United Technologies Corporation (NYSE:UTX) reported better-than-expected results in second-quarter 2017.

Earnings and Revenues

Quarterly adjusted earnings from continuing operations came in at $1.85 per share, beating the Zacks Consensus Estimate of $1.77. The bottom line also came in 1.6% higher than the year-ago tally. The upside was driven by solid organic sales and acquisition-based growth.

Net sales in the reported quarter came in at $15.28 billion, outpacing the Zacks Consensus Estimate of $15.18 billion. In addition, the top line came in 2.7% higher than the prior-year figure.

Segmental Details

United Technologies generates revenues from four segments:

Net sales of Otis were $3,131 million, up 1.1% year over year.

Aggregate quarterly revenues of UTC Climate, Controls & Security came in at $4,712 million, up 5.7% year over year.

Pratt & Whitney revenues were $4,070 million, up 6.7% year over year.

Sales of UTC Aerospace Systems in the quarter came in at $3,640 million, down 2% year over year.

Costs and Margins

Cost of goods sold in second-quarter 2017 was $11.1 billion as against $10.7 billion recorded in the comparable period last year. Selling, general and administrative expenses came in at $1,538 million, up 6% year over year.

Operating profit margin was 15%, down 70 basis points (bps) year over year.

Balance Sheet and Cash Flow

United Technologies exited the second quarter with cash and cash equivalents of $9,345 million, higher than $7,157 million recorded at the end of 2016. Long-term debt was $23,883 million, up from $21,697 million as of Dec 31, 2016.

In first-half 2017, United Technologies generated net cash of $3,139 million from its operating activities, up from $2,606 million recorded in the year-ago period. Capital spent on additions of property, plant and equipment totaled $771 million, up 18.8% year over year.

Outlook

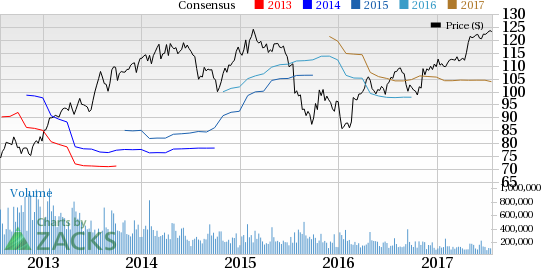

United Technologies is poised to grow on the back of innovation investments, robust backlog and strategic cost-reduction efforts. Backed by these positives, the company raised the lower end of its full-year 2017 earnings guidance. Adjusted earnings are currently anticipated to lie within the $6.45–$6.60 per share range, as against the previously estimated range of $6.30−$6.60. Additionally, this Zacks Rank #3 (Hold) company lifted its revenue guidance for 2017 from the previous projection of $57.5–$59 billion to $58.5–$59.5 billion (estimating an organic growth of 3–4% year over year).

Stocks to Consider

A few better-ranked stocks in the industry are listed below:

Federal Signal Corporation (NYSE:FSS) generated an average positive earnings surprise of 3.10% over the trailing four quarters and currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Crane Company (NYSE:CR) , which carries a Zacks Rank #2 (Buy) at present, pulled off an average positive earnings surprise of 8.41% over the last four quarters.

Honeywell International Inc. (NYSE:HON) currently holds a Zacks Rank #2 and has an average positive earnings surprise of 1.99% for the past four quarters.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Honeywell International Inc. (HON): Free Stock Analysis Report

United Technologies Corporation (UTX): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Crane Company (CR): Free Stock Analysis Report

Original post