United Technologies Corporation (NYSE:UTX) provides high-end technology products and services to the building systems and aerospace industries worldwide. It has a diversified business mix and wide geographical presence to mitigate operating risk. The business mix and diversification allows the company to remain profitable even during tough economic times, delivering consistent earnings and dividend growth.

The company is susceptible to high operating risks following the Brexit referendum, as it has a huge operating exposure in the U.K. Fluctuations in foreign currency exchange rates and macroeconomic turbulences also affect the stability of the company’s cash flows. This limits the visibility regarding the company’s future performance. With the extent of competition increasing over time, investors have been eagerly awaiting the company’s latest earnings report.

UTX has some outstanding earnings track record, and has delivered an average positive earnings surprise of 3.94% in the last four trailing quarters.

However, UTX currently carries a Zacks Rank #4 (Sell), but that could change following its third-quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: UTX beats on earnings. The Zacks Consensus Estimate called for earnings per share (EPS) of $1.68, while the company reported adjusted EPS of $1.73.

Revenue: Revenues beat. UTX posted net sales of $15.1 billion, which was higher than the Zacks Consensus Estimate of $14.89 billion.

Key Stats to Note: UTX is poised to grow on the back of innovation investments, robust backlog and strategic cost-reduction efforts. Backed by these positives, the company has raised its full-year 2017 earnings guidance. Adjusted earnings is currently anticipated to lie within the $6.58–$6.63 per share range, as against the previously estimated range of $6.45−$6.60. Moreover, the company lifted the lower-end of its revenue guidance for 2017 from $58.5–$59.5 billion to $59–$59.5 billion (estimating an organic growth of 3–4% year over year).

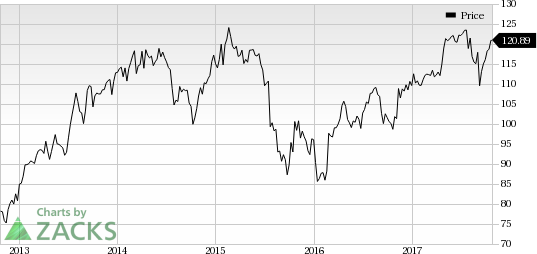

Stock Price: As of Oct 23, 2017, UTX’s stock closed the trading session at $120.89 per share.

UTX’s shares were flat in the pre-market trading. It would be interesting to see how the market reacts to the results during the trading session today.

Check back our full write up on this UTX earnings report later!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

United Technologies Corporation (UTX): Free Stock Analysis Report

Original post