Carrier Corporation, a unit of United Technologies Corp. (NYSE:UTX) , has finally resolved to lay off employees at its Indianapolis factory. This decision coincides with President Donald Trump’s six-month anniversary in office and with “Made in America” week.

Thursday will be the last working day for about 300 Carrier employees as per a statement made on Jul 19. Carrier plans to relocate manufacturing of fan coils to Mexico. However, the news of headcount reduction failed to evoke negative investor response as shares traded higher to close at $123.08 yesterday.

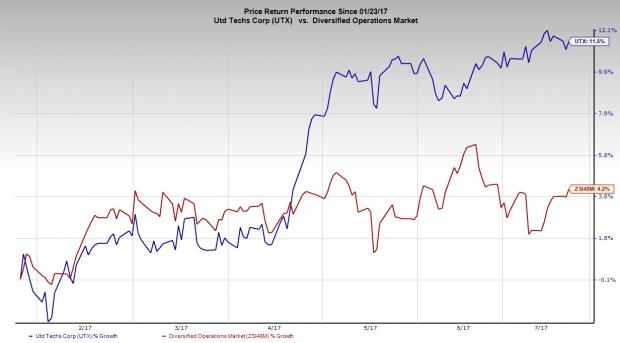

Over the last three months, shares of United Technologies, which carries a Zacks Rank #3 (Hold), have returned 7.04% compared with the Zacks categorized Diversified Operations industry’s 0.79% gain. The outperformance has been driven by investments in product innovations, acquisitions and business development.

News in Detail

As per Carrier, the announced layoffs are part of a total of 600 job reduction expected over the next few months.

In Feb 2016, United Technologies had announced plans to shut down its Indianapolis factory. Trump had then brokered a deal with Carrier to prevent the shutdown. In exchange, he had offered $7 million in conditional state tax incentives and training grants. Shortly thereafter, Carrier came with an announcement to move its fan coil operation to Mexico, resulting a total of 600 layoffs at the Indianapolis plant.

Carrier has however decided to keep some factory jobs in Indianapolis as part of its commitment to employ about 1,100 at the gas-furnace plant. It has also decided to reimburse the exiting workers with job retraining programs, a one-time payment, severance pay and six months of medical insurance.

United Technologies anticipates that the relocation will help it to become more cost effective and better serve its customers. In addition, the company expects such strategic moves to ensure production ramp-up of fan coils to cope with intense competition from peers.

Stocks to Consider

A few better-ranked stocks in the industry include Federal Signal Corporation (NYSE:FSS) that currently sports a Zacks Rank #1 (Strong Buy), and Crane Company (NYSE:CR) and ITT Inc. (NYSE:ITT) , both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Federal Signal topped earnings estimates twice in the trailing four quarters with a positive surprise of 3.1%.

Crane has a long-term earnings growth expectation of 10.1%. It topped earnings estimates in each of the trailing four quarters with a positive surprise of 8.4%.

ITT has a long-term earnings growth expectation of 13%. It topped earnings estimates thrice in the trailing four quarters with a positive surprise of 8.2%.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy.

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

ITT Inc. (ITT): Free Stock Analysis Report

United Technologies Corporation (UTX): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Crane Company (CR): Free Stock Analysis Report

Original post

Zacks Investment Research