for earnings is pegged at 72 cents.

American Public Education, Inc. (NASDAQ:APEI) is scheduled to report second-quarter results on Aug 8. The Zacks Consensus Estimate for quarterly earnings is pegged at 23 cents.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively. And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Capella Education Company (CPLA): Free Stock Analysis Report

Universal Technical Institute Inc (UTI): Free Stock Analysis Report

DeVry Education Group Inc. (ATGE): Free Stock Analysis Report

Original post