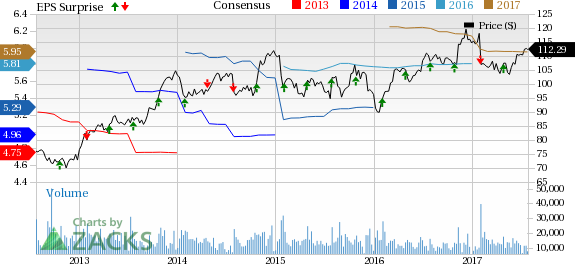

United Parcel Service, Inc. (NYSE:UPS) reported second-quarter 2017 earnings of $1.58, beating the Zacks Consensus Estimate of $1.46 per share. Earnings increased 11% on a year-over-year basis. Results were aided by higher revenues.

Revenues improved 7.7% to $15,750 million from the year-ago quarter, beating the Zacks Consensus Estimate of $15,477.3 million. The upside was driven by growth across all the key segments of the company.

Segmental Details

U.S. Domestic Package revenues climbed 8.1% year over year to $9,745 million in the reported quarter, driven by e-commerce growth. Segmental operating profit improved 13.1% to $1,395 million.

Segmental average daily package volumes increased 4.9%, driven by a 4.2% rise in Ground products and 6.4% growth in Next Day Air services. Deferred Air products were up 11%. Average revenue per piece was up 3%.

International Package revenues improved 2.8% to $3,163 million, despite the adverse impact of foreign currency. Export shipments rose 12% in the quarter on the back of growth in Europe and Asia.

However, segmental operating profits decreased 4.9% to $583 million in the quarter. The measure came in at $697 million on a currency neutral basis. Revenue per piece declined 2.3%.

Supply Chain and Freight revenues increased 12% to $2,842 million. Segmental results were aided by the acquisition of Coyote Logistics, which was completed in the third quarter of 2015. Operating profits in the segment climbed 24% to $238 million in the reported quarter.

Other Details

United Parcel has spent $2 billion as capital expenditure in the first six months of the year. Moreover, the company paid approximately $1.4 as dividend to shareholders in the first half of 2017. It also bought back 8.4 million shares for more than $900 million.

In fact, the company’s efforts to reward shareholders consistently through buybacks and dividend payouts are impressive.

Outlook

United Parcel carries a Zacks Rank #4 (Sell) company. It still expects 2017 adjusted earnings per share in the band of $5.80 to $6.10, which includes $400 million of pre-tax currency headwinds. Foreign currency related headwinds are also expected to hurt 2017 results. The Zacks Consensus Estimate for 2017 is currentlypegged at $5.95 per share. Tax rate of 35% is projected for the latter half of 2017.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Transportation space are keenly waiting for second-quarter earnings reports from key players like American Airlines Group, Inc. (NASDAQ:AAL) , Copa Holdings, S.A. (NYSE:CPA) and Air Lease Corp. (NYSE:AL) . While American Airlines is scheduled to report second-quarter results on Jul 28, Copa Holdings and Air Lease will report the same on Aug 9 and Aug 3, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Copa Holdings, S.A. (CPA): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Air Lease Corporation (AL): Free Stock Analysis Report

United Parcel Service, Inc. (UPS): Free Stock Analysis Report

Original post

Zacks Investment Research