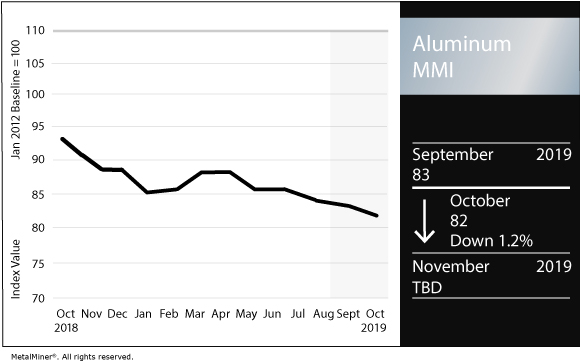

The Aluminum Monthly Metals Index (MMI) dropped by one point again this month, this month down to an MMI reading of 82.

However, rather than universal price weakness like last month, price declines in China pulled the index down (along with a milder drop in LME prices).

All other prices in the index increased, although some of the gains were relatively small (i.e., under 1%).

LME aluminum prices weakened in September, despite looking stronger early on in the month. Less robust manufacturing and economic indicators hurt some industrial metal prices this month, including aluminum. The stronger U.S. dollar also resulted in weaker prices.

LME prices look close to possibly dropping below yet another critical price level, $1,700/mt, after clearly breaking the $1,800/mt support level since last month.

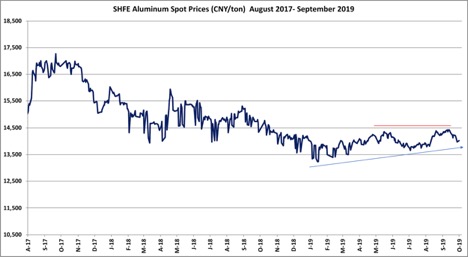

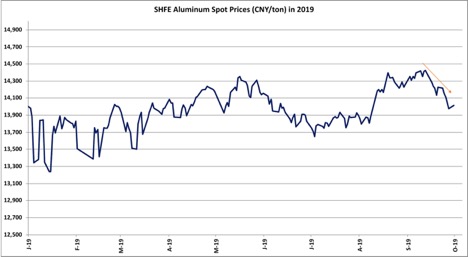

SHFE Aluminum Prices Lost Ground in September

Over the course of 2019, SHFE aluminum prices continued to show sluggish upward momentum, constrained by the CNY 14,500/mt price level.

However, during the past one month, SHFE prices dropped:

The price drop looks somewhat mild, as it looks to be within the range of normal price fluctuations for the metal over the past year.

Around mid-month, news of slowing economic growth in China led to a stalling of price momentum for some key industrial metals, including aluminum.

However, not all the recent news from China indicated manufacturing is slowing.

While the Caixin Purchasing Managers Index (PMI) clearly jumped into the expansionary zone.

China’s National Bureau of Statistics’ (NBS) competing PMI also edged up to 49.8 (compared with August’s reading of 49.5). In particular, the production subindex jumped to 52.3, while the new orders index increased to 50.5 — both marking expansionary readings.

Recently, the Chinese government implemented fiscal measures expected to help maintain higher growth rates through improved banking sector liquidity. Expected beneficiaries of the measures include the construction industry and small businesses.

Demand in the automotive sector remains weak, adding to aluminum price weakness. The government implemented measures to help improve traditional car sales; so far, the data do not show an uptick in sales as a result of these measures, which rely on implementation at the local government level.

Strong U.S. Dollar Suppresses LME Prices

One effect of slowed growth in other major countries pertains to the continued upward trend in the dollar’s value, which grew stronger vis-a-vis other major currencies.

This compounds with China’s decision to devalue the yuan in early August, which translates into yet lower prices.

Key raw material input costs have also dropped.

Therefore, producers — particularly producers in China — have a greater buffer against lower prices, allowing them to lower prices while maintaining margins. As such, those producers can then continue to produce, even at lower prices.

Additionally, when Chinese domestic prices stay the same or decline in dollar-denominated prices, increased sales volume may be the result. Chinese producers can therefore benefit without effectively offering any actual price discount. In the worst-case scenario — the case of rising prices — the alteration in the exchange rate slows the rate of increases in dollar-denominated prices.

Vietnam Announces Tariffs on Aluminum Imports from 16 Chinese Companies

Based on the findings of an investigation launched in January, Vietnam announced it would impose anti-dumping duties on some aluminum products from 16 Chinese companies.

The tax will range from 2.49% to 35.58% for five years, starting from Sept. 28, 2019.

U.S. Aluminum Premiums

The U.S. Midwest Premium increased marginally, placing it firmly at $0.18/pound, indicating supply tightness continues in spite of weaker demand.

What This Means for Industrial Buyers

Aluminum price momentum stalled in September.

Recent Chinese currency devaluation and a stronger dollar means lower prices — for now.

Industrial buying organizations need to keep an eye on the bigger picture; should demand firm up in the fall, price momentum may still turn around.

Actual Metal Prices and Trends

Chinese prices in the index moved lower overall this month.

Chinese aluminum primary cash and scrap prices decreased by 2.9% and 2.8% respectively, to $1,955/mt and $1,762/mt.

Chinese aluminum billet and bar prices posted 0.2% declines, falling to $2,056/mt and $2,150/mt, respectively.

The LME primary three-month price dropped by 1.5% this month to $1,720/mt, adding to the 3.4% drop the month prior.

European commercial 1050 sheet and 5083 plate both increased by 2.6% to $2,456/mt and $2,799/mt, respectively.

India’s primary cash price increased 1% to $1.96 per kilogram.

Korean commercial 1050 sheet, 5052 coil premium over 1050, and 3003 coil premium over 1050 all increased by less than 1% – reversing last month’s mild decrease of less than 1% — down to $2.97, $3.14 and $3.02 per kilogram, respectively.

by Belinda Fuller