United Continental Holdings, Inc. (NYSE:UAL) just released its fourth-quarter 2017 financial results, posting adjusted earnings of $1.40 per share and revenues of $9.44 billion. Currently, United is a Zacks Rank #3 (Hold), and is up over 2% to $79.58 per share in after-hours trading shortly after its earnings report was released.

UAL:

Beat earnings estimates. The company posted adjusted earnings of $1.40 per share, beating the Zacks Consensus Estimate of $1.34 per share.

Beat revenue estimates. The company saw revenue figures of $9.44 billion, just topping our consensus estimate of $9.43 billion.

United reported fourth-quarter net income of $408 million and full-year net income of $2.1 billion. The airline giant’s Q4 sales jumped by 4.3% year-over-year, while full-year revenues climbed 3.2% from $36.56 billion to $37.74 billion.

United’s Q4 consolidated passenger revenue per available seat mile (PRASM) rose just 0.2%, while cargo sales surged by 21.6% to $304 million.

"I am incredibly proud of how our employees delivered in 2017, achieving our best-ever operational performance. Reliability is an important pillar in our continued focus on further improving the customer experience," CEO Oscar Munoz said in a statement.

"Looking ahead, we are committed to improving profitability over the long-term by building on the strong foundation we have laid over the past two years. Everyone at United is excited to enter 2018 with a clear set of priorities and a renewed sense of purpose around unlocking the full potential of United Airlines."

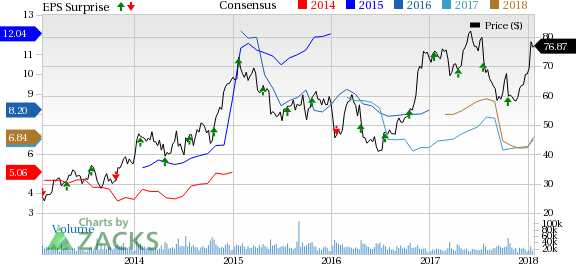

Here’s a graph that looks at UAL’s Price, Consensus and EPS Surprise history:

United Continental Holdings, Inc. is the holding company for United Airlines and Continental Airlines. The Company operates its businesses through two reporting segments: Mainline and Regional Affiliates. The Company manages its business as an integrated network with assets deployed across its Mainline and regional carrier networks.

Check back later for our full analysis on UAL’s earnings report!

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

United Continental Holdings, Inc. (UAL): Free Stock Analysis Report

Original post

Zacks Investment Research