Univar (NYSE:UNVR) logged a profit (on a reported basis) of $31.3 million or 22 cents per share in second-quarter 2017, down around 21.4% from a profit of $39.8 million or 29 cents per share a year ago.

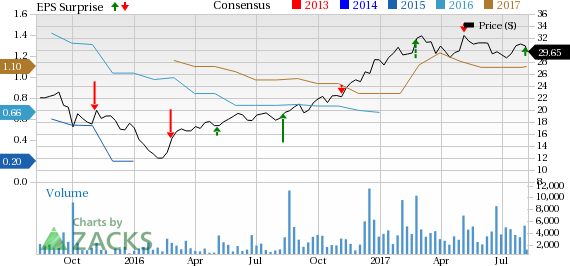

Barring one-time items, earnings came in at 34 cents per share in the quarter, beating the Zacks Consensus Estimate of 31 cents.

The chemical maker’s revenues dipped 0.7% year over year to $2,247 million in the reported quarter missing the Zacks Consensus Estimate of $2,266 million.

Gross profit rose around 4.6% year over year to $466.4 million in the quarter. Adjusted EBITDA margin increased 60 basis points to 7.2% with gains witnessed across all segments.

BASF SE (DE:BASFN) (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Univar Inc. (UNVR): Free Stock Analysis Report

Original post

Barring one-time items, earnings came in at 34 cents per share in the quarter, beating the Zacks Consensus Estimate of 31 cents.

The chemical maker’s revenues dipped 0.7% year over year to $2,247 million in the reported quarter missing the Zacks Consensus Estimate of $2,266 million.

Gross profit rose around 4.6% year over year to $466.4 million in the quarter. Adjusted EBITDA margin increased 60 basis points to 7.2% with gains witnessed across all segments.

Univar Inc. Price, Consensus and EPS Surprise

Segment Review

Revenues from the USA division fell around 1.8% year over year to $1.2 billion in the reported quarter, as improvements in the company's sales force was largely offset by lower volumes. Gross profit rose 4.8% to $275.7 million in the reported quarter.

Revenues from the Canada segment went up around 1.4% to $492.4 million, driven by higher sales volumes, partly offset by changes in market and product mix resulting from a soft agricultural season. Gross profit rose roughly 11.4% to $67.5 million in the quarter.

The EMEA segment raked in sales of $463.7 million, up 0.8%, helped by mix enrichment and margin improvement actions that were partly offset by a decline in volume. Gross profit rose around 1.6% to $104.7 million, supported by favorable market mix and end market mix.

Sales from the Rest of World unit fell 4.4% to $99.8 million as a result of softer demand and sluggish economic conditions in Latin America. Gross profit was essentially flat year over year at $18.5 million.

Balance Sheet

Univar ended the quarter with cash and cash equivalents of $321.8 million, up around 4.4% year over year. Long-term debt was $2,895.5 million, down around 4.7% year over year.

Outlook

For the full year, Univar sees high-single digit growth in adjusted EBITDA. For third-quarter 2017, it expects adjusted EBITDA growth of high-single digits from previous year's third-quarter figure of $145.9 million.

Price Performance

Univar has significantly outperformed the industry over a year. The company’s shares have gained 60% over this period compared with the industry’s gain of 20.6% over the same period.

Zacks Rank & Other Stocks to Consider

Univar is a Zacks Rank #2 (Buy) stock.

Other top-ranked companies in the chemical space include BASFY SE (OTC:BASFY) , Kronos Worldwide (NYSE:KRO) and Arkema S.A. (OTC:ARKAY) .

BASF has an expected long-term earnings growth of 8.6% and flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has an expected long-term earnings growth of 5% and sports a Zacks Rank #1.

Arkema has an expected long-term earnings growth of 12.8% and carries a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

BASF SE (DE:BASFN) (BASFY): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Univar Inc. (UNVR): Free Stock Analysis Report

Original post